Design Perspective And Forum

Six experts discuss ways to take advantage of composites in offshore applications.

With the exception of topside piping and grating, adoption of composites materials into offshore oil drilling and production platforms is in the formative stage. Even though composites have been successfully used in load-bearing aerospace, automotive, marine and sporting goods applications for decades, composite structures are relative newcomers to the oil industry. In the following discussion, six experts, drawn variously from operator firms, an offshore system design company, a supplier company and academia, offer their opinions on how composites can be better utilized in the offshore oil industry, as well as the benefits of wide-spread adoption of FRP materials in offshore projects, and how operators can capitalize on those benefits.

Long-term Performance

Steel and metal alloys are the traditional materials for oil field equipment and platform components. Although steel degrades, its behavior is well-characterized and design engineers feel comfortable with its properties. Inspection and repair methods are well-documented.

Question:

What’s the estimated performance life in offshore applications of composite materials, as compared to steel or metal alloys?

Answer:

“If the products are designed and installed properly, then the service life of composites is exceedingly good,” says Jerry Williams, of Petroleum Composites (Houston, Texas, U.S.A.) and formerly with the Composites Engineering and Applications Center (CEAC, at the University of Houston), Conoco and the National Aeronautical and Space Administration (NASA). “It’s in the installation where problems sometimes arise. For example, composite topside pipe requires a simple yet particular type of support system. Spacers must be closer together than for steel piping, because of the lower stiffness of composites, and care must be taken to design the system to prevent excessive pipe movement caused by dynamic surge loads, to avoid breakage at bonded joints.”

Shell has been a leader in incorporating composites in offshore construction, particularly since 1995 with the construction of its Mars platform in the Gulf. “The service life of composites depends on the type of service and the function,” says Shell Global Solutions U.S.’s K. Him Lo, one of the oil industry’s champions for composites. “Pipes can be designed to match the life of the platform, which makes them an attractive option. For something like grating or ladders, you can expect some replacement in heavy service areas, just as you would for steel.”

From the original installation of 215 tons of composites on Mars in 1995, the use of composites on that platform has grown each year as replacements for equivalent steel parts — today’s total is over 300 tons. “On the Ursa platform in the Gulf, we installed 210,000 ft² of composite grating, and have now accumulated 2 million walking miles on the platform with no wear after five years. We now know enough, and there’s enough of an economic incentive, that we can build-in an appropriate knock-down factor to ensure a risk-free product.”

Williams has investigated the longevity of installed composites, both offshore and onshore, and finds that, overall, operators have had good experiences with the products. “The material costs of FRP piping and other products are usually more than those for carbon steel, but they are less expensive than corrosion-resistant alloys,” says Williams. “The cost differential narrows when installed costs are compared, and shift in favor of composites when life-cycle costs are considered. We’ve seen life-cycle savings of up to 70 percent for FRP pipe.” Williams and others have collected FRP performance data in actual installations, and found that the vast majority of documented FRP component problems are due to rough handling, improper joining techniques or lack of proper installation support, rather than chemical degradation or failure of the laminate design.

Continues Williams, “There have been studies regarding erosion and cavitation effects in FRP pipe, including a test by the U.S. Navy. A two-inch FRP pipe showed no evidence of erosion after a year of exposure to seawater flow of 17 ft/sec, whereas a similar test with copper/nickel alloy showed damage. Erosion resistance can be enhanced with the selection of a tough (i.e., high strain elongation) matrix resin and reinforcing fibers properly sized for good fiber/matrix adhesion and a veil-reinforced resin-rich liner.”

Geoff Gibson of the Centre for Composite Materials Engineering at the University of Newcastle in the U.K. has tested the fatigue behavior of composites in conditions simulating offshore environments. “The effects of environmental degradation and fatigue have often been considered separately in composites, which has resulted in uncertainties — mostly on the conservative side — in design.” His research combines conditioning of samples in seawater to allow infiltration into the outer laminate layers with simultaneous fatigue bending. Samples were repeatedly flexed, then tested using acoustic emission equipment for signs of degradation. His data show that fiberglass/vinyl ester samples performed better than fiberglass/polyester or fiberglass/phenolic samples, and were unaffected by seawater diffusion. “Resin selection is important and must be matched to end-use conditions,” says Gibson.

Doug Johnson of Lincoln Composites (a division of Advanced Technical Products, Lincoln, Neb., U.S.A.) has been involved in the development of composites for offshore projects for more than 10 years, including risers and tension leg platform (TLP) riser tensioning system air pressure vessels. “Programs like those developed under the National Institute of Standards and Technology (NIST) umbrella are making oil companies more comfortable with composites — there’s a predictability of performance now.”

“Topside composite technology is maturing fast,” says Lo. “We’re now moving on to higher-risk components like risers, which have to withstand subsea conditions, and which need additional performance testing data.” Conoco’s Mamdouh Salama, currently testing a carbon fiber composite drilling riser joint in the North Sea, agrees. Salama has been deeply involved in programs aimed at developing a viable composite riser, including NIST projects and in alliance with Kvaerner. “The service life of composite components must be the same as the equivalent metal part, generally 25 years but perhaps as much as 50 years,” he explains. “The design knock-down factor, which ensures an adequate factor of safety, will be different depending on different loads, such as fatigue or torsion. For example, steel riser is designed to have a fatigue life several times greater than the expected life of the field. For composites, initially it’s likely that they will be designed to have an even higher safety factor to ensure performance, but over time as confidence grows the need to overdesign will lessen, and costs will come down,” says Salama.

Metin Karayaka of CSO Aker Engineering (Houston, Texas, U.S.A., a division of Coflexip Stena Offshore) designs risers to perform for 10 times the design life of the platform. “For example, if a platform has a 20-year life, the riser fatigue life would be 200 years, which is considered industry standard for any material. The work now is to show the operating companies that structural composite components are strong enough to withstand the demand of the applications, and put a large-scale demonstration project together to prove the benefits from the materials.”

Lo agrees that long-term performance data is a must, and supports manufacturers that are now working to accumulate long-term testing data on materials and products. “Seawater absorption can affect the fiber/resin interface and thus impact the properties of submerged composites, so testing is definitely needed to show performance and gain the operator’s confidence.”

Barriers Against Acceptance

The design flexibility of composites means that their properties can vary from application to application. In comparison to metals, there are relatively few material specification databases and design guidelines for composite materials. Many engineers have little first-hand experience with composites.

Question:

What are the barriers preventing acceptance of composites in platform construction? What steps should be taken, such as specifications, testing or education, to increase their use and increase the confidence level of the operators?

Answer:

“There are three major issues that operators look at when considering accepting composites,” say Him Lo. “There is the initial cost of the parts, which is more than steel. There is the issue of performance, and in particular, composite-to-composite and composite-to-steel connections, which can be problematic. Third, there is the question of how well the composite components can meet the tough fire performance requirements that are mandatory on offshore structures. New design concepts are needed that can meet these challenges while keeping costs down.”

“Major barriers to the expanded use of FRP products in the oil industry are the lack of familiarity with design and performance specifications and the lack of adequately trained installers and operators,” Williams explains but adds, “As familiarity increases — for example as composite gratings are installed—the operators and the platform workers begin to find that there are benefits, like the human factor of being easier on the legs and knees. There are operational benefits, such as the fact that the gratings can be installed without welding, so operations don’t need to be shut down for hot work, which results in an economic benefit. As you get from initial disinterest in even using the product to a state of neutrality, you begin to find some hidden jewels that create an incentive to use the product.”

In Johnson’s opinion, oil companies recognize the performance benefits of composites and the life-cycle cost advantages, but are much more comfortable specifying composites when there is an empirical database of performance in similar applications. “In the case of composite pressure vessels, operators were willing to adopt them right away for offshore service because they could see a long history of successful service in other pressure vessel applications. The same was true for topside piping. When in-service data is not available, operators are reluctant to accept new materials.”

According to Salama, the expanded application of composites in the offshore industry continues to face technical, financial and emotional barriers that must be overcome to allow their full potential to be realized. “Solutions to these barriers involve developing a more comprehensive design and manufacturing database to allow well-quantified risk assessment, establishment of a reliable cost structure for components and systems as well as familiarity on the part of offshore contractors and suppliers so that they gain confidence in design and use of the materials. I can’t overemphasize the value of accepted design codes for specific composite components— in the area of risers this need is currently being addressed, and regulatory agencies appear to be receptive.”

Another barrier cited by all forum participants is that the existing industry infrastructure supports incumbent traditional materials. “The offshore industry knows how to design steel,” says Karayaka. “Therefore, if you ask the platform designers to integrate major components made from a different material, the industry doesn’t have the infrastructure to support that, from purchasing on down to service companies, installers and testing companies. So at present, composite product introductions take a specialized effort, starting with persuading the operating company to participate. It takes a champion, someone who can get a commitment and complete a large-scale demonstration to document the benefits.”

Williams explains that while composites might be making inroads into the retrofitting of existing platforms, simple material substitution to gain immediate weight savings or corrosion resistance doesn’t exploit the full advantages of composites. “If you retrofit, you’re not taking advantage of all of the benefits of composites. Composites will really come into play in reducing overall platform system costs.”

Karayaka points out that the “window of opportunity” for composites in the offshore industry is not limitless, because other technologies have developed simultaneously with composites to respond to the challenges of deep water production. “When we started with composite risers, 3,000 ft of water was considered very deep. And that wasn’t that long ago. There are new platform concepts such as Truss Spars, SSVRs and mini-TLPs coming up every day that can go into deeper water, which are being designed with steel risers. It doesn’t mean that there’s no room for composites, but we need to be cognizant that other technologies are also pushing the envelope boundaries. But composites can make a major contribution, and the faster the composites industry reacts, perfecting the technology and making it more acceptable, the better for the ultra-deepwater applications.”

Innovative products and ideas are definitely coming to the forefront, such as composite drill pipe and new “smart” pipe with sensors embedded in the laminate, capable of self-monitoring and relaying information. According to Williams, smart pipe is a revolutionary development that can solve the critical challenge of testing and inspecting in-service composite components and enable rapid, in situ health monitoring of risers and export piping. “The aspect of integrating the signals into the pipe wall, I think, is an exciting area, a real milestone that could really set off activity in composites.”

A barrier to the use of composites in the past was the high price of carbon fiber, says Gibson, but current low fiber prices are making high-performance structural composites more attractive. “Because the specific stiffness of fiberglass composites is less than steel or aluminum, there’s a natural limit to the size and length of glass-based structures — above that level, carbon is essential just in terms of stiffness. Maintaining the current low price for carbon fiber obviously will also greatly improve the competitiveness of composites and help keep the window of opportunity open. There will have to be a step change in carbon fiber production capacity, as well, to enable the material to go into new application areas.” Several carbon fiber suppliers have formed strategic alliances with oilfield product manufacturers, and the commitment is there to ensure adequate worldwide capacity for large-volume applications.

Says Lo, “We need several things in order to move forward. First, successful field trials are necessary to build confidence; second, we need creative and innovative approaches; and third, we must have collaboration across groups, for example, between engineers and platform constructors. Standardization of regulations and design guides will also help the industry understand and accept the performance of composites.”

“The big developments in deepwater are likely to happen in the next decade. We’re in the formative period now, as I see it, so now is the opportunity for the offshore industry and the composites industry to form alliances that will show what composites can do, to benefit both groups,” Williams concludes. “If composite designs and products can be specified now, they will become the standard.”

Related Content

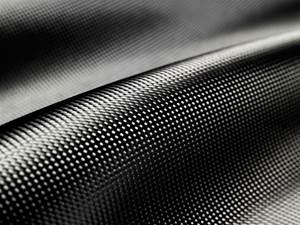

Materials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreThermoplastic composites welding advances for more sustainable airframes

Multiple demonstrators help various welding technologies approach TRL 6 in the quest for lighter weight, lower cost.

Read MoreWhy aren't composites synonymous with infrastructure?

The U.S. seems poised to invest heavily in infrastructure. Can the composites industry rise to the occasion?

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)