Gratifying local passions. Like other reshored framebuilders, We Are One has enjoyed brisk demand for its bikes from local cycling enthusiasts — much of which arose in an apparent response to pandemic restrictions. Photo Credit: We Are One

Are carbon fiber-reinforced polymer (CFRP) bicycle frames poised for a “great reshoring” — the return of production to locales near the customer base — or will they continue to be fabricated and shipped largely from Asian countries, as the vast majority are today? The short answer, according to bike manufacturers interviewed by CW, is that Asia will continue to predominate. Still, noteworthy changes to the bicycle manufacturing landscape are evident.

CFRP frame manufacturing is making inroads in North America and Europe, where most CFRP bike enthusiasts reside. “One of the biggest differences [between offshore and reshored manufacturing] is product ownership,” emphasizes Dave Luyckx, chief product officer at Leuven, Belgium-based Rein4ced. “Asia doesn’t have a bicycle culture, but we have this cycling culture that infuses passion into the product.”

A case in point of passion-inspired manufacturing is Ontario, Canada-based startup Bridge Bike Works, whose co-founder Frank Gairdner previously gained a deep knowledge of composites producing high-end CFRP power boats. “I wanted to care about the full cycle of the product,” says Gairdner of his switch from boats to bike frame manufacturing

Of course, cycling passion must be accompanied by composites know-how and innovative approaches before reshored CFRP frames achieve considerable market penetration. To the extent that the geography and technology of CFRP bike frame manufacturing are changing, key factors include the same market forces affecting all globalized manufacturing industries today: supply chain issues, fallout from the pandemic and geopolitical uncertainties. But the primary agent of change appears to be the classic tension between two manufacturing dynamics often at odds with each other: economies of scale versus production agility. The latter has prompted innovation that includes technical advances in the traditional hand-laid fabrication approach as well as forays into new materials and automated processes.

Post-mold labor versus upfront engineering

The dominance of Asian CFRP bike manufacturing is exceptional within the composites industry: Nic McCrae, R&D manager and senior composites engineer at Santa Cruz Bicycles (Santa Cruz, Calif., U.S.), reports that Asian frame manufacturers likely hold more than a 95% share of the dollar volume, producing close to 99% of CFRP frames worldwide. “Some super-large factories in Asia produce 500,000 frames per year,” McCrae says, noting that this is a factor in recent market consolidation. “This economy of scale tends to weed out smaller brands.” Santa Cruz builds its CFRP frames at the company’s exclusive factory (called Skybox) located in southeast China.

Bettering conventional framemaking. While some work in thermoplastics and automation is underway, most innovations in CFRP frame manufacturing are being applied to conventional hand layup of proven carbon fiber/epoxy prepreg. Photo Credit: Ibis Cycles

Companies finding success through local hand production, many in Canada and the U.S., occupy the opposite end of the volume spectrum. Those interviewed report annual production in the hundreds up to about 1,200 frames. Brands seeking to operate between these two groups, McCrae believes, are unlikely to succeed. For those making frames at an annual rate in the low thousands, he says, “They usually won’t have the prestige of small boutique frame builders to justify higher cost or the economy of scale to be cost-competitive.”

The relatively low-tech approach of most Asian manufacturers has proven to be a winning recipe for CFRP frames — highly complex structural components made for a cost-driven marketplace. “It’s such a complex structure, about as complex as you get,” notes Preston Sandusky, development engineer at Ibis Cycles (Santa Cruz, Calif., U.S.). “The frame is bladder molded all in one piece, with wall thickness varying from 1.5 millimeters to 10 millimeters.”

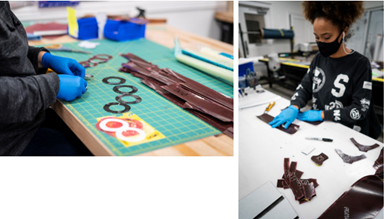

The Asian approach comprises a labor-intensive hand layup process, using carbon fiber-reinforced epoxy prepreg with a long track record of meeting frame demands for light weight and high strength and stiffness. The prepreg is cut and kitted; each frame may consist of 400 or more patterns. These patterns are then hand laid on bladders and mandrels to form the frame shape. The completed layup is placed in a mold, then debulked and cured.

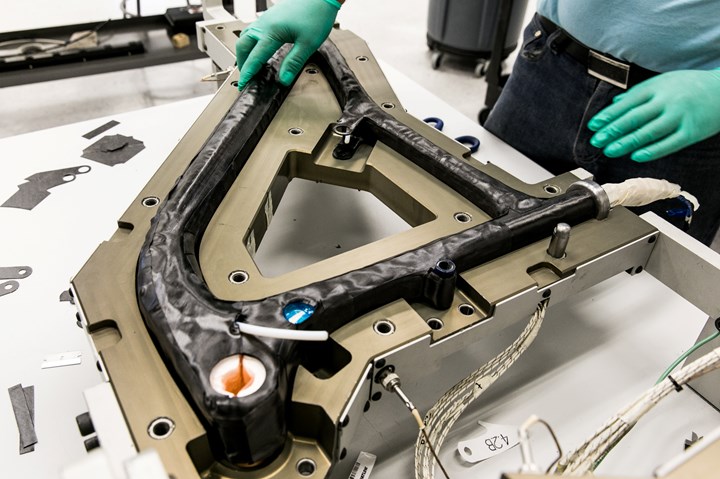

High complexity. Bicycle frames take advantage of CFRP directional strength and stiffness properties over tight geometries and with complex inserts and fittings — all of which make hand layup the most time- and cost-efficient process for now. Photo Credit: Ibis Cycles

Because this process is dependent on a considerable amount of manual labor, questions about the quality of the frames have been raised. McCrae counters that companies like Santa Cruz have been able to build a high-quality product using Asian production, not by making big changes in materials and processes but by what he calls “less exciting, small details.” The company has cultivated manufacturing consistency and also streamlined processes through vertical integration, working with the same shop and same personnel for a decade or more, and spending significant time honing the skills of the fabrication team.

To investigate innovations in CFRP bike-making, Santa Cruz recently built a carbon prototyping lab at its U.S. base in Santa Cruz. A focus on design for manufacture there has yielded great benefits, McCrae reports. “Increasing a draft angle on a part has increased yield from 92% to 99%, for example.” The lab explores changes in angles, ply overlaps, the mix of fabrics and fiber orientations, and more.

Most reshored, local manufacturers also report making innovations to the basic hand-laid, bladder molding process rather than developing new processes or materials. In some cases, like at Allied Cycle Works (Rogers, Ark., U.S.), this means sticking with tried-and-true carbon fiber/epoxy, but honing in on the best types of prepreg to meet specific design and performance objectives. The company cites as a key advantage its U.S.-sourced prepreg that was created to support demanding aerospace and defense applications.

Engineering ply patterns. Allied Cycle Works employs a mix of prepreg patterns, leveraging the drapability of larger plies where possible and using small plies to meet performance goals in high-stress areas of the frame while minimizing weight. Photo Credit: Allied Cycle Works

Allied’s primary material is a Mitsubishi Chemical Carbon Fiber & Composites (Sacramento, Calif., U.S.)

Bridge’s Gairdner concurs, especially with regard to tooling. “The mold is your golden egg in the shop,” he says. “If you’re not controlling your mold, you’re not controlling your product.” Bridge machines its own molds, having outfitted its shop with a Haas (Oxnard, Calif., U.S.) VM3 CNC mill. The company employs an Autometrix (Grass Valley, Calif., U.S.) cutting table to cut its prepreg patterns, a Wabash (Wabash, Ind., U.S.) hydraulic platen press and a DuroPure booth from Duroair Technologies (Niagara Falls, Ontario, Canada) for paint prep and painting. Gairdner reports that Bridge is working with several companies to evaluate their prepreg. Most of these suppliers use Toray (Tokyo, Japan and Morgan Hill, Calif., U.S.) carbon fiber fabrics with their own resin systems.

Unlike McCrae, a number of these reshored manufacturers told CW that ongoing issues with quality and consistency from their Asian suppliers contributed to their reshoring decision. For example, Dustin Adams, CEO of We Are One (Kamloops, B.C., Canada), experienced such issues when he worked for a company that sourced frames out of Asia. But moving production into places with a higher wage labor force is likely to be successful only by reducing the amount of labor going into each frame.

Mold advancements. Several companies report using aluminum molds in their reshored operations to gain greater control as well as energy efficiency. Ibis Cycles has also incorporated electrical heat cartridges and sensors, enabling computer control of thermal and pressure cure profiles. Photo Credit: Ibis Cycles

Ibis Cycles has launched a small manufacturing operation in the U.S. but continues to use offshore manufacturing for much of its portfolio. “All our design and engineering are here [in the U.S.] and most manufacturing is in Asia,” explains Colin Hughes, Ibis engineering manager. “That is the model for most of our business. I don’t think we will ever replace Asia.” Hughes adds that the high-volume contracted factories in Asia are more resistant to new ideas, since they have a proven, stable process for making a high volume of frames. It is much easier to introduce innovations at small reshored factories, a fact that contributed to Ibis’ decision to build some frames in the U.S.

As Ibis Cycles considered reshoring some of its framebuilding around 2014, “we knew the only way you can make carbon fiber bike frames in the U.S. is [to] cut the labor time out of it,” Sandusky recalls. “There’s got to be a lot of upfront engineering so that everything is lined up to reduce the amount of labor.”

Post-mold labor in particular, which is a major part of the framemaking process in Asia, has been identified by many manufacturers reshoring into North America and Europe as the low-hanging fruit for labor reduction. The conventional post-mold process may include deflashing, sanding and surface treatment, machining, assembly and surface finishing/preparation prior to painting. In the Asian factories Adams observed, he estimates that 50% to 60% of labor occurs post-mold.

Class A out of the mold. Many reshored framemakers have achieved cost-competitive production by fabricating frames that need little post-mold labor to produce high-quality finishes. Contributing to quality and cost improvements are careful selection and sourcing of prepreg as well as stringently engineered and controlled molds. Photo Credit: Allied Cycle Works

Adams set out at We Are One to make mountain bike frames that achieve a Class A finish out of the mold. “If we could remove the post-molding process,” Adams says, “we could compete on a dollar-for-dollar basis.” Process advancements that We Are One has made include a reengineered bladder technology that uses better bagging material (made from polypropylene) and achieves higher in-mold pressures. The company also investigated and found a prepreg made with a Class A resin system with Toray fibers. To ensure a rapid and accurate layup process, the company cuts and kits its ply patterns using Gerber (Tolland, Conn., U.S.) and Autometrix CNC ply cutters. One other major change the company made is to use aluminum instead of steel molds. We Are One uses its two Haas VM-3 vertical mills to machine all of its tooling in-house. Adams reports that these molds enable We Are One to better control viscosities, ensure all air is removed without a large vacuum debulk and produce a more consistent, uniform finish out of the mold.

Ibis Cycles has followed a similar path for its U.S.-manufactured Ibis Exie cross-country race bike. In 2014, the company began a two-year R&D effort at its new U.S.-based prototype lab to uncover opportunities for greater manufacturing efficiency. The resulting process has cut cycle time from 86 hours to 34 hours, a 60% reduction that enables the U.S.-built frames to be cost-competitive with those coming out of Asia. Ibis sources its intermediate modulus (IM) carbon fiber/epoxy unidirectional prepreg from Toray’s and Hexcel’s U.S. operations out of Tacoma, Wash., U.S., and Salt Lake City, Utah, U.S., respectively, and uses its Autometrix cutter for efficient ply cutting. One key to the improved cycle time is a 70% reduction in the number of ply patterns in each kit. Careful engineering and controlled manufacture of the Ibis Exie, Sandusky notes, results in a frame about 225 grams (0.5 pound) lighter than what Ibis could make in its Asian factories.

Post-mold touchup. Some Asian frame manufacturers have been observed to spend 50% to 60% of labor time on post-mold finishing operations. To cut labor costs and production time, many reshored framemakers choose instead to carefully engineer material selection, layup design/schedule and moldmaking to minimize post-mold requirements. Photo Credit: Ibis Cycles

Like We Are One, Ibis has also switched to aluminum tooling, in this case with a clear hardcoat anodized finish and with built-in electrical heat cartridges and sensors to maximize heat efficiency. The tooling system enables energy efficiency — Ibis currently powers its manufacturing fully through its rooftop solar cells — and consistent, high-quality finished product through computer control of the thermal and pressure cure profiles. The company designs its own molds, sources out the machining, then assembles them in Santa Cruz.

Smaller local framemakers are also advancing the bladder molding process for greater quality and efficiency. Argonaut Cycles (Bend, Ore., U.S.) has distinguished its framebuilding by employing a patented high-pressure silicone molding (HPSM) approach. The company identified fiber distortion, caused by lack of control over bladder expansion during cure, as a significant manufacturing issue — especially for road bikes. Because fiber distortion can adversely affect frame strength, bike builders often design and build in a margin of safety by increasing wall thickness and, therefore, weight. Argonaut replaces the conventional bladder with a silicone structure built on an alloy skeleton.

Using silicone’s high coefficient of thermal expansion (CTE) to create a more controlled internal pressure during oven cure, the company lays claim to frame components that contain no voids, pinholes or other structural flaws. The HPSM process enables Argonaut to decrease safety margins while achieving needed strength. The company also employs high-modulus UD prepreg in 85% of the frame, enabling highly tailored strength and stiffness profiles, with another 10% consisting of 3K weave and the final 5% using Kevlar for its damping performance and impact resistance. Highly engineered designs and molds produce frames that require little post-mold labor, like those discussed above.

Complementing design flexibility is the manufacturing agility that local manufacturers enjoy, having eliminated the lead time required for Asian frames. “Lead times were okay pre-pandemic,” recalls Rein4ced co-founder and CEO Michaël Callens, “but in the pandemic, there was huge variation in ordering and forecasting, and no one knew quite what to do.” Typical pre-pandemic lead times of three to six months have stretched to as much as two years in the post-pandemic supply chain crisis. Rein4ced’s European suppliers support much shorter lead times and enable the company to move toward just-in-time manufacturing and to more readily accommodate order changes. We Are One’s Adam agrees. “We are much more agile. We can chase an idea by the end of the week. If you have the tooling, the staff and the wherewithal, you can move very quickly.”

The automation horizon

More radical changes to materials and processes are moving forward, though in some cases they have been hampered by past failures. Industry veterans like Santa Cruz’s McCrae are skeptical about the short-term viability of two technologies that are pointed to as most promising: thermoplastic resins and automated fabrication techniques. “They have had lukewarm success so far. They are not competitive on cost; their manufacturing method limits design; and thermoplastics are producing heavier frames so far. Plus, scalability hasn’t yet materialized.” But he sees their promise on a time horizon of five to 10 years. “There could be significant advancements that trickle down from the automotive industry,” he continues. “It’s just that the bicycle industry doesn’t have deep enough pockets.”

Agile manufacturing. The elimination of lead times is a key advantage for companies that build their own tools and frames. The resulting agility enables companies like We Are One to advance new designs quickly into production. Photo credit: We Are One

Luyckx of Rein4ced, which has developed both a new material and a new automated manufacturing approach for CFRP bike frames, agrees with McCrae on two counts (though he anticipates a shorter time horizon). First is the potential for drafting off the advancements of the automotive and aerospace industries. Launched in 2015, Rein4ced is staffed by cycling and composites professionals with ties to the advanced composites work of Delft and Leuven universities in Belgium. Before he joined Rein4ced, Luyckx was educated at TU Delft (Netherlands) and then began his career with Asian-manufactured frames. “I got accustomed to hand manufacturing. But a great pool of composites knowledge in Belgium was not being applied to bikes,” he recalls.

Luyckx also agrees that early efforts to apply thermoplastics to the biking industry were problematic. “Thermoplastics have not had a good reputation because the 1980s and 1990s had many examples of how not to do it!” he says. “Thermoplastic technology was not there yet, so it was a marketing gimmick that failed and resulted in the bad reputation.” But automotive and aerospace development of thermoplastic composites has matured the technology in recent years, to the point that it is ripe for reconsideration by the bicycle industry, he says. Additionally, growing sustainability efforts raise the appeal of thermoplastic composites and their end-of-life (EOL) inherent recylability. Importantly, thermoplastics also lend themselves more readily to automated processing. “In thermoset manufacturing, prepreg must be placed immediately and in the right place [for the finished component],” notes Rein4ced’s Callens. “This is highly complex for automation.” Manufacturing with thermoplastic composites, in contrast, can be performed in more steps, a fact that Rein4ced uses in its process.

For its bike frames, Rein4ced has tapped advancements both in thermoplastic materials and processes, and in reinforcing fibers. Specifically, the company has built upon Callens’ academic work on the application of fine steel microfibers to composite structures. Based on this work, Rein4ced developed the Feather material, which combines a minimal amount of ductile steel fibers with carbon fibers in a thermoplastic matrix. The material offers near-equal fiber stiffness to carbon fiber alone, with no weight increase and much higher impact performance. Safety and reliability are enhanced for cyclists because the material eliminates the sudden and catastrophic failure profile of traditional CFRP. “Steel deforms plastically,” Callens explains, “and higher energy levels are needed to cause failure.”

Rein4ced’s automated process remains predominantly undisclosed; Luyckx and Callens describe it as a press-forming process of tailored blanks, which are laid up robotically from UD prepreg tapes, followed by a proprietary assembly step. The company has partnered with multiple European bike makers. Just this year, Kellys Bikes (Veľké Orvište, Slovakia) launched its Theos e-bike that employs frames fabricated and supplied by Rein4ced.

In Denver, Colo., U.S., Revved Industries is also developing an automated process using thermoplastics, a material that caught the company’s interest for its Guerrilla Gravity mountain bike frames because of its impact resistance. In fact, impact resistance was one of the three goals the team set for themselves, along with controlling cost and manufacturing the frame in the U.S., as they began their efforts in 2013. “We had a good idea of what impact damage aggressive riders in aggressive terrain would see in the ownership of the bike,” says Matt Giaraffa, Revved Industries co-founder and chief engineer. Their work resulted in their Revved Carbon technology and the launch of Guerrilla Gravity frame manufacturing in 2019.

Extensive coupon testing on various carbon fiber-reinforced thermoplastics (CFRTP) developed through aerospace and automotive R&D led to Revved Industries’ material choice. Material and process developments at the company rely on recent innovations in the composites industry. “The material and the technology that made this possible simply wasn’t available when we first started looking,” Giaraffa recalls.

At Revved, the material is laid up using a patent-pending automated fiber layup system, which reduces labor time by about 80%. The cure process, performed in the company’s proprietary Frame Maker 3000, also accelerates production compared to conventional curing. “With traditional materials, they need a very controlled ramp, a very controlled dwell time and a very controlled cooling time,” explains Ben Bosworth, Revved Industries composites engineer. “The Revved technology doesn’t really care about how fast or slow it’s heated

Ensuring quality. Several of the interviewed companies that manufacture their own frames cite as an important benefit the confidence they have gained through immediate control over quality and consistency. Photo Credit: We Are One

Sanding and finishing time is also reduced by 90% compared to the conventional Asian approach, Giaraffa says. “We can pull them out of the mold, do some basic cleanup and then powder coat them” rather than applying wet paint. Powder coating eliminates labor and the release of volatile organic compounds (VOCs) found in wet paint.

Negotiating market uncertainties

Regarding global market forces and their particular impacts on the CFRP bicycle industry, geopolitical concerns had prompted some shifts in Asia — primarily from China to countries such as Vietnam, Cambodia, Thailand and Myanmar — even before the pandemic began. COVID-19 then cemented the need for this supply chain diversification, not only in Asia but also through the reshoring efforts of companies like those covered here. “During the pandemic,” Luyckx reports, “customers realized that having manufacturers on the other side of the globe is not good for the supply chain.”

The pandemic also created demand for bicycles that initially surprised local manufacturers. Bridge had just started development when COVID started. “We thought we had to put it on pause,” Gairdner recalls, “but three weeks later, the bicycle boom started.”

“COVID has set the high-end cycling market on fire,” Allied’s Pickman agrees. “People had a lot of time at home. They were looking for activities they could do safely outside. A lot of people prioritized their physical health at that time. When COVID first hit, we were nervous, pulling back on some forecasts. But we have a real supply and demand crunch right now.”

How long the boom will last, and its enduring effects on the bike frame market, remain to be seen. “The smarter people think it’s about a five-year thing,” Pickman continues. “Keeping customers in the market is then up to us. It’s exciting but also nerve-racking.”

To build and/or keep up the market momentum, reshored CFRP frame manufacturers have found a need to help would-be customers reorient their perspective from unit prices to the total value of local production — starting with shipping costs. “Pre-pandemic, a shipping container from Asia might cost $3,000 to $4,000; now it is $15,000 to $16,000,” Luyckx reports. Expanded lead times tie up working capital, increasing manufacturers' capital requirements and overall costs. Sustainability is also better supported by local production, which drastically reduces the carbon footprint of product delivery.

Around the next bend

Whether thermoplastics and automated fabrication make their mark on the CFRP bike frame marketplace in 10 years, as some predict, or within the more optimistic two- to five-year window, it is likely that these technologies will eventually capture a significant market share. When a single factory is making a half-million CFRP components annually, it seems inevitable that reducing labor costs will make good economic sense at some point, the complexity of bike frames notwithstanding. Technological advances in materials and processes will continue through automotive and aerospace R&D efforts, feeding advancements in other industries, including bicycles. While the Asian approach is rightly labeled a “winning recipe” today, these advancements may make the labor-intensive approach less cost-competitive in the not-too-distant future.

At the same time, the agility, flexibility and quality control achieved by low-volume frame manufacturers are also likely to enable companies to continue reshoring the hand layup process, growing and maintaining enough market share to support their businesses well into the future. To achieve this success, these framebuilders are keeping their noses to the grindstone, eking out additional efficiencies and quality improvements wherever they can. “We’re looking to achieve a better manufacturing process,” says Adams at We Are One, “and making advancements daily in control of the process.”

Related Content

Materials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreComposite rebar for future infrastructure

GFRP eliminates risk of corrosion and increases durability fourfold for reinforced concrete that meets future demands as traffic, urbanization and extreme weather increase.

Read MoreThermoplastic composites welding advances for more sustainable airframes

Multiple demonstrators help various welding technologies approach TRL 6 in the quest for lighter weight, lower cost.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More