Carbon fiber market: Cautious optimism

As the recession recedes, the demand for carbon fiber, and the supply to meet it, will exceed prerecession expectations.

Predicting carbon fiber supply and demand is ever an inexact science — and one that produces forecast data about which it is easy to argue. But most composites professionals agree, at least, that the further away the industry gets from the economic swoon of 2009-2010, the better. Indeed, many of the attendees at CompositesWorld’s Carbon Fiber 2010 conference in La Jolla, Calif. (Dec. 7-9) seemed eager, albeit with some uncertainty, to look ahead rather than rehash a recession that, by all appearances, is very gradually dissolving into the past.

In the carbon fiber market’s future, there’s much to like: The Boeing Co. (Chicago, Ill.), despite the well-publicized delays, is inching closer to the inevitable first delivery of the composites-rich 787 Dreamliner. Boeing announced on Jan. 18 that the new target for first delivery is the third quarter of this year. This key event will trigger increased supply chain activity and end program uncertainty. Meanwhile, Airbus (Toulouse, France) is moving ahead aggressively with its own twin-engine, twin-aisle, carbon-fiber-intensive aircraft, the A350 XWB, which will, in turn, activate another large carbon-fiber supply chain and significantly step up overall demand. The wind energy industry fancies bigger but less weight-intensive blades, which means more carbon fiber will be heading to wind farms both on- and offshore over the next few years. Even the auto industry, having seen the writing on the alternative-energy wall, is making heretofore unheard of promises to use carbon fiber in several new and exciting structural applications that are designed to reduce weight and increase fuel efficiency.

These positive indicators drove the discussion at the Carbon Fiber 2010 conference, which was headlined again this year by Chris Red, editor and VP of market research at Composite Market Reports (Gilbert, Ariz.), and Tony Roberts, principal of AJR Consultant (Lake Elsinore, Calif.). They offered their annual predictions of carbon fiber supply and demand for the next several years. Unlike last year, when Red and Roberts each offered their own set of data (see last year's CF Market Outlook, title "Carbon Fiber — UP!" under "Editor's Picks" at right), the numbers this year were consolidated (see tables, at right). However, in what has become a tradition at the Carbon Fiber conference, Red’s and Roberts’ assessments differed at points, most markedly about future demand for carbon fiber in wind turbine blades.

Carbon fiber supply

The pair began by gauging present and future carbon fiber supply, a task as imprecise as measuring potential demand because not every carbon fiber manufacturer shares data regarding plant capacity. At the conference, however, there was general agreement that the figures supplied by Red and Roberts, adjusted with these limitations in mind, were relatively accurate.

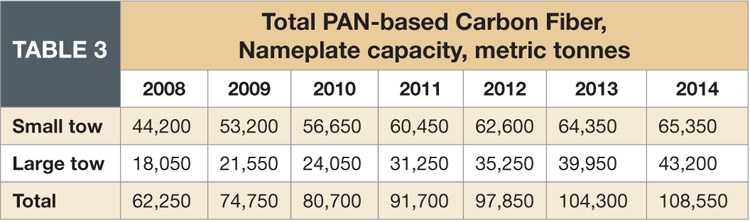

The numbers reflect only polyacrylonitrile (PAN)-based carbon fiber and are divided into small tow (1K to 24K) and large tow (larger than 24K). Further, the data reflect nameplate (maximum) capacity and do not account for the knockdown effect. Knockdown represents the amount of usable carbon fiber that comes out of a carbon fiber line’s stated capacity. The knockdown varies by tow count, but the average knockdown for all fiber types is about 35 percent, which means that 65 percent of a line’s nameplate capacity is usable. The knockdown percentage tends to be smaller for large-tow carbon fiber and larger for small-tow carbon fiber.

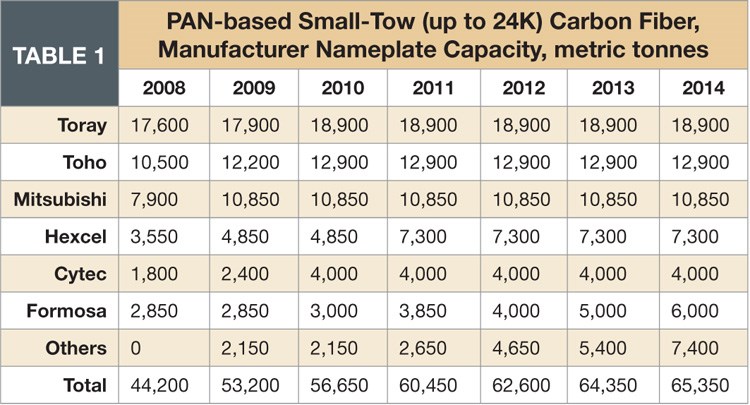

PAN-based, small-tow carbon fiber suppliers include the following familiar names, in descending order of capacity: Toray Industries Inc. (Tokyo, Japan), Toho Tenax Europe GmbH (Wuppertal, Germany), Mitsubishi Rayon Co. Ltd. (Tokyo, Japan), Hexcel (Dublin, Calif.), Cytec Engineered Materials Inc. (Tempe, Ariz.) and Formosa Plastics Corp. (Taipei, Taiwan). The total nameplate capacity for all small-tow suppliers in 2010 was 56,650 metric tonnes (124.9 million lb), up from 53,200 metric tonnes (117.3 million lb) in 2009 and headed toward 65,350 metric tonnes (144.1 million lb) by 2014.

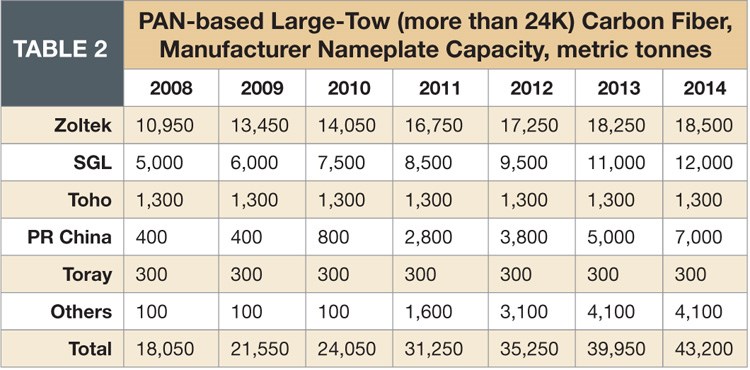

Large-tow carbon fiber suppliers include Toray, Toho Tenax, Zoltek Corporation (St. Louis, Mo.), SGL Carbon SE (Wiesbaden, Germany) and a smattering of newer, smaller manufacturers in China. The total nameplate capacity for all large-tow suppliers in 2010 was 24,050 metric tonnes (53 million lb), up from 21,550 metric tonnes (47.5 million lb) in 2009 and expected to reach 43,200 metric tonnes (95.2 million lb) by 2014.

Red and Roberts noted that in 2010, about 5,000 metric tonnes (11 million lb) of new carbon fiber capacity came online. Roberts, who has spent much time in China during the past few years, believes that the recent rate of carbon fiber manufacturing expansion there will diminish in the near future, primarily due to the lack of local technical expertise and limited access to the precursor required for carbon fiber. Red reported that today there are available 100 commercial grades of carbon fiber. Of that number, he said, 80 to 90 percent is standard-modulus fiber, ranging from 12K to 50K tow. The balance, 10 to 20 percent, is intermediate- to high-modulus fiber.

A big question before the carbon fiber supply community is whether or not a viable, inexpensive non-PAN precursor can be developed to help reduce the cost of carbon fiber. The acrylic used to make PAN is manufactured in a capital-intensive process. Therefore, many potential players are deterred from the carbon fiber market by the cost of entry. Red’s forecast is pessimistic about non-PAN precursor; however, Oak Ridge National Laboratory (Oak Ridge, Tenn.) is pursuing development of a lignin-based precursor that, it’s hoped, could reduce carbon fiber cost by as much as 50 percent.

Carbon fiber demand

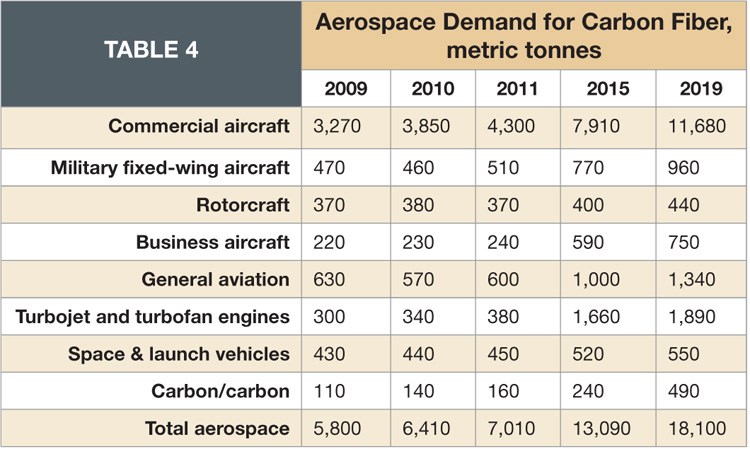

Historically, carbon fiber demand rises and falls with the fortunes of a few high-profile aerospace part programs, primarily space and military contracts. Today, those programs have been eclipsed by Boeing’s and Airbus’ commercial transport programs. Boeing’s 787 and the Airbus A350 boast primary structures that are at least 50 percent composites by weight. Each also represents a major leap in aerospace carbon fiber use that already has touched off a round of carbon fiber plant expansions and startups. Even so, Dan Pichler, director, carbon fiber, at carbon fiber manufacturer AKSA Akrilik Kimya Sanayii A.S. (Istanbul, Turkey), told Carbon Fiber 2010 attendees that the aerospace sector’s reign as the largest and most important link in the carbon fiber supply chain has passed. He reported that industrial applications accounted for more than 50 percent of carbon fiber demand in 2010, while aerospace represented only about 25 percent. By 2020, he forecasts, industrial demand will increase to 75 percent, while aerospace, despite the implementation of known large programs, will slide to about 20 percent.

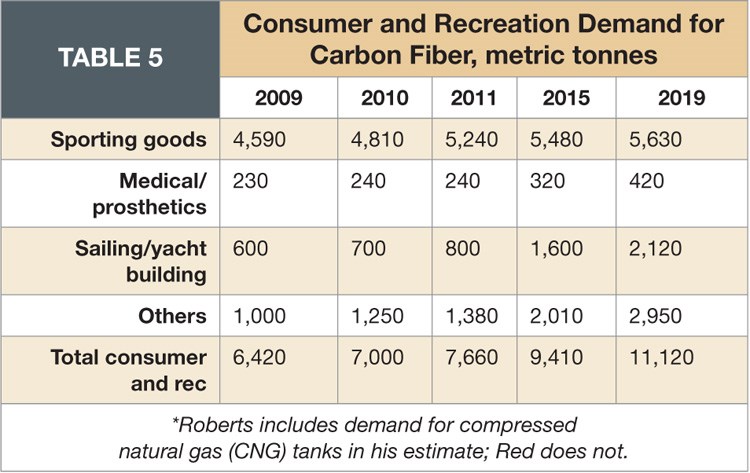

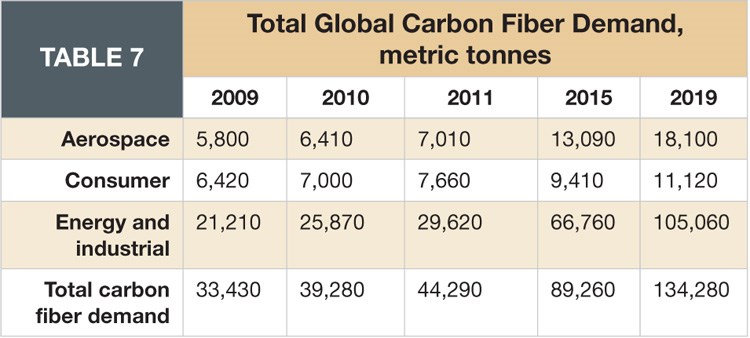

This trend is evident in the demand data presented by Red and Roberts. Their figures were split into three broad categories: aerospace; consumer and recreation; and energy and industrial. Looking 10 years ahead, Red and Roberts sketched a rapidly changing demand picture as more carbon fiber is funneled toward high-volume industrial applications.

In 2010, Red and Roberts showed a demand of 6,390 metric tonnes (14.09 million lb) for aerospace; 7,000 metric tonnes (15.43 million lb) for consumer and recreation; and 25,850 metric tonnes (56.99 million lb) for energy and industrial. Red and Roberts forecast that by 2019 those demand figures will increase, respectively, to 18,100 metric tonnes (39.90 million lb); 11,100 metric tonnes (24.47 million lb); and an eye-popping 105,080 metric tonnes (231.66 million lb). A large majority of the energy and industrial demand is expected to come from wind, which Red and Roberts peg at 9,990 metric tonnes (22.02 million lb) in 2010 and 64,190 metric tonnes (141.51 million lb) by 2019.

This is a contentious point between Red and Roberts and among some carbon fiber suppliers. Red is notoriously bullish about carbon fiber demand for wind blades — particularly as they get larger and as weight reduction becomes more important. Red predicts that by 2019 the world will produce 27,000 wind turbines and 82,000 blades, and carbon fiber composites will comprise 6 percent of all composites in each blade.

Roberts is not as optimistic and told conference attendees that he thinks the wind energy demand for carbon fiber will be closer to 50,000 metric tonnes (110.23 million lb) by 2019. “Wind power people are still very conservative about carbon fiber,” Roberts said, “one for price and two for supply.” However, even if Roberts’ predictions are more accurate than Red’s, 50,000 metric tonnes would dwarf every other carbon fiber application in the world. In short, the wind energy market looks to be the dominant market for carbon fiber for several years to come.

Despite the growing prominence of wind in the carbon fiber market, aerospace remains important and active. Although commercial aircraft orders have declined steadily since 2007, Red and Roberts say they show signs of resurgence as the recession slowly unwinds. In any case, despite the slowdown, Boeing and Airbus each have more than six years of backorders on their books, which represents steady, sustainable demand.

Although the 787 and A350 represent a shift in composites use in commercial aircraft, Red and Roberts said not to expect a substantial increase in the use of carbon fiber composites in commercial airplanes — 50 to 55 percent of aircraft structure appears to be the upper limit. Two developing projects to watch, they noted, are regional jets (narrow-body, <200-passenger commercial aircraft), the COMAC C919, under development at Commercial Aircraft Corp. of China (Shanghai, China) in China and the Sukhoi Superjet 100 from Sukhoi Civil Aircraft (Moscow, Russia). Designed to compete with similar offerings from Bombardier (Montreal, Quebec, Canada) and Embraer (São José dos Campos, Brazil), each is expected to include 30 to 37 percent composites by weight.

The business jet and general aviation (GA) segments — particularly hard hit by the recession — are showing signs of life and offer a substantial opportunity for growth in demand, said Red and Roberts. The decade from 2010 to 2019 is expected to see the addition of 12,400 aircraft in the GA segment and 13,600 more in the business jet market. Notable among these is the forthcoming Learjet 85 from Bombardier. The flyaway weight of composites is about 54 percent in GA aircraft and 68 percent in business jets, said Red and Roberts.

Back on the ground, one carbon fiber end market that shows significant growth potential is pressure vessels, particularly those for compressed natural gas (CNG) and hydrogen storage for automotive applications. In 2010, pressure vessel carbon fiber demand was 1,480 metric tonnes (3.26 million lb). These figures are expected to grow to about eight times that size — 11,470 metric tonnes (25.29 million lb) — by 2019. Carbon fiber accounts for about 10 percent of the fiber used in Type III and Type IV pressure vessels, Red reported, noting that these types are expected to see greatest use in developed countries.

Ever in the background but still a high-value target for carbon fiber suppliers is the oil-and-gas industry. Observers have long maintained that this industry should have adopted carbon and glass fiber composites long ago to take advantage of its corrosion resistance, weight and lifecycle-cost benefits in pipe, risers and other deepsea applications. But the consensus at the conference was the oil-and-gas industry remains averse to change. If it adopts carbon fiber, it will do so slowly and reluctantly. In short: Don’t hold your breath.

Demand, supply balance

Looking out over the next decade, if Red’s and Roberts’ numbers hold firm and assuming a relatively stable knockdown effect, carbon fiber supply and demand are expected to reach equilibrium in the 2014-2015 time frame. After that, demand is expected to quickly outpace supply, resulting in a capacity gap of 70,000 metric tonnes (154.32 million lb) by 2019.

It’s assumed that the carbon fiber manufacturing community will fill the supply gap, but the inequity highlights a chronic problem the carbon fiber community faces: A real or perceived carbon fiber shortage can sideline potential carbon fiber users who fear that the time and expense of developing carbon-fiber-reinforced products might be for naught. This challenge could be met, at least in part, by successful development of a non-PAN precursor, which would boost the total carbon fiber supply and provide a less costly fiber alternative for developers of products that do not need aerospace-grade fiber.

DowAksa Ileri Kompozit Malzemeler Ltd. Sti

Editor’s note: Carbon Fiber 2011 will be held Dec. 5-7 in Washington, D.C. Also in 2011, CompositesWorld will host the Wind & Ocean Energy Seminar (April 13-14, Portland, Maine) and the High-Performance Fibers conference (Nov. 9-10, Charleston, S.C.). Keep an eye on www.compositesworld.com/conferences for information.

Related Content

Novel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreOne-piece, one-shot, 17-meter wing spar for high-rate aircraft manufacture

GKN Aerospace has spent the last five years developing materials strategies and resin transfer molding (RTM) for an aircraft trailing edge wing spar for the Airbus Wing of Tomorrow program.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreRead Next

Carbon Fiber: UP!

Despite 2008-2009 recession lows, prognosticators at CompositesWorld's recent Carbon Fiber Conference predict a decade of highs.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More