Carbon Fiber in the Wind

Is there a market for carbon composites in wind turbine blade construction? Yes, but the real question is, how big will it be?

Much has been said about the potential for carbon fiber use in wind energy systems. The driver for its use is the need to optimize stiffness-to-weight as wind turbine designers increase blade length (and rotor swept area) to make turbines more cost-effective. Historically, blade length has increased 10 percent annually and doubled approximately every seven years. In the mid-1990s, the largest turbine had an output of 800 kW. Today, a turbine of average size is rated between 1.5 MW and 2.0 MW, and at least three of the top 10 manufacturers have 5.0-MW prototypes installed or in development. Of the top 10 global wind turbine and wind blade manufacturers, the largest two, Vestas Wind Systems A/S (Randers, Denmark) and Gamesa (Zamudio, Spain), publicly acknowledge that they currently use carbon fiber. Vestas and Gamesa accounted for 44 percent of the total wind turbine market in 2006, but each uses carbon fiber as the primary reinforcement in the spars of all blades above a certain length. DeWind Ltd. (Lübeck, Germany, part of EU Energy in Milton Keynes, U.K., in turn a subsidiary of Composite Technology Corp. in Irvine, Calif.), also uses carbon, but inserts a precured carbon prepreg spar into a shell preform, which it then infuses using VARTM. By contrast, GE Energy (Atlanta, Ga.), Suzlon Energy Ltd. (Aarhus, Denmark), Nordex AG (Norderstedt, Germany) and LM Glasfiber Group (Lunderskov, Denmark) all use some form of resin infusion, rather than hand layup, to improve the fiber-to-resin ratio of their all-fiberglass blades. Additionally, these companies credit sophisticated refinements in blade design and drivetrain for significant weight, cost and efficiency improvements, without resorting to the use of carbon.

Still, analysts believe carbon fiber has a more significant role to play, and blade manufacturers are researching where and how to use the material — and where to get it until the present supply crunch eases. As one major carbon supplier has stated, “We’re talking about many companies and a significant amount of material.” In fact, at the current rate of growth, carbon fiber consumption in the wind industry could be as much as 6,804 metric tonnes/15 million lb per year.

Solving the cost/benefit equation

Predicting the future of carbon use in wind systems is difficult, in part, because of the markedly different approaches that blade manufacturers have taken to the same engineering problem.

In Europe, Vestas manufactures blades at its factories in Lem and Nakskov in Denmark and in Lauchhammer, Germany. Historically, its blades have been made using fiberglass/epoxy prepreg. Each blade consists of two shell sections, which are bonded onto a precured spar, with the spar determining the strength of the blade. As Vestas built larger turbines, however, it explored new designs and new materials. When Vestas began European production of its V90 1.8-MW, V90 2.0-MW and V90 3.0-MW turbines in 2004 — the 44m/144-ft blades for the V90 3.0-MW turbine are the longest Vestas currently has in production — carbon fiber replaced fiberglass in several key areas, including the spar cap, making the 44m blades lighter than their 39m predecessors. The new blades also incorporate an advanced aerodynamic profile that helps to minimize the loads on the nacelle and the tower. Reduced weight means reduced loads, which improves efficiency. The 1.8-MW and 2.0-MW V90s also use the new 44m blade, with a 27 percent increase in swept area at the same weight as the 37m/121-ft blade used in the V80 wind turbines.

Vestas also is manufacturing blades from wood and carbon fiber/epoxy composites. In a presentation at the SAMPE UK 6th Annual Technical Conference in 2006, John Rimmer of Vestas Blades (Isle of Wight, U.K.) described the company’s technology for making blades of 40m/131 ft and longer: Finnish beech, balsa, carbon fiber and a small amount of fiberglass reinforcement are laid up dry and then processed by resin infusion. According to Rimmer, this combination can produce a finished blade in 24 hours. Vestas acquired this technology in 2003 when it merged with NEG Micon (Randers, Denmark), which, in turn, obtained it in 1998 from Aerolaminates (Newport, Isle of Wight, U.K.), which had been supplying Wood Epoxy (WE) composite blades to U.K. companies.

At the time of its development, NEG Micon R&D manager Ole Gunneskov explained the reasoning behind the WE composite technology. “Apart from its natural strength, the clear advantage we get from wood is that it has a natural attenuating effect, and that it is an extremely stable material in its own right. The combination of wood and epoxy has already been proven through application over many years in wind turbine blades.” He continues, “The combination of aerodynamic design, use of carbon fiber and dry layup of materials means a weight reduction of around 30 percent, compared with the traditional wind blade made from fiberglass-reinforced polyester. Another ad-vantage over the traditional fiberglass blade is that we achieve a slimmer and lighter blade design, reduced load on the main components and lower costs.”

The WE blades were used in NEG Micon’s NM82 1.5-MW turbine, which was competitive with Vestas’ V80 models and thus phased out after the merger. However, according to an independent financial analyst’s report, Vestas has built a 59m/194-ft WE composite blade that has a total weight of 12.6 metric tonnes (27,778 lb) and a total head mass (THM) of only 210 metric tonnes (462,970 lb), comprised of the nacelle and rotor. REpower’s (Rendburg, Germany) new 5-MW turbine, which uses LM Glasfiber’s 61.5m/202-ft blades, has a THM nearly double this at ~400 metric tonnes (881,849 lb).

Like Vestas, Gamesa uses carbon fiber in its largest blades: the 42.5m and 44m (139 ft and 144 ft) blades for its G87 and G90 2.0-MW turbines, respectively. These are made in both Spain and Gamesa’s Ebensburg, Pa., plant, which has produced roughly 400 blades since production startup in mid-2006.

Gamesa interleaves carbon fiber prepreg with glass fiber prepreg on the upper and lower surfaces of the tubular spars. Some carbon fiber also may be used on both of the spar beam sides, again interleaved with fiberglass.

Gamesa’s technical specification for the G87 wind turbine says, “Glass fiber blades are dimensioned by maximum deflection; in long blades this would mean an important increase in weight.” It goes on to say that the use of carbon fiber allows the blades “to be dimensioned by stress, optimizing the quantity of material …. The carbon and glass fiber combination is an agreement between structural stiffness and cost.”

The technical specification also describes how the manufacture of this blade is automated using prepreg tape placement and tape winding. The outer shell is fabricated in two pieces, each comprising a glass fiber/epoxy and PVC foam core sandwich. Once the shell halves and spars are cured, they are adhesively bonded together.

Gamesa also may have switched away from autoclave cure to heated composite molds, which has become standard industry practice. A patent filed by Gamesa in 2002 describes an innovative tooling system where upper and lower shell halves are hinged together and incorporate air conduits and structural ribs to form a heated mold that cures the composite blade while minimizing unwanted movement due to thermal expansion in both the tooling and the part being cured.

A third manufacturer, REpower, used a hybrid carbon/glass fiber construction in the pp82 rotor blades developed for the prototype of its 2-MW MM 82 turbine in 2003. Although these 40m/131-ft blades weighed the same as those for their smaller 1.5-MW MD 70 turbine, REpower has discontinued use of carbon fiber, according to a company spokesperson.

LM Glasfiber also was using carbon fiber, particularly as reinforcement in the shell laminate on the trailing edge of its 61.5m/202-ft blade, currently the largest in the world, which were used in REpower’s 5-MW turbine. It too has reversed course. “With the advances we have made in materials and process technology … we will achieve the same or better properties, but at lower cost,” says Steen Broust Nielsen, head of corporate communications for LM Glasfiber. “Our research centers on reducing the need for carbon fiber, based on cost, reliability and supply.”

According to one industry source, however, the real issue is process, in that the manufacturers who have found a way to make carbon fiber work economically in wind blades are using it in prepreg, while those using it solely with infusion have not. This source claims that the basic issue is a technical one: to date, infused carbon fiber UD fabrics have a 30 to 45 percent knockdown in compressive properties vs. those using carbon fiber prepreg. While DeWind avoids this phenomenon with its prepreg spar insert, there is also ongoing research into stitched unidirectional fabrics that might help overcome this issue (see “Special Report,” p. 3).

Contending with high cost and short supply

Although all the raw carbon fiber producers are now in the process of adding capacity, the still-troublesome scarcity is likely to have an impact on turbine manufacturer decision-making. According to Dayton Griffin, director of engineering for wind energy technology consulting firm Global Energy Concepts (GEC, Seattle, Wash.), use of aerospace-grade carbon fiber in wind blades could decline for several years because the wind blades in production today were designed just before the carbon fiber supply tightened. “The overall economic case for carbon fiber in wind blades tilted the wrong direction starting in 2005 when it became too expensive to be competitive as a replacement for glass in structural spars,” Griffin explains. “If Vestas was designing its V90 blades today, I expect they would have faced a tougher trade-off in deciding to use carbon fiber.” Griffin points out that the primary driver in turbine design is to reduce the Cost of Energy (COE). “In order to do this with carbon fiber, you need to be using it to achieve some type of real innovation,” he explains, “such as a more slender planform or an increased potential for aeroelastic tailoring. The V90 is an excellent example of this, as load reductions (enabled by carbon fiber) in the blades were used to enable system-wide weight reductions.” Ultimately, he contends, “The higher specific stiffness of carbon fiber alone isn’t going to enable enough of a COE reduction to justify the cost.”

It is important to note that the two largest manufacturers with active carbon-reinforced blade programs, Gamesa and Vestas, have supply contracts with Zoltek Inc. (St. Louis, Mo.) for its 50K Panex 35 commercial-grade fiber. Zoltek’s agreement with Vestas in December 2004 committed as much as $100 million (USD) of fiber in the first three years of the contract. Zoltek recently announced a new Vestas contract for at least $300 million of raw fiber over the first five years of the agreement, which Vestas will process into prepreg. In March 2005, Gamesa and Zoltek agreed to a three-year deal with projected supply of as much as $75 million worth of fiber. Meanwhile, a Chinese prepreg manufacturer, Plain Fishing Rod Factory of China (Waihei, Shandong Province), says that it cooperates with Gamesa on prepreg for wind blades, which it predicts will consume more than 1,000 metric tonnes (2.2 million lb) of carbon fiber per year. And, as this issue went to press, Zoltek signed a third long-term agreement, this time with DeWind, projecting $30 million in sales for the first three years. DeWind uses carbon in the 40m/131-ft blades for its D8 2-MW turbine and is a growing global player. The company signed agreements for up to 250 turbines (500 MW of capacity) in 2006, with subsequent reserve agreements in the U.S. for up to 1,600 MW over five years, plus 300 MW of turbines to be manufactured in India and licensing agreements in China, according to Matthias Krebs, DeWind’s commercial director. “We need a reliable source of carbon fiber to match our growth and expansion plans, and Zoltek is geared up to meet the needs of a fast-growing market,” says Krebs.

Tim McCarthy, Zoltek’s VP of sales and marketing, points out the fact that turbine producers who use carbon make up 44 percent of the overall market. “Vestas has 79 percent of the 2.5-MW and higher market where carbon fiber now has over an 80 percent market share.” He explains, “Those companies who have embraced carbon will continue to employ it in new designs, as will DeWind, Euros [GmbH, Berlin Germany] and two others who are just starting production. And we have four to five development projects ongoing.” McCarthy acknowledges that carbon fiber price and supply have been an overall industry issue but notes that Zoltek is selling at a significant discount below aerospace-grade fiber and is expanding capacity from the 3,500 metric tonnes produced in 2005 to 10,500 metric tonnes by early 2008. This will go a long way toward meeting the needs of Zoltek’s wind power customers, says McCarthy.

Most turbine manufacturers do not foresee hitting a wall with turbine and blade size any time soon. “I am sure that we will see longer blades than 61.5m in the future,” says LM Glasfiber’s Nielsen, “particularly as European large-scale offshore takes off and we increase our ability to intelligently and dynamically control blade loads through the use of integrated blade monitoring systems.”

Carbon fiber user Gamesa says that it does not see offshore and carbon fiber as necessarily interrelated. But offshore does seem to open some opportunity because as the foundation/base and installation costs for these massive wind turbines become a much greater percentage of the overall installed plant cost, the blades become a smaller cost factor. Thus, if carbon fiber is able to offer a dramatic weight savings in larger offshore turbines, it may be an easy decision for manufacturers to use it because its cost impact will be relatively small in the overall total.

Awakening the Asian market

Another question mark in the carbon fiber/wind energy discussion is China. A newer and, comparatively, almost untapped wind power source, the Chinese mainland is hungry for electric power, and its government has set ambitious goals for energy from renewable resources (see “High Wind in China” in “Related Content”). The potential for carbon fiber in Chinese wind energy applications is bounded by several factors: First, only Vestas, Gamesa and DeWind publicly anticipate carbon use and only in large turbines (1.8- to 3.0-MW). Second, the rough rule of thumb for the amount of carbon fiber used is approximately 750 kg to 1,000 kg (1,653 lb to 2,205 lb) per megawatt. (Note: The “rule” employed above was generated from several resources, including a 2004 presentation by Toray Carbon Fibers America, Flower Mound, Texas.). Third, China is forecast to install 2,100 MW per year for the next 15 years. Therefore, the best case for annual carbon use (assuming selective placement in the spars) would be 1.5 million to 2.0 million kg (3 million to 4.4 million lb).

More realistically, actual use could be a fraction of that figure. Zoltek’s McCarthy says it is too early to expect much carbon fiber use in China, “Even the U.S. is lagging Europe by about five years in its carbon fiber use, and it is a much more developed market than China.” However, China is plunging into MW-sized machines very rapidly, and McCarthy notes that Zoltek carbon fiber will be used in China later this year.

That said, two of the largest Chinese turbine manufacturers, Goldwind Science and Technology Co. Ltd. (Urumqi, Xinjiang Province) and Nantong CASC Wanyuan Acciona Wind Turbine Manufacture (NCWA, Nantong City, Jiangsu Province), have long-term supply agreements with LM Glasfiber. Vestas is producing 2.0-MW turbines in China, but they are its V80 models, which do not use blades with carbon fiber. Further, neither Vestas nor Gamesa has announced when it will pursue production of larger wind turbines in China that may use the carbon spar blades. The potential near-term user of carbon fiber may be Beijing Beizhong Steam Turbine Generator Co., which has a license to produce DeWind D8 turbines. The remaining manufacturers of 2.0-MW and larger turbines and/or blades, based on existing arrangements, do not appear to have current plans to use carbon fiber. Therefore, although the overall wind power market in China looks bullish, the market for carbon fiber is unlikely to improve until (1) carbon fiber producers’ promised new capacity comes online, easing the supply and price squeeze and making it more attractive to blade manufacturers; (2) blade manufacturers develop and commercialize new blade designs in which carbon fiber enables innovations such as reduced-width planforms and/or aeroelastic tailoring that significantly reduces COE.

According to GEC’s Griffin, “We are already producing 120m [394 ft] diameter rotors without carbon. However, it’s not obvious that we will get to 150m [492 ft] without it. The design drivers say it makes more and more sense to use carbon strategically, but in the end, it really depends on the economics and availability.”

Zoltek’s outlook, however, is a bit more optimistic. According to McCarthy, “China will definitely use carbon fiber in its wind blades eventually, especially as offshore wind farms start being developed.

Related Content

Materials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MorePlant tour: ÉireComposites, Galway, Ireland

An in-house testing business and R&D focus has led to innovative materials use and projects in a range of markets, from civil aerospace to renewable energy to marine.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreJEC World 2022, Part 1: Highlights in sustainable, digital, industrialized composites

JEC World 2022 offered numerous new developments in composites materials, processes and applications, according to CW senior editor, Ginger Gardiner, most targeting improved sustainability for wider applications.

Read MoreRead Next

Carbon fiber composite driveshaft drives innovative wind turbine

As wind turbine designers try to capture greater energy with each turbine, blade length, size and weight have increased dramatically. Further, blade tip speed is limited by noise ordinances, so very large turbines typically spin at less than 20 rpm. Yet hub rotation is the driver for the generator. For that reason,

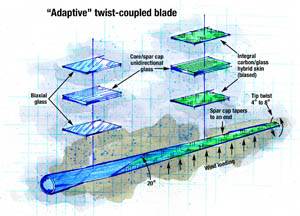

Read MoreCarbon/glass hybrids used in composite wind turbine rotor blade design

As turbine blades grow to greater lengths, composite blade manufacturers take a long look at carbon/glass hybrids.

Read MoreAnisotropic wind blade design expected to reduce wind-energy costs

Deliberately unbalanced laminate produces smoother power input from adaptive wind blades

Read More

.jpg;maxWidth=300;quality=90)