Automotive composites: Thermosets for the fast zone

Epoxies continue to be developed for faster cure to meet automotive production rates.

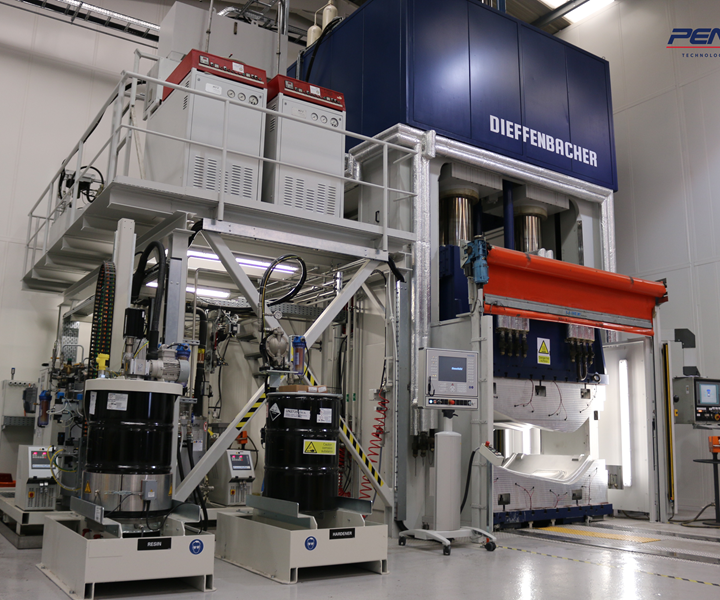

Epoxies to keep up with fast HP-RTM: This high-pressure RTM equipment in use at specialist vehicle manufacturer Penso Consulting Ltd. in the UK is molding parts with Cytec’s fast-cure epoxy, XMTM710. Source | Cytec Industries Industrial Materials

There are some realities of life that you can’t change. Taxes, for one. Another is that an automotive supplier must have the ability to produce a composite part in a minute, or at least in minutes — not the hours or days that has been the norm for composites in most other industries. The part-per-minutes goal is a hurdle a few composites fabricators have cleared, and many more are involved in development efforts, with OEM or Tier partners. Although the value of thermoplastics for fast automotive production is well established, new versions of thermoset epoxies are proving to process nearly as quickly. But, that said, part-per-minute cure demands are taking epoxies into unknown territory, and not all parameters are well understood yet, says automotive industry consultant Gary Lownsdale of Trans Tech International (Loudon, Tenn., U.S.), formerly the chief technology officer at Plasan Carbon Composites (Wixom, Misso., U.S.).

Pushing the limits

Fast-cure resins go hand in hand with speedy processing. Currently, the fastest processing methods for thermoset composites include resin transfer molding (RTM), high-pressure RTM (HP-RTM), wet compression molding — in which dry reinforcements are wet out with a resin and quickly transferred to a hot compression press — and prepreg compression molding, with and without a vacuum assist (See "Prepreg compression molding makes its commerical debut”).

Plasan Carbon Composites uses a fast compression molding technology called RapidClave, from Globe Machine Mfg. (Tacoma, Wash., U.S.) that incorporates fast mold heating with hot oil. Overmolding of thermoset parts by injection molding methods can be included as well, for hybrid part approaches.

Plasan Carbon Composites’ RapidClave process molds G83C rapid-cure epoxy prepreg from Toray Composites America (Tacoma, WA, US), a well-characterized material. Source | Globe Machine Mfg. Co.

Automotive composite suppliers are for the most part focusing on epoxy, because of its superior adhesive strength and modulus, minimal creep, high toughness and good fatigue performance. (Snap-cure polyurethanes are another option, and can provide strength similar to epoxy, but are not covered here.) Resin chemists have gone far beyond conventional autoclavable aerospace epoxies, which were formulated for stable storage and long out times. To achieve the very low void content aerospace parts must have, those systems require temperature ramps, with dwells, to reduce viscosity and induce flow under slowly increasing pressure in order to remove volatiles and mitigate thermal stress.

In sharp contrast, the cure technology of fast-cure epoxies has been greatly accelerated by changing the “protonation” or catalytic amine reaction at the terminal carbon atom sites with proprietary additives, which results in a “thermolatent” system — that is, one that exhibits very low viscosity for a specified length of time, delaying the onset of cure and allowing easy flow to fully wet out the fiber reinforcement, coupled with fast reaction with the hardener as process temperature reaches a specific target. Table 1 summarizes key information for the fast-cure epoxy resin products reviewed for this article.

Lownsdale asserts that while a 30-second cure sounds great, there is much to be considered before actually making parts: “All of the process parameters need to be taken into account, as to how you achieve your part Tg, to ensure the resin is compatible with your process.” In addition to the degree of crosslinking, he also points out that little is known about “dynamic viscosity,” that is, how does the resin viscosity change under all of the temperature and pressure conditions of the process: “This is a critical issue, and there’s a lot of confusion in the industry, with very little information available because standardized testing is lagging behind the new processes.” He cautions composite processors to investigate these unknowns with their resin suppliers, to ensure that produced parts match OEM requirements and expectations.

So how does one choose a snap-cure resin and determine whether or not it’s a good fit with a process? It comes down to working with a supplier, trusting them to guide you through a selection process and asking the right questions, says Lownsdale. CW checked in with the makers of snap-cure epoxy, for liquid molding and prepreg processing, for their perspectives on the snap-cure trend, their fast-cure products, processing considerations and where the autocomposites sector is going.

Peter Cate, global strategic marketing manager for composite structures at Dow Mobility (Horgen, Switzerland) says that snap-cure is triggered by the material’s exposure to tool temperature, but adds, “Snap cure alone is relatively easy to achieve but is useful only if the resin has fully infused the fiber preform. The key is to know the latency, or the gel time before the material will no longer flow through the preform, to differentiate products.”

Dow Automotive’s in-house Composite Development Center in Switzerland is equipped with a high-pressure RTM machine used for development programs for its VORAFORCE fast-curing epoxy. Source | Dow Automotive

Dow introduced its VORAFORCE fast-cure automotive epoxy infusion resin platform at JEC Europe 2014. It includes the “workhorse” 5300 grade and several developmental grades, to suit customer needs. Cate asserts that VORAFORCE offers cure time as fast as 30 seconds, and the resin’s latency characteristics coupled with low viscosity (as low as 10 MPa/sec), maximizes infusion speed. The resin is intended for HP-RTM-processed structural composites, to replace steel and aluminum, although it can be used for body panels. Cate points out that cost-reduction benefits come from part consolidation applications: “The low viscosity and latency of our resin enables much larger parts to be infused in one shot.” He adds that the “thermal and chemical stability” of epoxy enables optimized part designs, with less material, where less-able polymers require overdesign.

Working with equipment from Krauss-Maffei (Munich, Germany) or Cannon SpA (Peschiera, Italy), Dow reports that wet compression molding separates resin application from the curing step, enabling molding cycle times as low as 30 seconds. Complexity is a limiting factor of the technology, Cate says, and it is best for relatively flat or slightly contoured parts. For more complex parts, he explains, RTM is the next-best alternative. Dow currently has a part on a unnamed European car model. Several more will be commercialized in the near future, he reports, including projects for North American and Asian car models.

DSM Composite Resins AG (Schaffhausen, Switzerland and Zwolle, Netherlands) has updated the company’s RTM resin, trademarked Daron, to target fast processing of automotive structural parts. “The new resin series actually consists of three resins, each with specific characteristics, but all show the benefits of speed and tunability to specific designs,” says Thomas Wegman, DSM’s manager of marketing and external communication. As shown in Table 1, the three versions, 120, 150 and 200, correspond to increasing Tg and temperature resistance. Daron 120 is a one-component system, while the higher-temperature versions are two-component.

Offering performance equivalent to epoxy, low-viscosity Daron was originally developed as unique hybrid of unsaturated polyester and polyurethane. The hybrid system has been reported to consist of an unsaturated polyester polyol (A) component and an isocyanate (B) component of the MDI type. DSM says the resin chemistry provides high fracture toughness and good impact resistance, together with fast wetout, and is compatible with all fiber types. Says Wegman, “Daron is relatively insensitive to process and fiber variation, and wets out carbon fiber very well.” He points to the short process cycle, which can be tailored to part complexity and molding process by varying the mold temperature and accelerator type. Also, little or no post-cure is needed, and he adds that an efficient internal mold release system ensures hassle-free demolding in a serial production scenario.

In terms of Daron’s use by OEMs, Wegman says the resins are currently being evaluated but no details can be discussed. That said, ESE Carbon Co. (Miami, Flori., U.S.) is using Daron 200 to make an all-carbon aftermarket car wheel, reportedly the lightest carbon fiber wheels currently available at 5.2 kg, and rated for a maximum axle load of 1746 kg. The wheels are produced in ESE Carbon’s proprietary Next Generation Autoclave Process (NGAP), which combines a high-speed autoclave cure with liquid infusion. ESE Carbon chose Daron for its low viscosity, adjustable cure chemistry, good wetout of the carbon reinforcement and high mechanical properties at elevated temperatures, says company president Eric Escribano.

“We see greater use of composites in structural applications, going forward, with BMW as a good example. We’re working on sheet molding compound (SMC) solutions with carbon fiber, in order to take full benefit of the fiber’s capability to reduce weight,” concludes Wegman.

Keeping fiber architecture intact

Westlake Epoxy (Formerly Hexion, Columbus, Ohio, U.S.) has offered a range of optimized fast-cure epoxies, curing agents and preform binders for several years, and continues to work with customers as structural composite programs progress, says Francis Defoor, Westlake’s global segment leader, transportation. “The performance benefits of epoxy can meet safety demands as well as lightweighting objectives. Suspension systems, such as leaf and coil springs, are good candidates.”

A composite coil spring for the Audi A6 Avant 2.0 TDI Ultra model is produced using a Westlake Epoxy-developed filament-winding epoxy with good fatigue performance. The spring is manufactured by S.ARA Composites SAS, part of the SOEGEFI Group. Source | Westlake Epoxy

Specifically, Westlake’s trademarked Epikote Resin TRAC 06170 with Epikure curing agent TRAC 06170 are targeted to structural parts made using RTM or wet compression molding. The combination reportedly results in a part-to-part cycle time of less than 1 minute, depending on part size and complexity. The Epikote Resin TRAC 06400 series is available for fast-cure prepregs as well, with cure times as short as 90 seconds, he adds, when cured at 130°C.

“The result is a fast cycle, fast demold and excellent adhesion to glass, carbon and aramid.” The secret, he adds, was a complete redesign of the resin chemistry, achieved by “rigorous control” of processing conditions and an optimized balance of viscosity and reactivity.

Westlake’s Epikote TRAC 06720 is a curable preform binder, developed to minimize fiber deformation before or during injection. Fully compatible with RTM matrix epoxies, it co-cures with the part and, says Defoor, allows less preform material to be used, for faster layup and faster filling rate, because the fibers are firmly fixed by the binder. A premium German automaker is reportedly using Hexion fast-cure epoxies for several structural parts on a sports car model, for both flat and more complex shapes.

“Instead of pushing new processes into an established industry, we are trying to work with automotive partners to determine the best way to support their existing manufacturing processes, and manufacturing speeds,” asserts Adam Harms, marketing manager for automotive at Huntsman Advanced Materials (The Woodlands, Tex., U.S.). Specifically, the speed of wet compression molding enables Tier 1 fabricators to more closely mimic existing sheet molding compound (SMC) molding or metal stamping processes. The company has worked for the past seven years with BMW on its i3 production car program, which uses Huntsman’s trademarked Araldite LY 3585 resin, coupled with Aradur 3475 hardener in a high-pressure RTM process (Read “BMW Leipzig: The epicenter of i3 production").

Huntsman associates examine an automotive part made with trademarked Araldite LY 3585/Aradur 3475 fast-curing epoxy system in the Huntsman composites laboratory. The epoxy product is used to produce the BMW i3 production car, in a high-pressure resin transfer molding (RTM) process, and the company says that second-generation versions are now available. Source | Huntsman Advanced Materials

“The Aradur resin chemistry allows us to adjust the chemistry and the cure time for an optimized reaction, for a specific part,” adds Harms. “As the robustness of the resin system and processes continue to evolve, OEMs can now begin targeting more parts to convert into composites.” Currently, several European OEMs are “aggressively” evaluating the Huntsman product, he adds, on programs potentially starting in 2017.

Adapting prepregs to automotive demands

Hexcel (Stamford, Conn., U.S.) offers a snap-cure prepreg, trademarked HexPly M77, that has a two-minute cycle at 150°C (80 bar pressure) for a 5-mm-thick part. The low tack of HexPly M77 enables the prepreg to be cut into precise shapes by laser cutter, then robotically oriented, assembled and consolidated into flat preforms. Its Tg of 125°C enables demolding of cured parts while hot for a faster production cycle, says the company. M77’s long shelf life at room temperature reportedly helps fabricators meet their lean manufacturing goals.

HexMC, the company’s trademarked carbon/epoxy molding compound material — made with HexPly M77 — also has been adopted by the automotive industry. At 150°C, a complete cycle takes 120 seconds from mold close to mold open, for a 4-mm-thick part, but low viscosity and gel time enable the resin to flow and conform to mold contours while air is evacuated, for complex part geometries. M77 prepregs and HexMC (based on M77) are targeted for structural body-in-white parts and for aesthetic parts that require a carbon fiber look. HexPly M77 can be used for body panels that are subsequently painted. Although Lamborghini is a well known Hexcel customer, using 90-minute cure products for its Aventador LP700-4 roof part, Hexcel says that its faster-curing products are certainly contenders for series production applications (Follow this link to Hexcel’s video on this subject).

At Toray Composites (America) Inc. (Tacoma, Wash., U.S.) Dr. Felix Nguyen, a principal research scientist at Toray’s composite materials research laboratory, says its G83C prepreg is “very robust and versatile” for both autoclave and advanced fast-cycle processing methods: “The material is ideal for high-volume Class A parts for automotive due to its fast-cure characteristics that balance resin flow and cure kinetics.” Indeed, the material has been used for several years by Plasan Carbon Composites for both Chevrolet Corvette and Viper sports car programs. While data sheets for the product show conservative cure times from 20 minutes, depending on cure temperature to achieve desired degree of cure and hence target glass transition temperature, Lownsdale asserts that the G83C material can cure very quickly, in less than six minutes, in the Plasan RapidClave machine process, and he says that faster cures are possible.

Nguyen says that Toray’s research laboratory in Tacoma is charged with the development and expansion of composites usage in aerospace, as well as automotive, sport and industrial applications. “We’re currently seeking partners in the prepreg supply chain to propose a project to IACMI to address the challenges of rapid-cure prepregs for automobile structural applications.” The company says it will be launching additional automotive applications of G83C in the near future, which could include structural, thin parts.

Balancing properties for mass production

In terms of resin development, Mark Steele, R&D director at Syensqo (formerly Solvay Composites Materials, Heanor, Derbyshire, U.K.), reports that an 18-month R&D program there has resulted in several sub-3-minute-cure epoxy resin chemistries for primary and secondary vehicle body-in-white structures (see Table 1, at left).

But Syensqo’s global automotive director Alexander Aucken points out that the real mission extends far beyond resin formation: “Rapid-cure materials are a fundamental part of the solution, but the automotive industry needs far more than just a fast resin.” Mass production requires a balance of technical and commercial aspects. Materials, design for manufacture and processing must come together to create the most affordable solution. Technical factors that affect the issue include not only the resin’s processing time, toughness and Tg, but also preforming needs, such as highly drapable fabrics, affordable carbon fiber, automation, recyclability and sustainability. “We’re working with key alliance partners to develop technologies that address all of these automotive cornerstones,” adds Aucken. “Our new multi-million dollar Application Centre, scheduled to open later this year, is being equipped to support these technology developments and will be used to showcase to OEMs and their supply chain ways to integrate carbon fiber part manufacture within their current infrastructures,” concludes Aucken.

Dale Brosius, chief commercialization officer at IACMI, says the new collaborative organzization is in the midst of tackling these issues: “We need grades of carbon fiber specific to automotive, faster cycles for orienting fibers in preforms or stacks to match the speeds of the resin systems, both thermoplastic and thermoset, and improved modeling and simulation for end-to-end simulations of design and processing that are easily accessed by engineers and manufacturers.”

Looking down the road

Resin manufacturers have recognized the need to step beyond formulation to integration of resin systems into entirely reinvented production systems. According to Syensqo, new technologies must include automated preforming systems, scrap reduction strategies, material recycling and affordable large-tow carbon fiber.

Fast-curing thermosets for automotive apps will continue to be improved, says Dow’s Cate, noting, “We see automotive customers becoming bolder in their plans for composites, and both process and chemistry have to adapt to keep up.” He adds that epoxy systems can be corrosive and tough on metal molds, so suppliers are working to try to produce more benign formulations, easier on equipment, which will help keep production rate high, without having to stop for maintenance issues.

For its part, Westlake is confident that composites will be adopted in applications where they bring greater functionality, such as better fatigue properties, while maintaining fast cycle times.

Huntsman’s Harms says that a collaborative focus, with composite machine manufacturers, on joint development of chemistry and processes for even faster cycle times is the key to achieving sub-1-minute cycle times and competing with existing automotive part manufacturing processes.

Hexcel believes prepregs and molding compounds will be developed with even shorter cure cycles and higher Tg. together with reduced shrinkage and better bonding properties. And CW sources say new prepreg snap-cure forms for Class A and non-Class A structures are imminent. Says Toray’s Nguyen, “The technical challenge is to achieve both rapid cure cycle time and thermal/mechanical performance, which is very difficult as they are trade-off attributes.”

Finally, Brosius concludes, there’s more than one way forward: “Composites suppliers don’t have to follow the example of the BMW i3 and i8, and perhaps the way BMW is using carbon fiber on its new 7-series platform offers a more practical path to reducing weight, in a multi-material vehicle.” Even small composite parts, used in high-volume production, obviously represent a huge opportunity for the composites industry. The prospects for more automotive composites are looking pretty good.

Related Content

Materials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreRead Next

Auto composites quest: One-minute cycle time?

Faced with high fuel prices and ever-more stringent restrictions on tailpipe emissions, automakers are taking composites into their own hands.

Read MoreSuddenly, automotive composite production abounds

There are at least eight composites manufacturing systems targeting high-volume automotive production.

Read MoreSuddenly, automotive composite production abounds

There are at least eight composites manufacturing systems targeting high-volume automotive production.

Read More

.jpg;maxWidth=300;quality=90)