Automate or emigrate

Automated fiber and tape placement is not just a notion, but a real manufacturing strategy, and one being embraced by HITCO Carbon Composites.

Among the myriad decisions manufacturers face today, if and how to automate production is among the biggest. In composites manufacturing, long dominated by manual production techniques, integrating automated machinery involves an expensive and daunting paradigm shift. HITCO Carbon Composites and its parent company, SGL Group – The Carbon Co. (Wiesbaden, Germany), have chosen to invest in the automation of HITCO’s composites manufacturing plant in Gardena, Calif., to position the company for significant growth in demand for composite structures. Company leaders say this is the preferred strategy, one far preferable to contracting work to offshore fabricators. The choice, says HITCO’s COO Edward Carson, was to “automate or emigrate.”

It’s a choice many composite manufacturers face today as the leading airframe companies, The Boeing Co. (Seattle, Wash.) and Airbus Industrie (Toulouse, France), have committed to composites as never before, significantly increasing the material’s content in new aircraft designs and fueling the shift of companies like HITCO to automated manufacturing strategies.

Boeing’s 787 Dreamliner features the first-ever carbon fiber fuselage on a commercial jet, as well as composite wings, wingbox and tail sections. In addition, within the next few years the industry will welcome Airbus’ A350 XWB, which also promises extensive use of carbon composites in fuselage, wings and other structures. Regional jet, business jet, very light jet (VLJ) unmanned aerial vehicle (UAV) and rotorcraft manufacturers also are making extensive use of composites, fostering a new generation of lightweight, efficient aircraft.

The challenge facing companies like HITCO is how best to effectively and efficiently meet demand for composite structures in a demanding aerospace environment. Although many processors have elected to emigrate, retaining hand layup and relocating manufacturing operations to China, Mexico and other low-cost-labor countries, HITCO has chosen otherwise.

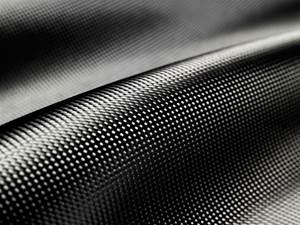

Founded by Harry I. Thompson in 1922 as the H. I. Thompson Glass and Paint Co., HITCO has maintained its Los Angeles base for 85 years, its interest in composite and insulation products since the 1950s and the HITCO name since 1966. The company is still a leader in high-temperature applications, producing materials and systems to withstand ultrahigh-temperature and fire-resistant environments. A pioneer in the development of polyacrylonitrile (PAN)-based carbon fiber, the company has leveraged its knowledge of composite materials into the fabrication of high-strength, lightweight structures for aerospace, defense and commercial industries using traditional and innovative hand layup processes.

As an established Tier II aerospace and defense manufacturer, HITCO is now taking the leap to automate production processes under the leadership of SGL Group, one of the world’s leading manufacturers of carbon-based products.

Identifying the challenge

Carson notes the necessity in composites manufacturing for a strategic operation plan and says the biggest challenge in automating airframe part manufacture is “getting a Tier I partner to sponsor qualification by a major aircraft company such as Boeing or Airbus.” A Tier II company already qualified for hand layup of parts is halfway there but must still convince its Tier I customer that automation is to its advantage. “Are you going to reduce your customer’s risk and cost?” asks Carson. The answer must be yes. “Otherwise, why should they sponsor you?” Further, a supplier contemplating investment in automation must have knowledge of composites and must have an engineering staff that can handle the complexities of tooling and part design as well as machine programming. Further, Boeing requires parts made by automation to use the same material and process specifications as those made by hand layup.

Following a strategic review of HITCO’s business, parent company SGL chose to automate HITCO’s composites manufacturing processes by renovating the entire plant and, in place of selected composite hand layup operations, installing two, and possibly three, automated tape laying (ATL) machines and one or two Viper automated fiber placement (AFP) systems built by Cincinnati Machine Composites (Hebron, Ky.). One ATL already is in position, with the second on order and the third still under consideration; one AFP has been ordered for late 2008 delivery, with an option for a second.

Carson estimates that, depending on the complexity of the part or structure, an ATL can process 25 to 45 lb/hour of carbon fiber tape and an AFP can process 15 to 25 lb/hour of carbon fiber filament, while the average hand layup technician, processes only about 2.5 lb/hour of carbon fiber material. Thus, automated systems operate 6 to 18 times faster than hand layup.

Carson emphasizes, however, that not all hand layup was replaced, because a balance between hand layup and automation is a requisite strategy for keeping overall costs under control. In some cases, part configuration or size is not suitable for automation, and therefore hand layup secures the baseload business for a processor. A case in point is the flap track fairing that HITCO manufactures for Boeing’s 767. The fairings are canoe-shaped pods that attach to the underside of aircraft wings to cover and protect the hydraulic system that operates the flaps, spoilers and other moving parts on the wing trailing edge. HITCO will continue to hand lay up these parts because the 18 complex pieces per fairing do not lend themselves to ATL or AFP production.

Additionally, the purchase of an ATL machine, AFP machine or other major equipment requires ancillary equipment: CNC drilling and ply cutting systems, handling equipment, essential autoclave capability and more. Investment in automation depends primarily on the kinds of components and structures being built, and the overall cost for equipment can run several million dollars, Carson says.

HITCO also has added two new autoclaves (one 40 ft/12.2m long by 15 ft/4.6m high), CNC ply-cutting systems from Gerber Technology (Tolland, Conn.), a 6-axis water jet cutter from Flow International Corp. (Kent, Wash.), laser positioning systems from Virtek Vision International (Waterloo, Ontario, Canada), a hot drape former from Laminating Technology (Knighton, Powys, U.K.), an automated deltoid filler machine from Radius Engineering (Salt Lake City, Utah) and other ancillary equipment. (Deltoid filler equipment extrudes uncured prepreg in long lengths through specially shaped dies, to form, for example, a round or triangular shape.)

Matching strategy to product line

The new automated systems will be implemented in a balanced manner to produce the following aerospace components and structures.

Tailcones. Tailcones provide aerodynamic shaping aft of the fuselage. One major example is a 12-ft/3.7m-long, 11-ft/3.4m-wide structure with a height that varies from a maximum 12.5-ft/3.8m to a 5-ft/1.5m minimum, made for the U.S. Air Force C-17 Globemaster cargo aircraft. Now produced by hand layup, this and other tailcones are prime candidates for automated fiber placement. According to Randy Kappesser, vice president and general manager of Cincinnati Machine, the VIPER AFP “independently manipulates 32 narrow epoxy-impregnated fiber tows in laying up round, oval, convex/concave and hollow shapes around fixed or rotating tooling.” The VIPER system has capacity for two tool stations and extended rail travel for the fiber placement head, enabling fabrication of one part while a finished part is removed from the other station and tooling is readied for the next.

Pressurized bulkheads and aircraft doors. The carbon composite skin panels for bulkheads and doors are currently made by hand layup but are ideal candidates for ATL production. Here, HITCO will use Cincinnati Machine’s CHARGER ATL, which is designed for production of flat or low-contour linear parts. “It can lay 3-, 6- and 12-inch carbon prepreg tape in any orientation and thickness,” Kappesser says. The panels are reinforced with carbon/epoxy I-beams; the I-beams themselves are stiffened by solid round rods, called noodles by Boeing and deltoids by Airbus. Although HITCO previously hand-rolled these noodles, they will be produced on its new automated deltoid filler equipment in the future.

Fuselage floor beams. These components will be made primarily by ATL. Following final cure, the beams will be sent through a newly installed automated drilling machine from Bertsche Engineering Corp. (Buffalo Grove, Ill.), custom programmed to rapidly drill holes in specific patterns. Carson acknowledges that other floor beams are being pultruded by another Tier II supplier, but he points out that design changes could result in huge nonrecurring costs for new pultrusion tooling. “All we have to do is change the ATL programming to accommodate any design changes.”

Control surfaces. HITCO is working with another Tier I supplier to develop fixed trailing edges for horizontal stabilizers fabricated via ATL.

Additionally, multiple complex small parts can be layed out on a large ATL platform and cut out by waterjet cutters, similar to cutting patterns out of a piece of fabric.

Preparing the physical plant

To prepare the way for its automated manufacturing systems, HITCO is extensively remodeling its physical plant. HITCO’s current facilities, consolidated over 22 acres in Gardena, Calif., have some 400,000 ft² (37,161m²) of enclosed space, about 75 percent of which is dedicated to manufacturing. Of this space, HITCO currently uses 60 percent, leaving 120,000 ft² (11,148m²) open for new programs and automated production. At least one building is being completely refurbished to make room for enclosed areas committed to AFP production. Another building has been gutted, had its roof raised and has been divided down the middle to make space for two ATL machines and auxiliary equipment.

A third building is dedicated to radiographic nondestructive testing (NDT). Other changes include conversion of office space to four cleanrooms for quality-controlled hand layup, relocation of all autoclaves to covered or inside locations, replacement of foundations with 30-inch/762-mm deep rebar-reinforced concrete and upgrade of electrical capacity for all relevant buildings to meet 440V code, enabling HITCO to safely run its new equipment. The very important matter of material handling systems and work flow — including entry doors of sufficient size to accommodate both new machines and finished parts — are being examined to obtain the greatest manufacturing efficiency.

Finally, HITCO also is updating its quality control systems. Since 1999, the company has operated under Lean Manufacturing principles with just-in-time (JIT) assembly. It has redesigned every major process and assembly practice to use Lean concepts, such as visual factory control, Kanban production/inventory control, Six Sigma statistical process control and 5S process improvement training.

Carson emphasizes that to make an automated factory work, quality control also must be automated. “The business system must be computerized so data is automatically collected, and a history of the part goes with it from order to shipment, so when the part is ready to ship, the documentation package is also ready.”

Related Content

Busch expands autoclave solutions

Busch announces its ability to address all autoclave, oven and associated composites manufacturing requirements following the acquisition of Vacuum Furnace Engineering.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreSafran Nacelles Morocco installs large autoclave, doubles cleanroom per development plan to increase production rates

Extension of 6,000 square meters dedicated to Gulfstream G700/G800 production, groundwork laid to digitalize processes and reduce environmental footprint.

Read MoreMaterials & Processes: Tooling for composites

Composite parts are formed in molds, also known as tools. Tools can be made from virtually any material. The material type, shape and complexity depend upon the part and length of production run. Here's a short summary of the issues involved in electing and making tools.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)