Autocomposites Update: Engine oil pans

As thermoplastic composites makes inroads into these complex, modular parts, weight and cost go down, functionality goes up.

A key engine component on all internal combustion engine-powered heavy-, medium- and light-duty trucks and passenger cars, the oil pan endures long-term exposure to hot oil. Because it is located on or near a vehicle’s underbelly, it’s also subjected to corrosive water and road salts, and abrasion from dust, gravel and stone impacts, particularly on high-carriage and off-road vehicles.

Metal pans are heavy, prone to corrosion/rust and denting, feature numerous subassemblies (e.g., oil pick-up tube, windage tray, filter, pump, etc.) and require secondary machining, welding and painting. This is, therefore, just the kind of application where composites can integrate subcomponents, reduce assembly costs and roughly halve pan weight at a time when there is great pressure to improve fuel efficiency and reduce emissions. Further, composites naturally dampen noise/vibration/harshness (NVH) values.

The sheer complexity of vehicles and the host of mandates they must meet means that the auto industry can seem slow to embrace change. However, composites are beginning to displace cast aluminum and stamped steel in engine oil pans. The OEMs who, thus far, have ventured into this arena are finding that thermoplastic composites offer better part performance, plus mass and cost savings. For example, an injection-molding tool typically lasts three times longer than aluminum casting tools. Given how long engine programs tend to run, the per-unit cost savings on medium- to high-volume platforms add up fast for OEMs. Cost savings also accrue thanks to the famous design flexibility and components integration for which plastics/composites are renowned, because reducing part counts and assembly steps positively impacts the bottomline. Further, in many cases, oil sump volumes can be increased in the same packaging space, extending engine life and decreasing oil-change intervals for operators.

Despite this compelling value proposition, metal-to-composite conversion has evolved slowly because OEMs are cautious about changes that ― should they not work ― could ruin expensive engines and lead to high warranty costs. Also, many oil pans perform a structural function, stiffening the lower side of the engine block, so car and truck manufacturers require extensive validation studies, complete with long-term and on-vehicle testing, before technology is “green-lighted” for commercial application. Despite these qualification obstacles, composite oil pans that are now on the road point to significant opportunities on a variety of trucks and cars.

Form & function

Oil pans are of two major types — structural and nonstructural — and several different pan architectures are in use. Some pans are designed as two-piece, enclosed shells, featuring an upper pan directly connected to the engine and transmission, and a lower pan that holds the majority of the oil at any given time. The upper and lower pans are joined with a seal/gasket and bolts. Other pans are one-piece structures that bolt directly to the bottom of the engine block. Nonstructural pans are often made from hybrid materials, with cast aluminum uppers and stamped steel lowers and little added integration. They typically are found on engines with bed plates — ring structures that encircle the bottom of the block to increase stiffness for rear-wheel drive (RWD) vehicles or for high-pressure diesel engines on RWD or front-wheel drive (FWD) vehicles. Structural pans are usually one-piece cast aluminum, with little integration other than oil baffles. They’re designed to contribute stiffness to the engine block and transmission (via powertrain bending modes) and are found on most FWD vehicles.

Oil pans must exhibit significant strength. OEMs often require that they hold the static weight of the engine plus transmission (454-681 kg for a large V-8 engine) without breaking, because engines/transmissions often are serviced in this position outside the vehicle. And some OEMs require oil pans to pass dynamic engine drop tests. Engine oil pans also serve a number of important functions and, therefore, must:

•

Seal out environmental contamination (dirt, water) for the engine’s expected life.

•

Offer high use temperatures (110-120°C for continuous use and brief excursions to 140-150°C);

•

Provide long-term chemical resistance to hot oil (particularly used/oxidized oil, which is more acidic), fuel by-products (ethanol or more aggressive methanol on flex-fuel vehicles) and road salts (sodium chloride in North America and calcium chloride in Europe and extreme northern sections of North America).

•

Avoid transmitting noise from engine or gearbox.

•

Resist damage from impact by road debris or contact with speed bumps, curbs or parking barriers.

Impact resistance is particularly important. There have been cases in which dents in steel pans closed off oil pick-up tubes, literally starving engines of oil.

First thermoplastic oil-pan module

The dominance of metals in oil pans began to change in the 1990s, when commercial truck manufacturer Daimler AG (Stuttgart, Germany) initiated a five-year co-development program with Tier 1 supplier/molder Minda KTSN Plastic Solutions GmbH & Co. KG (Pirna, Germany) and materials supplier BASF SE (Ludwigshafen, Germany). The goal was a thermoplastic composite oil pan for its Mercedes-Benz Actros Class 8 truck. Much study and testing yielded a large 64 by 36 by 45 cm, one-piece, injection molded structural pan that could hold 30% more oil in the same package space as the aluminum and sheet-molding compound (SMC) versions it replaced. Launched in 1998, its increased sump volume meant that oil-change intervals could be extended by 50%. This reduced maintenance costs, extended engine life and kept commercial trucks on the road longer — making their owners more money.

To mold the 6-kg part with its deep undercuts, a large, complex tool was required. Equipped with slides and other tooling action, the mold weighed 30 MT and was produced by Hause Presswerkzeugbau Großdubra GmbH (Großdubrau, Germany). BASF’s Ultramid A3HG7 35% short-glass polyamide 6/6 (PA 6/6) exhibited excellent flow during the molding cycle and showed high resistance to stone impact, hot oil and heat aging during use. The pan also was 1 dB quieter, weighed 50% less, eliminated corrosion and — during impact testing with a 100g/25-mm projectile fired at 80 kph — proved tougher than benchmark aluminum.

North American wins and loses

Based on the success of the Actros application, BASF looked for ways to expand the technology to other customers and segments. Its North American team believed passenger cars and light trucks offered greater potential than commercial trucks, so it developed its own design concepts for oil pans and marketed them to Detroit’s carmakers in the early 2000s. Unfortunately, fuel prices were down and the post-9/11 market was slow. Paying extra for weight savings wasn’t high on OEM wish lists, so the concept didn’t gain traction. “Eventually we realized the only way we’d get a commercial program was if we did a proof-of-concept project to prove feasibility and drive interest,” remembers Scott Schlicker, powertrain market segment manager, BASF Performance Materials (Wyandotte, MI, US). “We felt that, from a technical standpoint, thermoplastic pans would work, and that with enough components integration, we could make a strong business case vs. metals.”

BASF entered into a three-year engineering, tooling and marketing program with Dana Corp. (Maumee, OH, US) on a 46- by 25- by 20-cm oil pan for the 3.7L V-6 engine on the Dodge Durango sport-utility vehicle (SUV) in 2005. The OEM, which was then DaimlerChrysler AG and is now (as of December 2014) FCA US LLC (Auburn Hills, MI, US), provided technical specifications and tested engines equipped with the composite oil pans, first on the dynamometer and then on actual vehicles. Results were positive: the technology was approved as “implementation ready,” and efforts began on the first commercial program.

As work got underway at DaimlerChrysler in 2007, a parallel program involving BASF and Dana started at Ford Motor Co. (Dearborn, MI, US) on the automaker’s 5.4L/3V (three-valve) V-8 engine for Ford’s F-150 pickups. This three-year effort yielded a 56- by 28- by 20-cm pan that, minus hardware, weighed only 2.24 kg. Also approved for implementation, this effort led to the team’s first North American commercial opportunity, on the 6.7L power-stroke turbo-diesel Scorpion engine in heavy-duty F-250 and F-350 pickups. The Scorpion engine was selected because Ford engineers wanted to integrate an oil level/temperature sensor in this engine’s 38 by 25 by 10 cm, 1.5-kg (fully dressed with hardware) nonstructural pan ― something that would’ve been difficult in stamped steel but straightforward in composites.

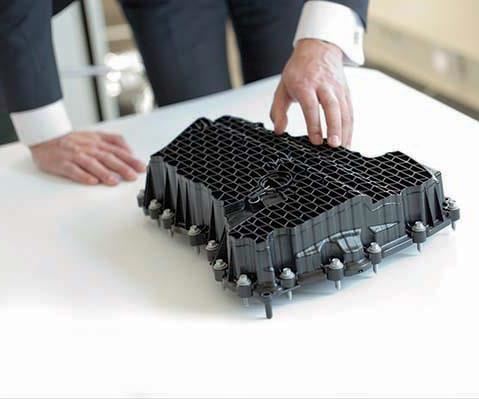

Launched in 2009, it was reportedly the first composite oil pan designed for exposed use (typical of North American vehicles without full underbody shields) thanks to a new material (Ultramid B3ZG7 OSI 35%-short-glass/PA 6) and a new waffle-rib configuration. The latter, for which BASF has patents pending, was developed and validated via extensive computer-aided engineering (CAE) analysis and impact testing. A proprietary modification package optimized the resin for stone impacts to -40°C and stabilized it against long-term heat aging in hot oil, bio-diesel and calcium chloride road salts (which normally attack polyamide). Although earlier composite pans had featured sacrificial ribs, this new rib design stood up to multiple stone impacts in BASF testing. Struck by a 100g steel impactor at 113 kph, the PA 6 lower pan sustained no damage, faring far better than legacy aluminum. Pan mass was reduced by 45%, NVH values were similar to aluminum and the pan didn’t rust or corrode. Several components were integrated to reduce assembly cost and it featured the first plastic drain plug, with a cam-lock element to prevent over-torquing and breaking the plug’s screw threads.

Despite these “firsts,” the global economy collapsed as the program progressed, so the oil level/temperature sensor was “de-contented,” leaving only a composite pan. Disappointingly, but not surprisingly, the production pan returned, after two years, to stamped steel to save money, reinforcing the team’s belief that composite pans were only competitive when they offered higher value via significant parts integration.

Meanwhile, back at what by now was Chrysler LLC, another commercial oil pan, also three years in development, was launched in 2009 on the company’s 5.7L/V-8 Hemi engines for the WK Jeep Grand Cherokee SUV. The supply team included BASF and MAHLE North America (Troy, MI, US). Notably, this 61- by 25- by 23-cm, 3.4-kg (fully dressed) pan was specifically designed for trail-rated vehicles and could channel oil uphill on a 60% grade to ensure hardworking engines weren’t suddenly without lubrication on a steep climb. The Hemi engine’s architecture made it possible for the nonstructural pan with an aluminum bracket to incorporate new levels of parts integration, including a windage tray (oil deflector) with cam-scraper function, an oil pick-up tube, seals, fasteners and an oil plug in an injection-molded PA 6 assembly that was joined via vibration and infra-stake welding. The highly integrated composite lower pan replaced a pan assembly that incorporated stamped steel, Quiet Steel (a steel/plastic/steel sandwich trademarked by Materials Sciences Corp., Elk Grove Village, IL, US) and cast aluminum. The composite reduced weight and tooling cost by 41% and 50%, respectively, and eliminated four assembly operations.

Since the Ford and Chrysler programs launched, additional development projects have been conducted, and North American automakers have recently launched commercial programs and have others scheduled in the next couple of years. However, program pace has been slower than hoped: typically three years development prior to approval followed by three years to commercialization.

European trends: Trucks to cars and back again

As the concept used in the Actros was applied in North America, DuPont Automotive (Geneva, Switzerland) and Daimler AG were at work in Europe on the first thermoplastic-composite engine oil pan for passenger cars. It, too, was a multi-year project. It made its debut on Mercedes-Benz C-Class 4-cylinder diesel sedans in 2007 ―

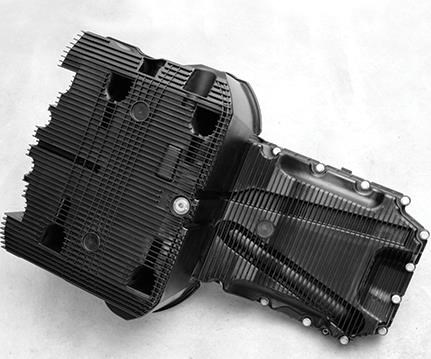

almost a decade after the Actros launch. The shell-type unit, produced by tier integrator G. Bruss GmbH (Hoisdorf, Germany), featured an upper pan of cast aluminum combined with a multifunctional lower pan injection molded from Dupont’s Zytel 70G35 HSLR 35% short glass-reinforced PA 6/6. The module integrated a windage tray, which reportedly reduced oil vapor around the crankshaft and improved horsepower by 5%, plus oil baffles that improved flow and reduced oil sloshing. It also reduced oil air entrapment and decreased friction, extending bearing life. The composite pan was 1.1 kg lighter and 20-25% less costly than the benchmarked all-aluminum design. Significant CAE work was done by Bruss and DuPont to refine rib positions that would boost overall stiffness in a critical flat section. The pan’s rear section formed the sump for approximately 6L of oil, so high ribbing in this area ensured its necessary stiffness and functioned as baffles to calm oil turbulence. Warm-embedded brass inserts also were used here to hold the oil discharge screw and oil-level switch. In contrast, the front section of the pan had to be flatter to fit into available space near the chassis and steering gear, which reduced bending stiffness. To prevent potential warpage/leakage at the joint to the upper aluminum pan and ensure the composite pan fit the tight space, a sandwich design was created in the part’s flat section by welding an injection molded PA 6/6 oil deflector in place. Like the high ribs in the sump area, the deflector helped calm and direct oil churned up by crankshaft and balance shaft, and stiffened the part. Due to the resin’s high melt-flow properties, only a single, center gate was needed to fill the 46- by 41- by 13-cm part. This minimized weld lines and reduced cycle time and tooling cost. The part passed challenging tests, including 1,000 hours’ exposure to hot oil at 150°C, and survival of a dynamic engine drop test.

Meanwhile, several commercial truck pans were launched. In 2011, truck OEM Scania (Södertälje, Sweden) used composite pans for its 440- and 480-hp, 13L Euro 6 diesel engines, which complied with new European Union (EU) legislation. The injection-molded pan was developed in Sweden by tier integrator Plastal Group AB (Gothenburg) and DuPont. The lower pan/sump used the same Zytel PA 6/6 resin mentioned above. Careful prototyping minimized warpage, so a consistent, tight seal was maintained between sump and engine across the large 85- by 47- by 20-cm part. Ribbing on the sump’s underside again played a key role in maintaining tolerances and resisting stone impact damage (parts were hit by progressively heavier steel balls, fired at 80 kmh via compressed-air cannon at a 45° angle until they broke). The final part reduced mass by 50% (6 kg) vs. the aluminum benchmark, helping it comply with new Euro 6 diesel-engine standards that phased in during 2013-2014. Other commercial truck programs have since deployed in Europe.

Composite oil pan programs continued to proliferate on European passenger cars and several went into production in 2012. The Peugeot 508 saloon/sedan from PSA Peugeot Citroën (Paris, France) is said to be the first to use a pan made from Akulon Ultraflow K-FHG7, a 35% short-glass/heat-stabilized PA 6 resin with very good flow properties from Royal DSM (Heerlen, Netherlands). Injection molded by Tier 1 molder Steep Plastique (Saint-Maurice-de-Beynost, France), its uniquely ribbed, nonstructural lower pan was 60% lighter and less costly than the metal version and, thanks to extensive CAE work by Steep, was specifically designed to pass very demanding application trials, including stone and curb impacts and an engine drop test.

Another composite pan, produced by Tier 1 supplier BBP (Marbach am Neckar, Germany) for Daimler’s Mercedes-Benz S-Class full-size luxury sedan, proved less costly and 50% lighter than the previous metal sump, using the same Akulon PA 6 grade. It exhibits good resistance to engine oil and meets challenging Mercedes vibration, stone impact and engine-drop tests. Reportedly it uses the same design as the earlier PA 6/6 pan on the C-Class, but is less costly.

What’s next?

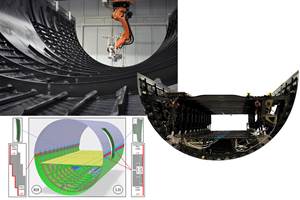

Engine oil pans, at least in North America, appear to be evolving from nonstructural to structural designs. A development project underway between Ford, the US Department of Energy (DoE, Washington, DC, US), and the Vehma Engineering and Prototype Div. (Troy, MI, US) of Magna Exteriors (Aurora, ONT, Canada) is investigating a multi-material lightweight vehicle (MMLV) based on a C/D segment sedan where the goal is to produce a drivable prototype weighing 25% less than the benchmark (Mach I), and then create a “virtual” concept vehicle that is 50% lighter than the benchmark (Mach II). One target area for lightweighting on this program is a V6 structural oil pan that will contribute to overall powertrain stiffness. The Mach I design is a two-piece, glass-reinforced PA pan with a carbon fiber-reinforced composite bracket. The Mach II phase will evaluate a one-piece, 50% long carbon fiber-reinforced PA 6/6 oil pan. Study goals include pan mass reduction by 30% (Mach I) and then 50% (Mach II) on a cost-neutral or better basis while maximizing powertrain bending frequency. BASF and Montaplast of North America (Auburn Hills, MI, US) are working on the Mach II pan. Reportedly, several unnamed structural pans at other OEMs are under development as well.

An intriguing application for composite oil pans outside the automotive industry is on stationary backup-power generators produced by MANN+HUMMEL Group (Ludwigsburg, Germany). Although some of the more rigorous impact requirements for pans on vehicle applications don’t apply here, the size of these pans —117 by 41 by 31 cm at a weight as low as 9 kg — is impressive.

Although the pace is slower than many would hope, developments in composite oil pans for commercial and light-duty vehicles are clearly continuing to proliferate. Composite pans are delivering tangible improvements in mass reduction (40-60%) and damage tolerance. And when engine architecture permits and designs teams are able to take advantage, significant cost savings also can be gained via component integration and follow-on assembly-step reductions. Transportation OEMs will certainly feel increasing pressure to shed mass and improve the efficiency of their vehicles. Assuming economic conditions continue to improve, the pace and frequency of composite oil pan introductions should go up.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreDemonstrating composite LH2 tanks for commercial aircraft

Toray Advanced Composites and NLR discuss the Netherlands consortium and its 4-year project to build demonstrator liquid hydrogen tanks, focusing on thermoset and thermoplastic composites.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreProtecting EV motors more efficiently

Motors for electric vehicles are expected to benefit from Trelleborg’s thermoplastic composite rotor sleeve design, which advances materials and processes to produce a lightweight, energy-efficient component.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More