Growth opportunites in global composites: 2016 and beyond

Lucintel LLC's (Irving, Texas) VP of consulting Norm Timmins predicts where and how much the global composites industry will grow during the next five years.

The global composite materials industry reached a total value of $17.7 billion (USD) in 2010 and, despite a still-sluggish world economy, its growth rate was 10.3 percent. Let’s break the numbers down a bit: Of the composite materials market’s global revenue, resins accounted for $8.8 billion and fibers accounted for $7.7 billion, with ancillary materials making up the difference. The total value of composite end products reached $50.2 billion. By 2016, I predict that the composite materials industry will reach $27.4 billion — a 7.8 percent compound annual growth rate (CAGR). In the same timeframe, composite end-products will total $78 billion.

What are some of the factors that have influenced this prediction? To evaluate the market opportunities for composite materials, Lucintel first looks at the penetration of composites into various market segments. In transportation, composites have a 3.6 percent share, based on monetary value, compared to a 68 percent share in marine. In construction, composites occupy 7 percent of the market; in aerospace, 10 percent; and in wind energy, 38 percent. These figures plainly indicate that there is vast growth potential for composites. The industry is certainly sustainable: In our view, there are upwards of 30,000 potential product applications. It is true that a variety of market segments have experienced huge fluctuations during the past five years, relative to the gross domestic product (GDP), and that composites performed poorly in the last half-decade. Yet, composites industry growth outpaced GDP in 2010, and trend data suggest that it will grow faster than GDP during the next five years.

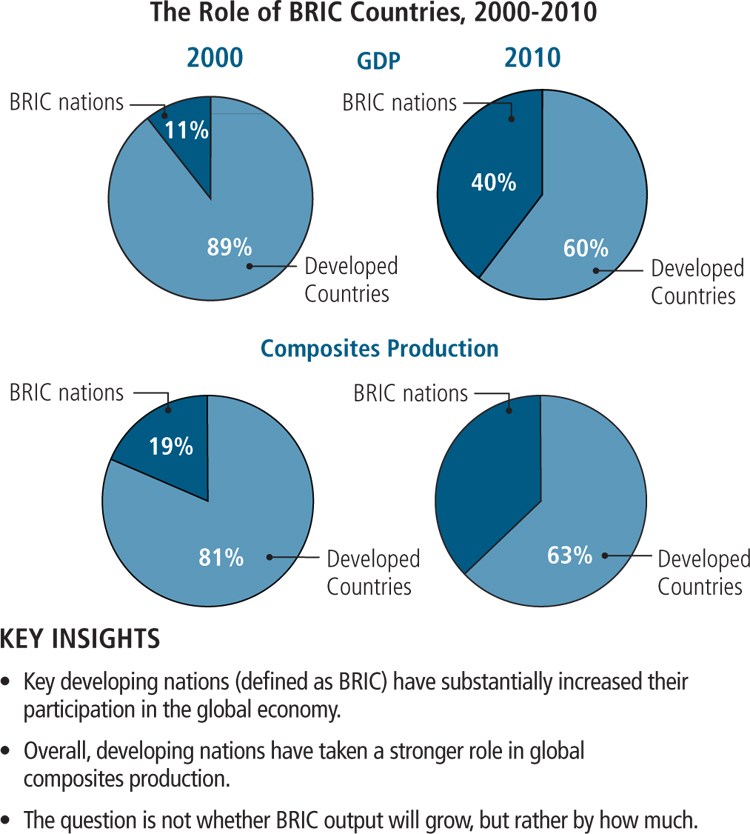

Secondly, we look at the potential for growth geographically. Here, developing countries will foster strong growth as they begin to play larger roles in the global economy and in composites manufacturing. These emerging economies include Brazil, Russia, India and China (the so-called BRIC nations), which are experiencing rapid growth and urbanization and show evidence of emerging middle classes and increased OEM production. In reference to BRIC composites production, it is not whether it will grow, but rather by how much. BRIC economic growth likely will lead to greater market fragmentation as composites-related companies jockey for space and share, but those with the capacity for innovation will thrive.

Another potent growth driver will be China’s wind market. Lucintel predicts that it will grow a robust 23 percent or more per year through 2015, based on our belief that wind is expected to remain the dominant renewable energy source during the next 10 years. The Chinese government has committed to generate at least 15 percent of its energy by means other than burning fossil fuels by 2020 — the country is currently at 8.5 percent. In pursuit of that goal, China will face major challenges. It lacks grid capacity, and 30 percent of its existing wind turbines are not connected to its national grid.

Although the U.S. wind market fell in 2010, there is still considerable growth potential, despite competition from natural gas and our own grid-connectivity problems. The lack of robust, long-term federal targets for renewables is unfortunate, but political support for renewable energy is expected, going forward. And even in highly developed wind markets, such as Germany, the penetration of composites compared to the potential remains low, at only 30 percent.

In our view, the future is bright. Although emerging countries will forge a new reality as they enter the composites fray, and the increased competition will mean fast-changing and complex markets, global composite materials growth of 5.9 percent in 2011 appears very likely. The sluggish automotive, construction, electronics and consumer-goods markets should bounce back. In North America and Europe, watch for wind and aerospace to remain the most attractive growth markets. Population increases, infrastructure needs and the green movement are only a few of the factors that will drive composites growth to new horizons. In the end, innovations that reduce the cost of composite products by 30 percent have the potential to triple the composites market.

Editor’s note: This article is excerpted from Timmins’ recent keynote address at the ACMA COMPOSITES 2011 Show in Ft. Lauderdale, Fla.

Related Content

Materials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)