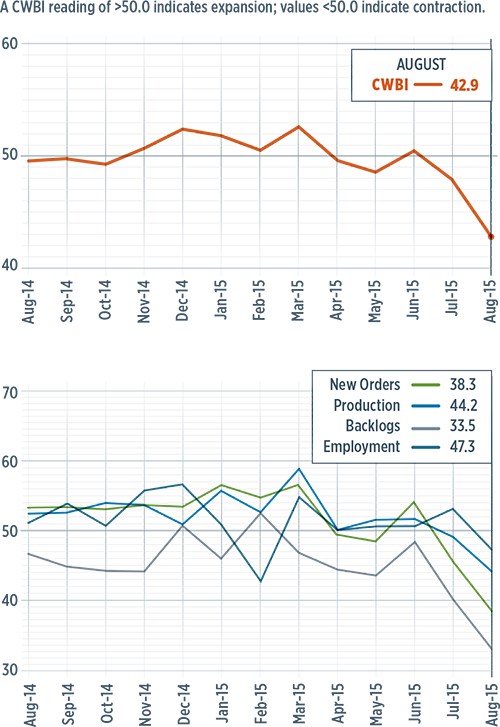

CW Business Index at 42.9 – Lowest since December 2012

Steve Kline, Jr., the director of market intelligence for Gardner Business Media Inc. (Cincinnati, OH, US), the publisher of CompositesWorld magazine, presents the CompositesWorld Business Index for the US composites industry through August 2015.

With a reading of 42.9, the CompositesWorld Business Index for August showed that the US composites industry had contracted for the fourth time in five months. Further, the rate of contraction had accelerated in June, July and August. And the Index fell to its lowest level in August since December 2012. Compared with one year earlier, the Index had contracted for eight consecutive months.

New orders contracted in August for a second month. The drop in that subindex was so steep that in August, it fell to its lowest level since the CWBI survey began in December 2011. Likewise, the production subindex had contracted two months in a row but its decline wasn’t as sharp. Because production had shown relatively greater strength than new orders, however, the backlog subindex plunged. In August, backlogs contracted at their fastest rate since the survey began. The trend in backlogs indicates that factory capacity utilization will fall heading into 2016. Employment contracted for the first time since February 2013. Because of the strong dollar, exports continued to contract. And in August, supplier deliveries continued to lengthen at about the average rate for 2015.

After going up at a steadily accelerating rate, the increase in material prices slowed in August. The rate, in fact, was below the rate of increase for 2013 and 2014. Prices received increased for the second month in a row. However, the rate of increase was minimal. Future business expectations had been trending lower since February of this year, and they hit their lowest level in August since October 2014. In August, expectations fell below their average level for the first time since October 2014.

The subindices at manufacturing plants of all sizes were below 50.0 in August. Plants with more than 250 employees performed significantly better than the other categories, however: the subindex for this largest facilities category was just under 50.0 at 49.4. All of the other plant sizes had posted numbers of 45.0 or less. Fabricators with fewer than 20 employees contracted for the sixth straight month. Companies with 50-99 employees contracted for the fourth time in five months. Plants with 100-249 employees contracted for the second time in four months. Facilities with 20-49 employees have contracted every month but two during the past 12 months.

All regions in the US contracted in August, too. The North Central-East contracted at the slowest rate, with an subindex of 47.7. This was the second month in a row this region contracted. The North Central-West contracted at a similar rate. It had contracted in two of the preceding three months. The subindex in the South Central dropped to 44.0 from 60.4 in July month. The Southeast contracted for the first time since February of this year. Both the West and the Northeast had an subindex below 40.0 in August.

Despite the negative trends in the August data, future capital spending plans for the 12-month period ending in August actually increased significantly. In fact, the month’s future capital spending plans figures were nearly double the July numbers, putting that category at about the average level recorded since December 2011. Compared with one year earlier, future spending plans increased 21.2% — the first month-over-month increase since June 2014.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreMaterials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MorePlant tour: Spirit AeroSystems, Belfast, Northern Ireland, U.K.

Purpose-built facility employs resin transfer infusion (RTI) and assembly technology to manufacture today’s composite A220 wings, and prepares for future new programs and production ramp-ups.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)