Composites Past, Present and Future

Scott Hemphill is president of Hardcore Composites (New Castle, Del., U.S.A.). He earned a BS in engineering from the University of Delaware and since has accumulated 24 years of experience in the construction and composites industries. Hemphill holds three composites-related patents and currently has two additional

Since I became involved in composites in the mid-1990s, it has been the unwavering desire of many companies and individuals that make up our industry to become involved in three areas that appear to have unlimited market potential on the upside, with no downside. The three sectors on our collective wish list -- civil infrastructure, automotive and wind power -- tantalizingly beckon our entry into their worlds. This trio of wishes reminds me of a classic story, "The Monkeys Paw" by W.W. Jacobs. For those unfamiliar with the tale, it tells of a man who gets three wishes and the misfortune that befalls him when they are granted. Our company, Hardcore Composites, wished to become the composites industry's leader in the civil infrastructure market, the realization of which resulted in an outcome that we could never have contemplated.

Hardcore Composites got its wish not only because of its own hard work, but through the efforts of many others, as well. The Market Development Alliance (MDA, recently reconstituted as the Composites Growth Initiative, under the auspices of the ACMA), the Civil Engineering Research Foundation (CERF), the National Composite Center (NCC) and the Society for the Advancement of Materials and Process Engineering (SAMPE) all worked in unison to cultivate the use of composites in infrastructure. In consultation the Federal Highway Admin. (FHWA), AASHTO (American Assn. of State Highway and Transportation Officials), The Army Corps of Engineers and State Departments of Transportation, these industry advocates extolled the superior performance of composites and convinced these groups to specify them in actual projects. Seizing the opportunities that were finally available, U.S. composites manufacturers such as Creative Pultrusions (Alum Bank. Pa.), Strongwell (Bristol, Va.), Martin Marietta Composites (Raleigh, N.C.) and Lancaster Composites (Lancaster, Pa.) joined us in stepping up to meet the technical and manufacturing challenges presented by the market we had for so long pursued.

Although our company was able to produce products that performed to expectation, we quickly realized that we were no longer playing by a set of rules that we understood. Not only did we not fully understand them, we were now forced to adopt business practices unlike any we had encountered in the markets our industry has previously entered. The world of construction was a new and dangerous place ruled not by our new "partners" in the specifying agencies, but by contractors.

Doing business with contractors exposed us to a plethora of business situations that we had neither expected nor planned for. Most debilitating was that somewhere in this process we no longer were playing the role of supplier, but now were being treated as a subcontractor. Suddenly, our engineers were spending less time on engineering than on documenting change orders and dealing with delays and back charges. Securing performance bonds and excessive amounts of insurance coverage strained not only our budgets, but also our internal resources. We soon found that months and, sometimes, years of delay between project initiation and actual delivery (and subsequent payment) was the norm, not the exception. Our best planning and budgeting fell short when applied to a process that includes "pay when paid" clauses, ten percent retainages and 90- to 120-day payments.

Although we successfully completed all our projects, including the largest use of composites in civil infrastructure to date (the wind fairings on New York City's Bronx-Whitestone Bridge), these external factors steadily and ruthlessly wore away at us until we were forced to seek Chapter 11 bankruptcy protection. It is easy, especially for our competitors and those directly affected by this action, to blame our problems on poor management and business practices. And ultimately, they are correct. By not fully understanding the arena that we would be doing business in, we were unprepared for the toll it would take on all our resources, especially financially. I proffer this not as an excuse, but as a lesson for our brethren in the composites industry.

Composite materials have reached a level of acceptance and credibility in the civil infrastructure market such that they are beginning to be specified on their own merits. As in "The Monkeys Paw," we got our wish, along with the unintended consequences. We now need to redirect our collective efforts to defining how composite fabricators are treated by the construction industry: Are we suppliers or subcontractors? Are special payment terms appropriate on state and federal projects, given the unique cost structure of our products? Why do we have to submit to testing, engineering reviews and shop drawings that are not required for other construction materials -- even new ones? Do we deserve material cost escalation clauses like steel and lumber suppliers receive? These are just a few of the areas that we as an industry now need to address if we want composites retain credibility in civil infrastructure.

I hope that those companies out there that are trying to break into the automotive and wind power markets closely examine all the possible outcomes of having their wish granted. I wish we had. We certainly will in the future.

Related Content

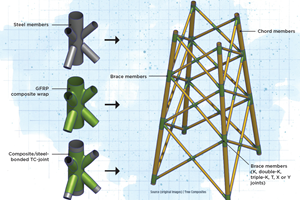

Novel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreMaterials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)