Composites Business Index 53.1: Growth in four out of five months

Steve Kline, Jr., Gardner Business Media's director of market intelligence, reviews the U.S. Composites Business Index for January and February 2014.

As the New Year turned, January’s Composites Business Index of 54.1 was 8.6 percent higher than it was in January 2013, and showed U.S. growth at its fastest rate since May 2012.

New orders had reached their highest level since February 2012. After two months of moderate contraction, production grew at its fastest rate since April 2012. Backlogs grew for the first time since May 2012, indicating that the industry should see better capacity utilization in 2014. Employment grew, as it had done at a steadily increasing rate since June 2013. Exports, however, remained mired in contraction. Supplier deliveries continued to lengthen, and at a slightly faster rate than in the second half of 2013.

Material prices grew at a faster rate in January, continuing a trend begun in August 2013. Prices received grew at its fastest rate since January 2013. However, the rate of increase was much slower than that for material prices. Future business expectations soared to its second highest level since the CBI began in December 2011.

Fabricators of all sizes grew in January. Those with 50+ employees continued strong, but the improvement was driven by smaller facilities: Those with 20 to 49 employees expanded at their fastest rate since June 2012, and those with fewer than 20 employees grew for the first time since March 2013.

Regionally, New England grew fastest in January, followed by the West North Central, which grew for the first time since July 2013. The Middle Atlantic expanded after two months of contraction. The East North Central grew for the third time in four months. The Pacific region expanded for the fourth straight month. The Middle Atlantic and South Atlantic, however, continued to contract.

Future capital spending plans were 17.8 percent higher than they were a year earlier. It was the fifth straight month that they were up from the previous year.

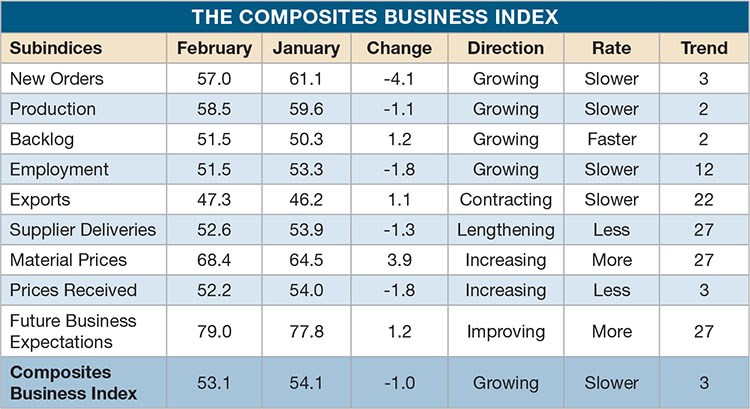

In February, the CBI of 53.1 showed that the industry had grown for the fourth time in five months — and had done so at its second fastest rate since May 2012. In fact, it had been improving at a generally accelerating rate since July 2013. The CBI was 6.2 percent higher than it had been one year earlier. It was the sixth straight month that the CBI had been higher than it had been in the same month a year earlier.

New orders grew in December 2013 and in January and February 2014, reaching their second highest level since February 2012. Production expanded at a significant rate in January and February, reaching its second fastest growth rate since April 2012. Backlogs increased in February for the first time since spring 2012, pointing to greater capacity utilization and capital investment in 2014. Employment continued to grow in February but did so at its slowest rate since September 2013. Exports were still mired in contraction at a rate similar to that in 2013. Supplier deliveries continued to lengthen but at a slightly slower rate than in the previous two months, but slightly faster than in the second half of 2013.

Material prices increased at a rapidly accelerating rate the first two months of 2014, and at its third fastest rate in CBI history. Prices received, rising in six of the past seven months, grew at one of its fastest rates since January 2013, but increased much more slowly than material prices. Future business expectations soared, reaching their second highest level since the CBI began.

Facilities of all sizes grew again in February. The rate of expansion, however, was significantly greater for facilities with more than 20 employees. Those with 19 or fewer recorded very slight growth.

Six of the seven U.S. regions registered expansion in February. The Pacific region grew the most, followed by New England, the South Atlantic, West North Central, Mountain, and East North Central. After expanding in January, the Middle Atlantic was flat.

Future capital spending plans were 30.2 percent lower than they were a year ago. It was the first time in five months that the month-over-month rate of change contracted. Change was likely, however, in March 2014 because the March 2013 CBI was one of the lowest yet recorded. Although the annual rate of change was still growing, the rate had slowed noticeably.

Read Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)