Bio-composites update: Beyond eco-branding

No longer dependent only on their green credentials, some suppliers of bio-based fibers and resins are competing on price and performance.

The huge potential upside of biopolymers and bio-fibers has never been in dispute. Resin and fiber suppliers who use feedstocks derived from plants and other natural materials can reduce or eliminate fossil fuels in the production loop. In theory, this reduces energy consumption, pollution and VOC emissions, resulting in a more planet-friendly product. It also can help take the historic price volatility of petroleum out of the commercial equation.

In pragmatic terms, however, making commercially viable bio-composite materials has proven to be a daunting challenge. Most natural fibers, such as flax and hemp, have generally inferior strength compared to their synthetic counterparts — glass, aramid, and so forth — and both bio-fibers and bio-based resins, thus far, have been more costly to manufacture. But recently several materials suppliers, spurred by ongoing innovations in bio-materials, are offering new commercial or near-commercial bio-fibers and bio-resins that, they say, can compete with synthetic-fiber products in terms of price and performance.

Consistent and cost-effective

A top contender is cellulose fiber. Flax, hemp, jute, kenaf, cotton and coir (coconut) fibers are stripped or extracted from the plant stalk or seed head and vary in diameter and length; cellulose fiber also is plant-derived, but is first must processed as pulp and then made into uniform-sized filaments by means similar to those used in the manufacture of glass and other synthetic fibers. Although they lack the name recognition of other plant fibers, cellulose fibers aren’t new, and their proponents say they’re poised to make a name in several markets.

When he founded Torrington, Wyo.-based Heartland BioComposites in 1994, Heath Van Eaton could claim to own the only company that commercially produced advanced composite materials using fiber reinforcements derived from wheat-straw cellulose. Although the company folded during the 2008 recession, Van Eaton went on to found several other bio-composite materials companies, including his latest, Agri-Fibers Inc. (Cheyenne, Wyo.). The company is purchasing production equipment, with plans to open a commercial facility in Cheyenne this August. Agri-Fibers will produce not only a wheat-straw-based cellulose fiber, trademarked Agri-Fi, but also pelletized compounds, under the trade name Poly-Fi, for injection molding and extrusion processes. Van Eaton claims the compounds’ fiber content, by volume, is as high as 80 percent for extrusion and 70 percent for injection molding. Although the fiber does not provide the net physical property improvements that glass fiber does, Van Eaton says it is less expensive and will be targeted as a filler for cost reduction, green certification and branding, with its primary application in composite lumber.

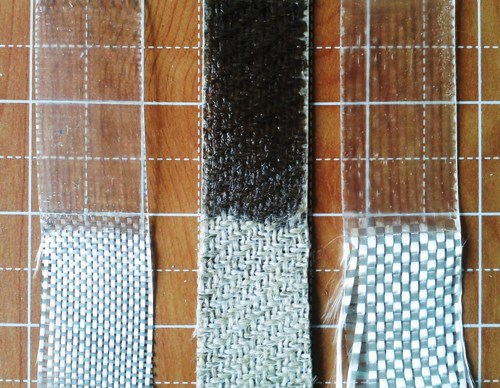

In October 2012, GS Consulting (aka Gordon Shank Consulting, Burnaby, British Columbia, Canada) and Engineered Natural Composites Corp. (aka ENC International Corp., Seoul, South Korea) introduced a continuous-filament cellulose fiber known as BioMid to the North American market. (ENC is the fiber’s manufacturer and owner; GS Consulting retains the exclusive marketing and sales rights.) The first commercial grade of BioMid is a 1,650-denier yarn, comprising 900 “extremely highly crystalline” cellulose filaments, each with a diameter of about 11 microns, according to Gordon Shank, coinventor of BioMid and president of GS Consulting. It has a tenacity of 8 to 9 g/denier and a modulus of 350g/d, properties that put it roughly on par with some E-glass yarns (typically 6 to 11 g/d) but below S-glass and aramid. The company also has a 2,200-denier yarn under development.

The fiber’s feedstock is a proprietary blend of softwood and hardwood chips. A North American contractor separates the raw biomass into lignin, cellulose and hemicellulose. The lignin and hemicellulose are fully used as additives and fillers for plastics and feedstock for bio-fuels. The remaining pure cellulose is converted into continuous filament and yarn by ENC in South Korea, but there are plans to eventually transfer this operation to the U.S. ENC and GS Consulting sell BioMid yarn to three companies that convert the material into fabric, contingent on the final fabric format: Absecon Mills (Cologne, N.J.) produces woven fabric; SAERTEX USA LLC (Mooresville, N.C.) makes stitched fabric; and A&P Technology Inc. (Cincinnati, Ohio) manufactures braided fabric. Additionally, Nexeo Solutions (The Woodlands, Texas) distributes BioMid yarn to converters for weaving processes and to part manufacturers for filament winding and pultrusion processes. A U.K.-based company is developing BioMid prepreg for the European market, and Shank is looking for a suitable partner to do the same in North America.

Absecon Mills was the first company to make a woven cloth from 100 percent BioMid cellulose fiber and began selling it late in 2012. The company also has plans to weave hybrid fabrics of either glass and BioMid or aramid and BioMid. “One of the drawbacks associated with renewables-based fibers of all types is their lack of availability and obscurity within the established composite supply channels,” says ENC president Hoper Hwang, adding that Absecon Mills’ reported ability to weave up to 10 million m2 (107.6 million ft2) of BioMid should overcome this limitation.

Why cellulose? One reason is that the availability of BioMid feedstock is limited only by the spinning equipment, and Absecon Mills is bringing more equipment online next year. Another reason, says Shank, is “we’re business people, not eco-warriors.” Shank is targeting BioMid to compete immediately on price and performance with E-glass and polypropylene and, with more development, possibly with S-glass and aramid as well. “Ten years ago flax and hemp were coming into the market and the joke going around the composites industry was ‘why would anyone pay twice as much for something that performs half as well?’” Shank says. The consensus was that making a cost-competitive natural fiber that works as well as synthetic reinforcements would probably not happen in the lifetime of today’s fabricators. But five years ago, ENC approached Shank with a proposal to do just that, and the quest began. Using a trial-and-error approach, GS Consulting and ENC tested dozens of raw natural plant fibers, such as jute, hemp and coir, and found critical cost or performance deficiencies in each that made them unsuitable for high-performance composites applications.

“For composites, you prefer a continuous and highly uniform fiber, without twist, which is impossible to make from raw plant fiber,” Shank notes. They realized the common active structural ingredient in all natural fibers is cellulose, so Shank and his team directed their efforts toward developing a cost-effective process for making pure cellulose fiber with high crystallinity. “Rayon is pure cellulose fiber, but it has a relatively low crystallinity of about 30 percent. We needed much higher crystallinity for composite applications,” Shank says.

After several years of trial-and-error testing, Shank and his partners settled on the feedstock blend and a closed-loop manufacturing process known as dry-jet-wet spinning, which is powered by wind-generated electric power. The cellulose is broken down into a slurry, reassembled under pressure and jetted through a spinneret to produce a fiber with a nominal diameter of about 11 microns. As the fiber leaves the spinneret it gets “quenched” and, Shank says, it coagulates to form a continuous filament with exceptionally high crystallinity.

Eco-friendly surfboards

Using BioMid fabric reinforcement in place of glass fabric, E-Tech Boards (Hawthorne, Calif.) is planning a line of eco-branded, zero-glass surfboards and paddle boards. Two prototype boards have successfully passed field testing. “The initial boards are performing great,” says company co-owner Ryan Harris, who reports that one of the prototypes was built as a promotional board for Monster Energy Drink. The woven fabric for the boards is a 5.1-oz, 100 percent BioMid, supplied in a 45-inch/1,140-mm width by Absecon Mills.

Harris explains that E-Tech has long sought to make and market its boards as having the highest amount of green content on the market. The company’s current line of boards are manufactured with an array of recycled and bio-based materials, including recycled expanded polystyrene (EPS) foam core, stringers made of sustainably harvested wood or bamboo and the industry’s first U.S. Department of Agriculture (USDA) “bio-preferred” certified epoxy, Super Sap Epoxy 100/1000 supplied by Entropy Resins (Hayward, Calif.). However, attempts to replace fiberglass with a bio-fiber have been problematic.

“It’s been a goose chase trying to replace glass,” says Harris’ partner, Todd Patterson. “I’ve tried just about all natural fibers and some you haven’t heard of.” He says he had some success achieving good properties with bamboo in several prototype shortboards, but in the end “it was just too difficult for the industry to accept.”

One deficiency of most natural plant fibers, which contain a high percentage of lignin, is the limits they impose on the quality of graphics that can be created on finished laminates they reinforce. Lignin imparts a brownish, opaque hue to a laminate. BioMid cellulose, however, has transparency that mimics glass. “BioMid takes color really well, which is why we were able to create the quality graphics on the Monster board,” says Harris.

Patterson reports that BioMid is a bit pricier than 6-oz E-glass, but less expensive than carbon. There is the initial sticker shock, “but the stuff is so strong, we may be able to use less of it when we scale up.”

Bio-resins make the grade

Notably, 37 percent of the Super Sap 100/1000 resin backbone is derived from naturally occurring pine oil and is said to adhere well to reinforcements and has better elongation properties than petroleum-based epoxies. Entropy Resins is targeting sporting goods applications with not only E-Tech, but also Stretch Surfboards (Santa Cruz, Calif.) and Niche Snowboards (Salt Lake City, Utah). Depending on the formulation, the epoxy has a bio-based carbon content ranging from 17 to 25 percent, derived from pine or vegetable oils. Company founder and president Desi Banatao says when the company introduced its first bio-epoxy grade in 2010, his team naïvely believed fabricators would buy it just because it is green. “We learned a few lessons,” Banatao quips, “and in the past few years, we have focused on enhancing the performance properties.” He admits the Super Sap line is more expensive than conventional epoxies, but says fabricators can expect Entropy’s products to perform on par with the oil-derived epoxies they replace.

Another bio-resin innovator is Pasadena, Texas-based Dixie Chemical Co. Inc., which formulates bio-based unsaturated polyesters (ortho-, iso-, and terephthalic, DCPD-modified and bisphenol A fumarate) and vinyl esters. At CompositesWorld’s Materials, Markets and Manufacturing conference in Charleston, S.C. (Oct. 22-23, 2012), Dixie’s composite applications chemist Alex Grous discussed his firm’s methacrylated fatty acid (MFA) reactive diluent, a partial styrene replacement derived from palm kernel and coconut oil, for use with polyester and vinyl ester in pultrusion, sheet molding compound (SMC), bulk molding compound (BMC), casting and resin transfer molding (RTM) processes. Applied in 15 to 18 percent loadings, MFA offers styrene emissions reductions of up to 27 percent, with good toughness and elongation, low-to-no odor and 60 percent bio-content. Grous walked attendees through several case histories in which Dixie worked with partners Ashland, LLC, Premix (N. Kingsville, Ohio) and the Maine Composites Alliance (Portland, Maine) to develop parts and structures made with resins formulated, in part, with MFA. The Alliance assessed data on MFA loadings of 15 percent in vinyl ester for a construction application, and 18.6 percent in polyester for a marine application. Infusion times were either unchanged or slightly improved, Grous said, with no sacrifice of toughness, flexural strength or other mechanical properties.

Canada’s Campion Marine (Kelowna, British Columbia) is the first volume boatbuilders to convert to a resin derived, in part, from renewable bio-sources. The polymer, Envirez from Ashland, is a polyester resin with a polyol component made from corn- and soy-based oil that accounts for 20 to 25 percent of its total molecular weight. Campion president Brock Elliott recalls that six years ago Ashland asked if his company would be willing to build and test prototype boats in which petroleum-based polyester was replaced with a bio-resin. Ashland formulated a special laminating grade, the Envirez L 86300 series, and in 2008, Campion built two powerboats with the resin and subjected both to rigorous open-water testing. When field tests verified that the bio-based resin had strength equal to, and elongation and elasticity superior to, the petroleum-based polyesters they had used, Elliott says Campion converted its entire powerboat line to Envirez in 2009.

“Improved elongation of the resin in laminate is good because when you bump the dock you don’t want the gel coat cracking,” Elliott says. Enhanced resin elongation also eases part demolding, an operation that sometimes requires the use of wedges at the flange of the mold to free the hull, which sometimes precipitates stress cracking. Elliott says Campion has seen lower warranty costs as a result of fewer stress cracks.

Robert Moffit, product manager at Ashland, recalls that its biopolymer development began in the late 1990s when John Deere (Moline, Ill.) asked if there was a way to incorporate its customers’ crops into its farm equipment. Ashland released the first commercial-grade biopolymer in 2000 for compression-molded SMC tractor and combine panels, and has since developed grades for infusion, RTM pultrusion and cast marble processes. He says the company uses DuPont Tate & Lyle Bio Products Co. LLC’s (Loudon, Tenn.) bio-based glycol in one grade and Archer Daniels Midland (ADM)’s (ADM, Decatur, Ill.) in another, but he notes that “we don’t switch between these sources for a given product.” The feedstock for each supplier’s glycol is commonly either corn or soybeans. In the case of the grade developed for Campion, the bio-glycol is not merely a drop-in replacement for glycol derived from crude oil. Instead, it reportedly enables chemists to achieve property combinations that are not available with traditional polyesters.

“With traditional polyester you can tailor the elongation but lose other properties, such as strength,” says Moffit. But he insists that “with our bio-resin, we can dial-in better elongation without a drop off in strength.”

The cost/performance equation

As long as there are doubters, bio-materials suppliers and end-users will need to keep pecking away at the perception that “bio-based” means less performance for more money. And they’ll inevitably struggle over which manufacturer’s product is the greenest (see the sidebar titled “Bio-fibers: Green litmus test?,” under "Editor's Picks," at top right). But the real question is, Will end-users buy green? Shank thinks market acceptance of cellulose fibers will grow because “BioMid is almost half the weight of glass,” and contends that production scale-up will do much to reduce the per-unit cost. “Once you normalize by volume there is very little difference between BioMid and glass fabric pricing.” On the bio-resins front, Ashland advises customers about which market segments are most interested in them. “Few end-user segments are willing to pay more for bio-containing materials,” Moffit admits, but points to “programs, such as the USDA’s Bio-preferred Procurement and Labeling initiative, that reward use of bio-based materials.”

Adapting bio-products as a drop-in replacements for tried-and-true resins and fibers is clearly a challenge but as bio-composites begin to compete financially and mechanically, the green label’s value will come into sharp focus.

A. Schulman Inc.

Related Content

Novel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

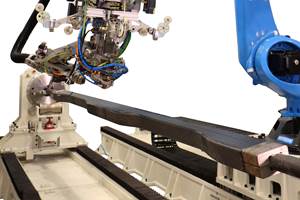

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreMaterials & Processes: Tooling for composites

Composite parts are formed in molds, also known as tools. Tools can be made from virtually any material. The material type, shape and complexity depend upon the part and length of production run. Here's a short summary of the issues involved in electing and making tools.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)