Where is the automotive composites supply chain?

Long-time composites industry observer Dale Brosius, now a consultant and the president of Dayton, Ohio-based Quickstep Composites, the U.S. subsidiary of Australia-based Quickstep Technologies (Bankstown Airport, New South Wales), asks some hard questions about the composites industry's readiness to supply the auto industry with the materials and processes necessary to meet coming lightweighting challenges.

Having spent more than half my life in the composites industry, I have been fortunate to have been exposed to many materials, processes and end-use markets around the world. While I continue to be a strong proponent of composites, I also have developed a healthy dose of skepticism when it comes to predicting the growth rate of the industry. Although I remain optimistic, my aim here is to be provocative in describing the challenges that must be overcome.

Back in 1984, I came to Detroit with Dow Chemical Co. (Midland, Mich.) and was tasked with selling epoxy and vinyl ester resins to the auto industry. At my first meeting with Chrysler in Highland Park, an engineering manager told me that “by the end of 1985, Lee Iacocca” — remember him? — “will drive an all-composite vehicle off the assembly line.” I immediately envisioned a modern-day River Rouge plant, with trainloads of resin and fiberglass, instead of iron ore, coming in one end, and shiny, lightweight composite cars rolling out the other. The fallacy here was that the automotive OEMs thought the composites industry knew all about designing and manufacturing car parts in high volumes, and frankly, we assumed the same about the OEMs. The truth was, nobody did. A supply chain did not exist.

Chrysler left Highland Park many years ago, and Lee Iacocca left Chrysler, but the lack of a viable supply chain for large-volume composite vehicles is a problem that is still with us.

In 1987 a senior engineer at Ford told me they would not make the investment required to produce 30,000 to 50,000 composite vehicles annually, and clearly none of the existing molders of sheet molding compound (SMC) had the wherewithal to do so either, especially because the likely technology for the body-in-white would be resin transfer molding (RTM), which was still relatively nascent. And we were still talking about glass fiber — industrial-grade carbon fibers were some years away.

There is no shortage of challenges to making composite vehicles commonplace. However, today we have materials that can deliver lightweight structures, processing times are dropping rapidly and predictive analytical software is reducing development costs. The biggest impediment to widespread adoption is the enormous investment required in people and capital equipment. None of the existing molders of automotive plastics have pockets deep enough to underwrite such a cost. Becoming a supplier to the automotive industry isn’t easy; carbon fiber molders from other industries found this out a decade ago with small-volume vehicle programs. It is one thing to keep up with production rates of 10 to 20 aircraft per month, but it’s another thing entirely when volumes jump tenfold. Today the automotive market is looking for the capacity to support 1,000 to 3,000 composites-intensive vehicles per month, if not more. It is up to the OEMs to lead the way.

BMW has taken on this challenge and created a full chain for carbon fiber supply, weaving and, finally, molding the structures and assembling the vehicles. Outside companies manufacture the raw materials, but the biggest investments in molding equipment and assembly processes have been made by BMW, rather than its suppliers. The whole industry will be watching to see how BMW’s i3 and i8 succeed in the market, but even if the estimates of 30,000 carbon fiber vehicles per year is attained, this still represents less than 3 percent of BMW’s annual vehicle production. As big a deal as this is, it is still a long way from significant market penetration.

The key will be to see who, if anyone, follows BMW’s lead. If other OEMs, especially in Japan and North America, step up and do the same, then the rosy forecasts for automotive composites might, indeed, be correct. If not, then composites are clearly destined to remain a niche solution for improving emissions and fuel economy.

Quickstep Composites LLC

Related Content

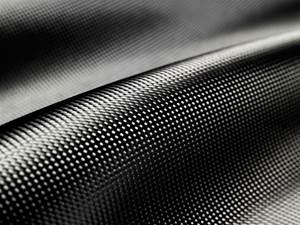

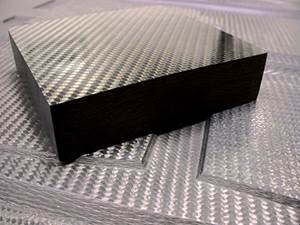

Materials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreMaterials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More