Wanted: Big thinkers and risk takers

Quickstep Composites (Dayton, Ohio) president and independent consultant Dale Brosius challenges the auto industry to think big and take risks in composites R&D.

In June, while on vacation in France, I visited the Château du Clos Lucé, in Amboise, near the center of the Loire Valley. Surrounded by large, tranquil gardens, replete with ponds and streams, the chateau was a gift from Francois I, king of France, to Leonardo da Vinci. One of the most brilliant and inventive men of all time, da Vinci spent the final three years of his life in Amboise and died there in 1519.

As an engineer by training, the visit captivated me. Placed throughout the gardens and in the chateau’s museum are full-scale recreations of da Vinci’s inventions, based on his sketches: swinging bridges, water transport devices, a rolling army tank, a glider with bat-shaped wings, trilevel machine guns, ball-bearing transmissions and other devices, many of which were not perfected until decades or centuries after his death and the principles of which form the basis of many vehicles and other machines we take for granted today.

Within a week after my return to the U.S., I received a press release about the closure and liquidation of Fiberforge (Glenwood Springs, Colo.). It got me thinking about how difficult it is for small companies to get new innovations to market in a time frame that will allow them to generate enough revenue to survive. Lengthy delays are typical largely because the market doesn’t readily embrace risk or invite exploitation by inventors with out-of-the-box ideas.

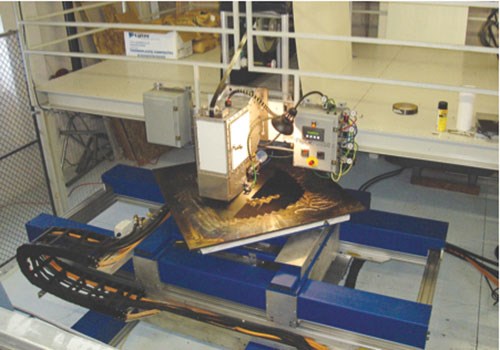

Fiberforge was created out of the Hypercar concept, developed by the Rocky Mountain Institute (Boulder, Colo.) in the mid-1990s. Incorporated in 1998 to develop and market technologies for automated cutting, layup and press cure of continuous fiber thermoplastic composites using carbon and glass fibers, the company received a number of research contracts and did paid prototype work in the automotive and aerospace markets. But those efforts had not yet culminated in full-fledged production cells, the sale and licensing of which might have provided the revenue stream necessary to keep the company alive.

Although in this case it’s possible that a larger company might yet buy the company’s assets and technology and give it a future, the question remains: Why is it that inventions meet such resistance in the marketplace and take so long to be implemented? First, old ways die hard. It requires a fair bit of risk-taking to see a new process through to approval on a major program. Without clear and compelling drivers, many novel ideas fail to gain market traction and eventually disappear. One notable exception is resin infusion, which has taken a big share of the wind energy and marine markets. But much of that growth was forced on processors by styrene regulations, not necessarily driven by the promise of improved processing. Of course, now that it is widely practiced, everyone sees the benefits. But that’s hindsight, not foresight. Likewise, rapid-cure thermoset resins and high-speed processing are quickly being developed and are seeing implementation in the automotive industry as composites replace metals. But these, too, are driven by mandates to increase fuel economy and reduce CO2 emissions. Without financial penalties to enforce these regulations, would this be happening?

Resistance to the new is especially prevalent in the aerospace and defense markets. Despite all the discussions about trying to find out-of-autoclave (OOA) solutions and the need for faster, less-expensive processing, actual implementation has been quite slow. Resin transfer molding (RTM) and vacuum infusion developments have been modestly funded for roughly 30 years, but today these processes produce less than 2 percent of the aerospace composites volume. NASA funded a successful infused wing project in the late 1980s; yet only now, on the Bombardier (Dorval, Quebec, Canada) CSeries, is a resin-infused wing headed for qualification on a commercial aircraft platform.

Although they can be consolidated outside the autoclave, thermoplastic composite structures are still few and far between, despite the fact that continuously reinforced material forms have been around for decades. Work with epoxy OOA prepregs has mainly investigated trying to get autoclave properties in an oven with vacuum pressure only, but long cycle times remain, and vacuum debulk times are often extended by hours. That said, a number of small companies around the world have introduced nonautoclave methods of structural composites fabrication that do offer higher production rates, lower tooling costs and lower recurring costs.

But the building block approach to qualification is a years-long process, creating a risk that these companies may cease operations before they see their technology adopted. If large aerospace OEMs and their Tier 1 suppliers were willing to underwrite early stage build-it-and-break-it prototypes, this commercialization cycle could be shortened. Promising technologies could be put on a fast track to qualification, benefitting both inventors and larger entities. Inventors whose developments fall short could pursue less demanding applications or seek other markets.

Even da Vinci, the genius, didn’t get everything right. He failed in trying to divert the flow of the Arno River in Florence, for example, and none of his flying machines ever got off the ground. But his backers supported these failed full-scale endeavors along with his successful ones. More aerospace companies need to take such risks today.

Read more about Fiberforge, its genesis and the pictured seatback project by clicking on "Tailored carbon fiber blanks set to move into steel stamping area," under "Editor's Picks" at top right.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreMaterials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreRead Next

Tailored carbon fiber blanks to move into steel stamping arena

Reduced scrap and cost driving forces behind new technique for automotive industry.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More