Turnkey manufacturing systems: Materials, markets and maturation

Automated production cells promise affordability and less risk in scaling up composites production, but are they really the path forward?

In 2012-2013, “turnkey” integrated manufacturing systems for composite parts were a noticeable trend. Targeting everything from wind blades to aircraft structures to automotive parts, suppliers of production equipment were banding together to offer entire systems to customers. Instead of offering individual machines, these partnerships/coalitions were promising the customer a capability, selling all of the production pieces required as well as the assurance that the desired parts could be made successfully upon installation. So how is this going? Has the trend continued, and are systems up and running?

In fact, integrated manufacturing systems have been fielded and several examples are highlighted in the four Side Stories listed at the end of this article, or alternatively, click on thier titles under "Editor's Picks" at top right). But there is also a wide-ranging debate on this topic, for which the sidebar examples provide additional insight and background in terms of how and why different systems have developed.

Turnkey or not turnkey?

“In my opinion, the industry is moving toward turnkey systems,” says Dieffenbacher North America Inc. (Eppingen, Germany) technology and business development director Matthias Graf. In his experience, “the molder trying different equipment, for example, a different supplier for the press vs. the dosing system vs. the heating and preforming units, then automation is a fifth company to manage? This molder has had to struggle to make it all work together, especially to orchestrate and control the whole line.”

But Peter Egger, director of ENGEL AUSTRIA GmbH Austria’s (Schwertberg) Center for Lightweight Composite Technologies, acknowledges the need for management: “If there is one supplier who ensures that all of the assorted units ‘talk’ to each other, then okay. Some of our customers have done this, but it has taken much time and effort.” Egger notes that developing optimized control for these integrated systems requires an investment on the integrator’s part but in the end will save the customer time. “In a turnkey system, this project engineering must also be done, so you will pay for it either way. The issue is whether you know what this investment will be or are you guessing and assuming risk.”

“The customer knows the total investment up front only if working with one turnkey supplier,” asserts Graf. “And that supplier must fulfill the performance requirements and schedule according to the contract. I think this takes risk away from the customer and provides a labor savings because it is easy to lose 10% over the system price in months of trying to get the line producing parts well.”

Egger adds that purchasing a turnkey solution doesn’t mean customers are settling for less production flexibility than they would get sourcing individual units separately. “These systems can be for one style of part or for many different types of parts, with the system cost varying accordingly,” he says. “That is a decision the customer has to make up front.”

Chantal Wierckx, business development director for turnkey systems provider Composite Alliance Corp. (Dallas, TX, US), goes back to fabricator risk: “If there is a problem in making a part, who accepts the responsibility? Does the moldmaker help or does he say that the press system is the problem?” Turnkey systems eliminate the fingerpointing. “We offer one point of responsibility.”

Sven Torstrick, net-shape RTM team manager at Germany’s national aeronautics and space research agency, DLR (Stade, Germany), and a system user, also sees a trend toward turnkey solutions, noting that equipment suppliers have made a lot of progress, with more such options available. “For example, at the time we began EVo [2009, see the Side Story titled "Automated RTM for aerospace"], FILL Gesellschaft mbH [Gurten, Austria] said that a line like ours would require a lot of development, but now they have most of the technology on offer.” However, he also points out that “since we did not rely on one supplier, we know every screw in the system and have a very good understanding of every subcomponent, how the line works, and where issues are likely to arise. With a turnkey system, that would be different.”

Egger acknowledges the user’s need for this level of knowledge: “We have customers who want to buy each piece separate because they want to keep their know-how in-house, but we also have customers who want to have a complete cell without spending too much effort. We must be ready for both.”

For Erich Fries, head of Krauss-Maffei Corporation (Munich, Germany) composites business unit, there is no real trend. “You either present a simple solution or a turnkey solution,” he says. “We will have a mix of both in the future, based on the customer’s needs. For example, some companies in Asia think they need to use a fully automated system right away, so they opt for turnkey solutions. But there are also small companies that still have labor available, so they choose smaller, less automated systems.” Fries says the bigger question is: What is the market?

Solution must fit the market

“What we see is that the solution depends on the industry and country,” says Fries. He points out that the demand for composites equipment in Germany is slowing after so much investment over the past few years. “Now they must work through the learning curve of what the equipment can do for them and how they can make money.” Fries says other countries, including the US and China, are now seeing the need for composites, so there will be a much bigger push coming from outside Germany in the future. “China is moving ahead very aggressively and will lead in sales and car production for the near future.”

Fries cites Adrian Wilson’s September 2015 report, “Automotive Composites: The make-or-break decade for carbon and natural fibre,” published by Textile Media Services Ltd. (Reepham, Norfolk, UK). Wilson points out that China became the world’s largest car market in 2009 when sales climbed by 45% and production reached 13.6 million units. In 2014, China produced 23.7 million cars and commercial vehicles. “So then, what solutions do we offer to China?” asks Fries. “In Germany, the solutions will always be highly automated because our labor rate is so high,” he observes. “But if you look at China and India, can the market there handle fully automated production or do they need a combination, a way to step into it?” Fries concedes that high production volumes demand more highly automated systems, but contends that, in this context, that really means movement toward injection molding.

Thermoset vs. thermoplastic

Egger at Engel agrees that thermoplastic composites offer the most efficiency for automotive and other high-volume markets, “because you can use injection molding and integrate functionalities via inserts and overmolding.”

Fries adds, “If you go toward injection molding — which is coming for composites — you will go fully automated because you have no time to do manual operations with cycle times below 1-2 minutes.”

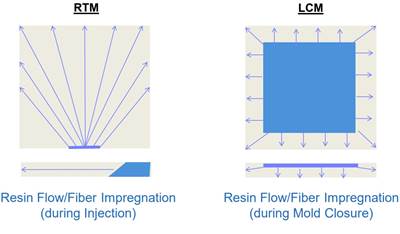

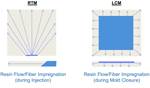

Egger admits, however, that thermoset processes like HP-RTM currently produce the most lightweight part solutions.

“But the only company that is really using RTM for serious production is BMW,” counters Fries. “If you look at the new 7-Series, the cycle time for the composite parts is below 3 minutes. This you can’t do without a fully automated system.”

“It’s clear that everyone is trying to get something out of thermoplastic composites because it offers so many advantages, including recyclability,” says Egger. “Thermoplastic composites will go to the next level to be competitive, but this will take time.” He thinks both injection molding and HP-RTM will remain for some time because they offer different advantages in the marketplace. “I think thermoplastics will win out eventually, especially if the technology can be developed to achieve lightweight structures like with thermosets, but some manufacturers will always stay with thermosets, and some will always stay with metals.”

Egger points out, however, that widespread success with composites in the automotive industry is yet to be seen. “It is still very much in development.”

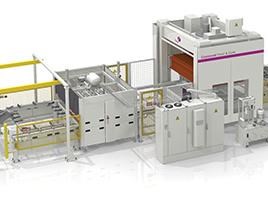

Compression molding machine supplier Pinette Emidecau Industries (PEI, Chalon-sur-Saône, France) also sees thermoplastics as more viable long-term vs. RTM, and is pushing development of its new Quilted Stratum Process (QSP) in that direction.

“There is no cure cycle with thermoplastics,” says North America business development manager Andrew Rypkema. “QSP uses automated ply stacking to build preforms and then forms them, but with very efficient patented technology for heating the preform.” Rypkema says the transfer operations are also innovative and the forming process enables overmolding in the press for local reinforcement.

Indeed, the potential of thermoplastic composites processing has been demonstrated in brake pedals for the Porsche 918 Spyder. The glass fiber/nylon 6 composite with compatible short fiber-filled overmolding was made using a two-part process, and it cut part weight by 30% vs. steel while matching metal’s functionality after 320,000 cycles at 3,000N load cycling between -35°C and 80°C. Although the program was low volume (a 918-vehicle limited production run), Egger notes, “it is real production and a success.” Moreover, it is just one of the many new technologies that have been trialed by Porsche on the 918 for refinement into future vehicles. These structural parts are where Engel sees the highest value for composites.

Production viability and development

Regardless of the material system or cycle time, getting automated composites manufacturing systems into full-scale production requires significant development. “One automotive OEM I’ve spoken with is frustrated,” says Rypkema, “because it seems the composites industry wants the OEM to bear the brunt of the cost to develop tooling, materials and process.” He notes that PEI has had interest from many automotive Tier 1 suppliers and OEMs, all looking for technology that is viable in a production environment and sufficiently low in cost. “The OEMs need the advantages of composites, but they’re not going to fund Tier 1 science projects,” he points out. This massive development doesn’t fit into their cost model for the current vehicles in pre-production.

“We cannot just deliver equipment and say, ‘Here it is,’ but not know how to make a part,” explains Graf. “We need to fully understand the process and material requirements,” he adds. Along these lines, the Fraunhofer Institute for Chemical Technology (ICT)(ICT, Pfinztal, Germany) and Dieffenbacher have had a cooperation agreement for 15 years. “We heavily engage in process development and collaborate intensely with Fraunhofer to strengthen our approach. They perform the research,” Graf explains, including, “what materials to use and how to set the process parameters to make a good part.”

Simply put, suppliers of integrated systems for auto applications must learn how to make parts. “In the automotive world this is called design for manufacture,” contends Dan Allman, director product strategy and development at Fives Cincinnati (Fives Cincinnati, Hebron, KY, US). He points out that some parts previously made with SMC cannot be made with continuous fiber without some development work. “Continuous fiber materials and conversion processes require a different design approach,” Allman says. “So we are going through this process now, looking at various parts that OEMs and suppliers want to convert to continuous fiber and seeing how they must be re-engineered.”

According to chief technology officer Yannick Leprêtre, Fives Group is assembling a composites technology and demonstration center at Fives Cincinnati in Hebron that will reportedly enable process development and demonstrations for the automotive, aerospace and wind industries. “The center will feature our automated tape and fiber placement capabilities, as well as cutting and machining and robotic-based conversion processes,” says Allman. “There are not many places the industry can go to do full-scale prototyping work for process development.”

Engel has its own R&D facility, the Technology Center for Lightweight Composites in St. Valentin, Austria, which opened in 2012. “Our goal is to find the best overall solution,” says head of project development Matthias Mayr. Engel runs part trials on the center’s HP-RTM, organomelt, injection molding and in-situ polymerization equipment, and also helps customers find other, more appropriate solutions, if necessary.

KraussMaffei’s Composites Technical Center opened in Munich in 2011, adjacent to its injection molding tech center. “You can see and run all of our composite technology, from thermoplastic to thermoset, with all of the machines in one place,” says Fries.

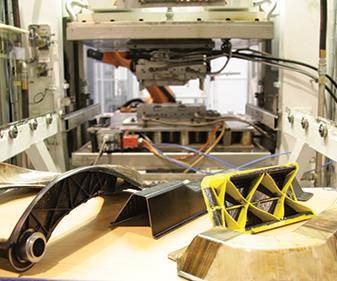

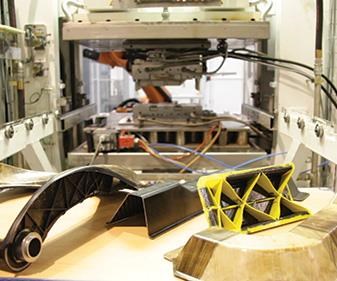

DLR’s EVo line was built for process development. “The goal of the machinery is not to produce parts but to see if different technologies work better or worse in an industrialized automated production environment,” says Torstrick. “It’s also to see if automation is always best, or if it is better to use manual operations for some steps. We are trialing different vacuum grippers, cutting technologies and methods for RTM heating. We are also running the process to investigate different alternatives for optimization, for example, part quality is key for aerospace but speed and low cost are more essential for automotive.”

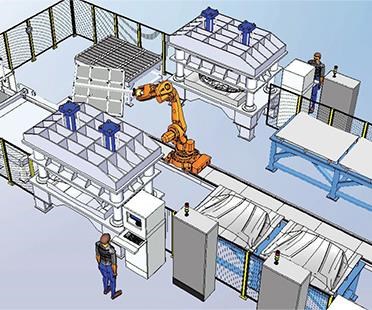

Composite Alliance stresses simulation. “There is the possibility to reduce the investment cost if you do production flow simulation first,” says Wierckx. On work for a customer in France, for example, as the latter started to plan production for a high-rate aerospace component, “originally, the line called for 30 RTM presses,” says Wierckx, “but thanks to our simulation work, we could reduce this to 23 presses and still meet all of their requirements.”

Wierckx notes that it is important to optimize automated systems for lean manufacturing, adding, “How are the different elements connected to each other? What is the optimal placement for workflow?” She claims this is another benefit of a systems integrator with years of experience like Composite Alliance’s majority partner, Techni Modul Engineering (Coudes, France), “We’re not locked into any one type of equipment, but instead look to optimize the process and lower the part cost.”

Signals on the road ahead

The way forward? KraussMaffei sees increased interest in thermoplastics. “We are getting more and more inquiries about injection molded composites, but it is still in development,” says Fries. “The first fully automated lines will be installed in 2016, and then the market will understand what this type of system can do.” He adds that, for thermoplastic composites, “It’s like what we’ve seen with BMW, where the automotive industry wanted to see if composites would work.” Now, the rest of the industry is willing to take it seriously. “But composites is still very young,” concedes Fries, “We have only five years of experience in serial production in some fields. This is very young for the automotive industry.”

For others, systems will be a mix. In the 2015 issue of Dieffenbacher’s publication Presses and More: Composites, head of sales Dr. Florian Luginger says that the Asian automotive industry is not just showing an interest in the company’s lightweight composites technology, but also investing in it. He notes increased demand from North America as well, aided by Dieffenbacher’s close cooperation with the Fraunhofer Project Center (London, ON, Canada). Luginger also sees a resurgence in SMC and LFT while new processes like wet compression molding offer a fully automated but more economical approach, currently in production at BMW for the 7-Series roof frames and other structures.

Although Composite Alliance has supplied thermoplastic and thermoset composite systems, as well as integrated systems for automotive, it sees a near-term need for automated prepreg systems for aerospace. “We have added ‘intelligent automation’ to dry preform production for RTM,” says Wierckx, “where robots pick and place plies, but also control positioning and check fiber orientation via visual control systems. But we also have robots that can pick and fold plies, placing them into a 3D shape, and we are extending this to prepreg systems because we see that the industry is struggling to meet the production rates required for the current backlog of aircraft.”

And customers also will include material suppliers. Egger notes that Engel has supplied a machine equipped with an oven and automation for thermoplastic composite parts to SABIC Innovative Plastics (Pittsfield, MA, US). “It’s important that they work with the process themselves to get the materials right for production,” he explains. Engel has also delivered a lab unit to Bond-Laminates GmbH, a division of LANXESS Corporation (Cologne, Germany). “So this is an indicator,” says Egger. “Many requests about thermoplastic composites systems are starting, and there are real projects coming up, working with fabrics.”

Why does this signal the path forward for integrated systems? “We have to make composites technology as simple as we can and as manageable as we can for future workers,” says Fries. “Simple and efficient is what injection molding is all about.” Egger notes that Engel, Dieffenbacher and KraussMaffei all have shown integrated turnkey systems since 2010, both thermoplastic and thermoset processes. “Now, it seems as though the business will really begin.”

Related Content

Braskem demonstrates PP solutions using Weav3D composite lattice technology

Partnership combines Braskem’s polypropylene sheets with Weav3D Rebar for Plastics technology to address new structural, automotive applications requiring high-strength, lightweight material solutions.

Read MoreCAMX 2022 exhibit preview: Bally Ribbon Mills

Bally Ribbon Mills’ highlights its capabilities in design and manufacture of woven structural shapes for hybrid composite structures used in aerospace applications.

Read MoreBiteam introduces 3D Noodle International AB spin-off for 3D fabric noodles

Biteam 3D’s third spin-off implements its proprietary 3D weaving technology to produce a variety of carbon, ceramic and other fiber 3D fabric noodle preforms.

Read More3D weaving capabilities achieve complex shapes, reduce weight and cost

JEC World 2024: Bally Ribbon Mills is displaying film-infused 3D woven joints, woven thermal protection systems (TPS) and woven composite 3D structures.

Read MoreRead Next

Turnkey manufacturing systems: Automated RTM for aerospace

German Aerospace Center’s (DLR) Center for Lightweight Production Technology site in Stade, Germany, has developed EVo, an automated production line capable of 100,000 complex composite parts/yr.

Read MoreWet compression molding

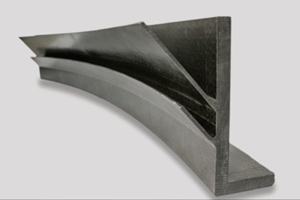

Automated process cuts cycle time and cost for CFRP parts with potential for 65% fiber volume via Dynamic Fluid Compression Molding variant.

Read MoreTurnkey manufacturing systems: Part-per-minute thermoplastic composites

Pinette Emidecau Industries’ (PEI, Chalon-sur-Saône, France) leads a consortium of providers that are collaborating on the Quilted Stratum Process (QSP), a means to accelerate thermoplastic composites processing in the auto industry.

Read More

.jpg;maxWidth=300;quality=90)