Thermoplastic Composites Making An Impact

Product/process developments accelerate use of long-fiber-reinforced thermoplastics in automotive and industrial markets.

The new 2003 Mazda 6 mid-size sports sedan features eye-catching styling and a high-performance power train. Built in the U.S. on an entirely new platform, the Mazda 6 also incorporates the first injection molded front-end modules and door modules produced in North America. The 3.5 kg/7.7 lb front-end module holds the radiator and associated components, the fan assembly and the hood latch; the 1.1 kg/2.3 lb door modules support speakers, latch assemblies, door lock actuators and window regulators. Lighter and less expensive than traditional stamped steel or compression molded plastic designs, the parts are the result of refinements in the injection process and a specially formulated material that meets part processing and structural requirements. Mazda specified Verton MFX, a 40 percent long-glass-reinforced compound from LNP Engineering Plastics (Exton, Pa., U.S.A.), which incorporates a low-viscosity polypropylene resin, permitting the molding of large, thin parts with high structural characteristics. The front-end module is injection molded by DDM Plastics Inc. (Tillsonberg, Ontario, Canada), and the door modules are injection compression molded by Automold of America Inc. (Auburn Hills, Mich., U.S.A.).

In the search for materials that cut mass and cost while providing improved performance, design engineers are increasingly turning to long-fiber-reinforced thermoplastics (LFRTs). Available in several forms, LFRTs contain reinforcement fiber lengths of 10 mm/0.4 inch and longer, compared to traditional glass-reinforced thermoplastic compounds that contain milled or short (less than 6 mm/0.25 inch) fibers.

The longer reinforcement, with typical loadings of 30 to 50 percent by weight, provides a significant increase in impact strength and flexural modulus — up to twice that of short fiber compounds with the same fiber percentage. With these advantages, LFRT materials are seeing increased use in structural and semi-structural applications traditionally reserved for metals and thermoset composites. Across the automotive industry, LFRT technology is being used in underbody shielding, front-end structures, seat shells, bumper beams, headliners, battery trays, gear shift housings and, more recently, door inner panels. Industrial and consumer products that incorporate LFRTs include pumps, office furniture, all-terrain vehicle components, and structural frames of business machines. To date, the greater shrinkage of the thermoplastic resin prevents LFRT use in Class A automotive or other high-gloss applications, but they are suitable where a grained or textured surface is either acceptable or desired.

Global usage estimates of LFRT for 2002 range from 250 million to 300 million lb, well below traditional sheet molding compound (SMC) use. However, growth rates through 2005 are forecast between 10 and 20 percent per year, driven largely by the automotive market, which accounts for approximately 75 percent of LFRT production. Sheet forms, also called glass mat thermoplastic (GMT), were the first to become commercially available and hold the largest market share, but injection-moldable long pellets are replacing GMT in some applications and now show a faster growth rate. The introduction of direct compounding and molding, bypassing the traditional compound supplier, provides opportunities for further cost reduction. This latter technology is attracting considerable interest, particularly among high-volume automotive suppliers.

Polypropylene, on the strength of attractive economics, easy processing and a good balance of properties, is the major resin used in LFRT, representing more than 70 percent of consumption. While fiberglass remains the dominant reinforcement in LFRTs, thermoplastics with alternate fibers, including carbon, stainless steel, and natural materials like flax and sisal, are finding applications as well.

High market growth rates and an increasing focus on weight reduction have spurred a number of developments in long-fiber-reinforced thermoplastics, attracting new suppliers of materials and processing equipment. This article looks at the current supply base with a focus on recent advancements in LFRT technology.

NEW GMTs RESPOND TO COST CHALLENGES

The introduction of GMT in the late 1970s was well funded and well marketed. Azdel, the first commercial product developed by PPG Industries Inc. (Pittsburgh, Pa., U.S.A.) and today supplied by Azdel Inc. (Shelby, N.C., U.S.A.), a 50/50 joint venture of PPG and GE Plastics (Pittsfield, Mass., U.S.A.), was priced, accounting for its lower density, about the same as SMC, a technology that was well understood at the time. GMT can be molded in SMC-like molds, using SMC presses, yet is processed in chilled molds (the GMT sheets are heated to their melting point in infrared ovens before pressing), rather than the heated molds that SMC uses.

In general, GMT parts are lighter and more damage resistant than SMC, and lower in cost, due to shorter molding cycle times. Molded scrap can be recycled with fresh material into new parts. The polypropylene resin used for these applications has sufficient strength and stiffness for automotive applications up to 120∫C/248∫F, which covers most of the vehicle in normal operation. Higher temperature PET versions of Azdel have been developed, but their premium cost compared to SMC has limited their use to only a few percent of the GMT market.

The market for GMT, of which automotive represents 95 percent, has grown rapidly, with significant consumption in bumper beams and load floors helping to boost the market in North America. In Europe, German automakers use GMT in many components, such as front-end modules, replacing multipiece welded steel and SMC versions. Underbody noise shields of GMT have become standard on upscale vehicles produced in Europe. Automated molding and finishing systems, developed by Dieffenbacher North America Inc. (Eppingen, Germany) and others, have further reduced manufacturing costs. Industry consolidation since 1997 has resulted in a market dominated by two major material suppliers — Azdel, and Quadrant Plastic Products AG (Lenzburg, Switzerland). Both provide a wide range of standard and custom GMT products, with fiber contents ranging from 20 to 55 percent.

Most GMT used for structural applications is produced by a melt consolidation process, in which alternating layers of polypropylene film and randomly oriented fiberglass mat (continuous strand or chopped) are combined under pressure and temperature in a double-belt laminator, chilled, then slit and sheeted to the desired size. Fiber lengths are typically 25 mm/1 inch, although longer lengths are possible, up to and including continuous unidirectional products. Because GMT parts are compression molded, little fiber breakage occurs, resulting in the highest stiffness and impact properties among the various LFRT processes.

GMT suppliers have faced challenges. There is cost competition from injection molded LFRT pellets, which greatly reduce trim scrap and secondary operations on complex parts like front-end modules. Additionally, integrated compounding and molding equipment eliminates the intermediate compounder entirely. These factors have pushed GMT suppliers into development of new products with more unique properties or lower cost. Azdel, for instance, has introduced several grades of Azdel SuperLite, aimed at large, less structurally demanding parts like headliners, door trim and sunshades. Reinforced with either 42 or 55 percent chopped fiberglass, the product is manufactured using an aqueous foam process similar to papermaking (the foam, which dissipates, serves to keep fibers and resin particles fully suspended before being deposited on the drying belt). Glass fibers, polypropylene and additives are mixed into the foam and dispersed over a continuous belt. Vacuum, combined with dryers and heaters, removes moisture and melts the resin, followed by roller consolidation, cooling and sheeting. Designed to be molded using the low-cost thermoforming process, the SuperLite sheets are combined with adhesive films and fabrics to produce lightweight, stiff panels in a single step.

Quadrant also has developed a lightweight GMT targeted at similar auto industry applications, notes North American sales manager Gerald Battino. Produced using a dry process, Quadrant's SymaLite material has been specified for an underbody shield for a BMW model, starting in 2003. The thermoformed shield is a sandwich structure, in which unreinforced polypropylene sheets surround the SymaLite GMT material. To meet growing demand for the product, Battino says Quadrant is installing a new production line, slated to begin operation mid-2003.

Both Azdel and Quadrant have increased efforts to develop products for highly loaded structural automotive parts. For a number of years, Azdel has produced bumper beams with traditional "C" shaped reinforcements. However, this shape is no longer competitive with "I" shaped steel beams used in bumpers. Working with Continental Structural Plastics (Southfield, Mich., U.S.A.) on the tooling and processing techniques, Azdel developed a cost-competitive product to use in I-beam applications, using Azdel Laminate C467, a 45 percent chopped glass GMT. The result is a beam that weighs 35 percent less and costs 20 percent less than the roll-formed steel beam, which requires welded mounting stays. First introduced on the rear bumper of the 1999 Mitsubishi Galant, the Azdel beam has achieved additional commercial success, including the 2002 Nissan Altima. Fred Deans, manager of advanced business for Continental Structural Plastics, projects "the next frontier for high-performance GMT is in critical chassis structure, like frame rails and transmission supports."

Quadrant's GMTex is a sandwich of traditional GMT surrounding woven fabrics of Twintex commingled polypropylene/glass fibers from Saint-Gobain Vetrotex International (Chambery, France). Introduced in the center of the laminate, the fabric becomes fully consolidated in the double-belt press during the production of the GMT. During the compression molding process, the fabric remains in the areas where additional structural stiffness is required, and the GMT flows into corners, ribs and bosses. The rear hatchback door of a new Nissan vehicle produced in Japan is taking advantage of this design flexibility, using the GMTex in the areas of higher loading, around the latch and hinges. Conventional GMT is used throughout the rest of the inner panel. Molded with a textured surface visible to the customer, the thermoplastic part supports fabric trim panels and other hardware. Additional commercial successes to date have included a spare-wheel pan for the Mercedes S Class (replacing stamped steel), a bumper beam for the Peugeot 806 (eliminating steel brackets), and a highly loaded rear-axle subframe support for the Volvo V70 4WD (replacing aluminum).

LONG-FIBER PELLETS DELIVER PROCESSING SPEED AND FLEXIBILITY

In the early 1980s, the first commercial long-fiber-reinforced thermoplastic pellets were introduced by Polymer Composites Inc. (Winona, Minn., U.S.A.), now part of Ticona (Summit, N.J., U.S.A.), and by LNP Engineering Plastics. Developed for use in the widely practiced injection molding process, the pellets today offer a degree of flexibility not available with GMT materials, especially with respect to resin selection. The pourable pellets are 10- to 12.5-mm/0.4- to 0.5-inch long, and can have fiber content ranging from 30 to 60 percent, with 40 percent the most common. To avoid excessive fiber breakage and maximize mechanical properties, pellet suppliers recommend several changes to the injection molding process, including higher melt temperatures, low-compression-ratio screw designs, larger injection gates and slower injection speeds.

Most LFRT pellets are produced by a melt pultrusion process, in which the reinforcing fibers are pulled through an impregnation chamber where the filaments are coated by molten resin supplied by an attached extruder, then pulled through metering dies, cooled and chopped to the desired length. Complete wetout of the fiber bundles at this stage is critical if molders are to attain uniform properties and good cosmetics in finished parts.

LNP has recently added several new products to its traditional base of glass-reinforced polypropylene, nylon 6/6 and polyphthalamide (PPA) resins. Verton AF is a combination of long glass and Cyclolac ABS resin, supplied by parent company GE Plastics (who purchased LNP in 2001). The material, aimed at applications in automotive interiors, furniture frames and structural housings, provides up to 48 percent higher stiffness than similarly loaded polypropylene without loss of impact strength.

Targeting improved surface appearance, Verton Nylon 6 is described by LNP as the industry's first "structural aesthetic" LFRT. Developed for applications where color is an important factor, the product incorporates LNP's special pigments, which do not reduce mechanical properties. Conventional color concentrates reduce tensile strengths as much as 30 percent and impact strength as much as 70 percent, explains Matt Miklos, global Verton business leader for LNP. Steelcase's Cachet chairs feature 35 percent LFRT nylon 6 in their hollow tubular frames, produced by gas-assist injection molding. The chairs' legs are injection molded from a colored 50 percent long-glass nylon 6 compound that requires no painting.

In conjunction with Saint-Gobain Vetrotex America (Valley Forge, Pa., U.S.A.), LNP is offering Verton MTX, a fully consolidated Twintex pellet with 75 percent glass. Available in 13-mm/0.5-inch and 25-mm/1-inch lengths, the MTX pellets are designed for blending with neat polypropylene pellets at the injection machine. This permits the molder to customize glass loading levels and reduce material cost by as much as 20 percent.

Ticona produces Celstran LFRT from glass, carbon, aramid and stainless steel fibers and a wide variety of resins, including polyethylene, polypropylene, nylon, acetal, PPS and polyesters. The company recently added polybutylene terephthalate (PBT) grades with 30, 40 and 50 percent long glass fiber, and a grade reinforced with a 50 percent loading of carbon fiber. Ticona expects the materials to be employed in automotive underhood applications where long-fiber polypropylene and short-fiber PBT fall short on mechanical performance, and as a substitute for nylon-based LFRT.

StaMax is a Netherlands-based joint venture between DSM N.V. (Heerlen, The Netherlands) and Owens Corning (Toledo, Ohio, U.S.A.). Based on polypropylene and using a wire coating production process, the StaMax P line of LFRT compounds includes grades with 20, 30, 40 and 60 percent glass, the latter for blending with neat resin. According to Maria Ciliberti, commercial leader for StaMax, the wire coating process offers production speeds three to five times as fast as melt pultrusion, with much lower capital investment than GMT, yielding a product with lower cost than competitive materials. Focusing on automotive applications, high-volume commercial successes include under body shields for the BMW 7 series, the front-end module for the BMW Mini and door modules for the Ford Fiesta. Ciliberti states that the new Porsche Cayenne and Volkswagen Touareg sport wagons feature injection-molded StaMax front-end modules, designed for sufficient strength without the traditional metal inserts.

RTP Company (Winona, Minn., U.S.A.) produces glass-reinforced LFRT compounds in a wide range of resins, including polypropylene, PBT, PPS and PEEK. RTP has developed its line of Advanced Fiber Compounds to bridge the price/performance gap between short-fiber materials and traditional LFRT. Produced using a proprietary extrusion compounding process, pellet lengths are similar to RTP's melt pultrusion products, with cost savings as great as 20 percent.

Montsinger Technologies Inc. (Matthews, N.C., U.S.A.) produces LFRT pellets by melt pultrusion, with enhancements to expand the range of polymers and reinforcements. The company's patented manufacturing process for ThermoStran uses a counter rotating die, which creates shear that reduces resin viscosity, improving fiber wetout. While MTI's principal volumes are in glass-reinforced polypropylene and nylon, the company also supplies specialty products made with higher performing PET, PPS, polyetherimide, polyethersulfone and PEEK resins. Wear-resistant grades using aramid or carbon fiber, and conductive compounds with carbon fiber and stainless steel reinforcement fill very specific application requirements.

Although long-fiber pellets have traditionally been designed for injection molding, most of the pellet compounders also supply even longer fiber grades suitable for compression molding. Typically supplied in 25-mm/1-inch lengths, the pellets are fed to a reciprocating-screw plasticizing machine, which gently melts the compound, producing a molten slug or preform ready for compression molding. C.A. Lawton Co. (Green Bay, Wis., U.S.A.) supplies plasticizers, compression presses and conveying equipment designed specifically for these materials. The products are targeted at higher cost GMT applications such as noise shields and spare-tire covers, where high impact resistance is desired, but the parts are simple enough for economical compression molding. Working in conjunction with DaimlerChrysler (Stuttgart, Germany), Ticona's Kelsterbach, Germany facility is supplying Compel polypropylene LFRT to molder HP Pelzer (Troy, Mich., U.S.A.) and its European affiliates for the production of a "belly pan" for new diesel engine models of the European PT Cruiser. The 3-mm/0.125-inch thick compression molded panel, which attaches beneath the engine to seal off noise that echoes off the road surface, outperforms SMC in impact tests, and is resistant to various automotive fluids (gasoline, oil and antifreeze).

IN-LINE COMPOUNDING COMES OF AGE

After melt pultrusion and screw plastification/compression molding, the next logical step in LFRT technology was to couple the compounding and molding steps into a single line, eliminating the offline compounding step. When raw glass and resin can be fed into one end of the machine, and molded parts can be pulled off the other end, raw material costs are reduced and the polymers see only a single heat cycle, reducing resin degradation and thereby improving properties.

CPI Binani Inc. (Winona, Minn., U.S.A.) introduced the first direct long-fiber thermoplastic (D-LFT) compounding and molding system in 1991. Developed by CPI president Ron Hawley (who earlier invented the Celstran melt pultrusion process used today by Ticona), the CPI D-LFT process uses a single-screw extruder to melt mix the resin (polypropylene or nylon) and additives and feed the mixture into a second extruder, where it is combined with preheated 12- to 50-mm/0.5- to 2.0-inch chopped glass. The screw of the second extruder is designed to achieve effective wetout of the fiber with minimal breakage. The resin/glass mixture is extruded continuously into an accumulator, which forms molten preforms ready for compression or transfer molding.

Some of the commercial parts produced by CPI include the door surrounds and soft-top header for the Jeep Wrangler, seat backs for a pickup truck and components for Herman Miller office furniture. Molded part cycle times range from 45 to 70 seconds, with part weights ranging from 1.0 to 15 kg/2.2 to 33 lb. The CPI system is capable of continuously compounding 1,100 kg/2,420 lb per hour. In Europe, Volvo has licensed the CPI technology for production of the front-end module of its V70. In 2001, Decoma International Inc. (Concord, Ontario, Canada) licensed the process for the production of running boards and similar exterior trim products.

Dieffenbacher has developed a highly automated D-LFT compression system, now used in Europe by Tier 1 automotive suppliers for high-volume production of front-end carriers and underbody noise shields. Named the Dieffenbacher Direct Process, the system uses a single-screw extruder to melt and combine the resin and additives. The mix is fed to a twin-screw extruder, where it is compounded with preheated roving. A specially designed screw element cuts the fibers to the desired length, which can be adjusted from 20 to 60 mm/0.8 to 2.4 inches, stresses Manfred Bruemmer, North American sales manager for Dieffenbacher. The finished compound is fed onto a conveyer where it is cut to the proper charge weight and robotically transferred to the mold. Bruemmer says the system can produce 30 percent glass-loaded compound at a rate of 900 kg/2,000 lb per hour. Cycle times for parts of 1.8-mm/0.07-inch thickness average 20 seconds.

D-LFT is not limited to compression molding. At least two injection molding systems have been developed and have entered production. Krauss-Maffei (Munich, Germany) has married a twin-screw compounding extruder with an injection machine. The continuously running extruder feeds an accumulator, which supplies molten LFRT to a plunger-type injection cylinder. As of late 2002, Krauss-Maffei had delivered three D-LFT injection systems to French molder Faurecia for use in the production of automotive front-end modules.

Woodshed Technologies (Winona, Minn., U.S.A.) — another company started by Ron Hawley — has developed a direct compounding system that can be retrofitted to conventional injection machines. A small extruder melts the resin and feeds it into a long die, where it is combined with glass rovings. The flow of the resin pulls the fibers along the die to the exit, where the impregnated rovings are cut to length and fed directly to the throat of the injection machine. Hawley emphasizes that this technology targets shot sizes ranging from a few ounces to a pound or so, a sharp contrast to the D-LFT compression system developed by CPI. Its smaller size will make it much less expensive to install. Hawley says Woodshed will mold no parts, preferring instead to license the technology to molders. CPI is the first licensee and is in early production of an unspecified marine component in long glass polypropylene, replacing stainless steel.

MULTIPLE OPTIONS, MANY OPPORTUNITIES

LFRT suppliers are convinced that the market for their product has considerable room to grow. Ciliberti believes that, in the automotive segment, the North American market lags behind Europe considerably, but is definitely ripe for the technology. Continental's Deans forecasts that many of the applications developed in Europe will eventually be adopted by North American automakers. Whether one LFRT technology will establish dominance remains a question, but CPI's Hawley says the potential market is large and diverse enough to support multiple technologies.

In-line compounding technologies are attractive from a material cost standpoint, but the technology has been developed primarily for polypropylene, and has yet to be fully proven for more difficult-to-process molding resins. Such lines are expensive, too, with the cost of a compounding system alone approaching $1 million (USD). A fully configured cell, complete with a 2,500-ton compression press, compounding unit and robotics for handling and trimming the parts is estimated at $4 million to $6 million. Most of the suppliers agree that D-LFT systems make sense where very high volumes, little variation in formulation and long part life cycles are part of the equation.

Highly loaded structural components will likely remain in GMT, and the economics of injection molding will provide increased opportunities for LFRT pellets in both automotive and non-automotive applications. However it all shakes out, it will be exciting to watch.

Related Content

Composite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreThe making of carbon fiber

A look at the process by which precursor becomes carbon fiber through a careful (and mostly proprietary) manipulation of temperature and tension.

Read MoreMaterials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

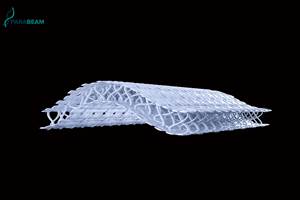

Read MoreCAMX 2022 exhibit preview: Parabeam

Parabeam’s 3D E-glass woven fabrics, particularly ParaGlass and ParaTank, continue to advance composite sandwich structures with high flexibility, strength and application versatility.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)