The promise of composites in automotive

The composites industry has for many years fervently sought a place at the high-volume automotive table. Now that that place appears set — thanks to unprecedented demand for vehicle lightweighting — the industry can’t help but wonder if the opportunity is a serious and sustainable one. Is this really the chance that’s been hoped for?

The composites industry has for many years fervently sought a place at the high-volume automotive table. Now that that place appears set — thanks to unprecedented demand for vehicle lightweighting — the industry can’t help but wonder if the opportunity is a serious and sustainable one. Is this really the chance that’s been hoped for?

The short answer is that it’s too soon to tell. The long answer is that it depends on several variables that are still unsolved. It depends on the automotive OEMs and what path they choose to reduce vehicle weight. And it depends on the composites industry and how quickly it can develop quality and process control systems that meet the needs of the automotive industry. And it depends on composites industry suppliers being able to supply the resins and fiber forms that allow truly high-volume composites fabrication.

Whatever happens, it’s apparent that use of carbon and glass fiber in automotive structures is increasing. What’s unknown is just how much and where these composites will be used.

Enablers

With Corporate Average Fuel Economy (CAFE) requirements ratcheting up in the United States toward 50 mpg by 2025, and with vehicle emissions requirements getting more restrictive in Europe, automakers in general see vehicle lightweighting as one major way to remain in compliance. Every 100 lb/45 kg of mass reduction in a car increases fuel efficiency 2 to 3 percent, and when overall mass is reduced, automakers can downsize other components, including the engine, transmission, brakes, suspension, batteries, etc.

Carbon fiber, as is well known, offers many advantages over steel or aluminum — light weight, high strength, durability, weatherability. The use of different fiber forms whose layup is optimized with fast-evolving design software packages provides a material that can meet many automotive structural and semi-structural requirements.

In the meantime, resin matrix manufacturers have worked quickly to develop epoxy systems that are tantalizingly close to the 60-second cure threshold the automotive industry has long demanded for high-volume vehicle manufacturing. Dow Automotive, Momentive, Cytec and Huntsman each have introduced epoxy matrix resin systems in the last 18 months that offer a 90-second cure cycle, with promises of 60 seconds in the near future.

Thermoplastics are getting serious consideration as well, thanks primarily to their ease of processing and recyclability. Carbon fiber manufacturer Teijin is working in a joint venture with General Motors (GM) on a thermoplastic composites manufacturing process to make automotive parts in less than 60 seconds. Neither GM nor Teijin is talking about the process, but reliable reports from within the industry indicate that the companies are at or near 60 seconds per cycle and that parts from the process may appear on a 2015 or 2016 model year car.

Suppliers on the process and machinery side have not been sitting still either. The processes gaining the most favor right now are high-pressure resin transfer molding (HP-RTM) and compression molding, and suppliers in each area have developed partnerships to integrate press and injection technology to provide customers turnkey manufacturing systems. Active players here include Dieffenbacher (presses), KraussMaffei (RTM injection), Schuler (presses), Isojet (RTM injection), Cannon (presses), Pinette Emidecau (presses) and several more. The goal has been to develop high-speed systems that offer the quality and process control required of the automotive supply chain.

To date, few automakers have embraced carbon fiber composites as thoroughly as BMW has. It’s new all-electric i3 passenger car features a carbon fiber passenger cell — dubbed the Life Module — fabricated via preformed carbon fiber layups and then molded on Schuler presses using a KraussMaffei HP-RTM system. It’s cycle time is reported by BMW to be “less than 10 minutes” using a Huntsman Araldite epoxy matrix resin.

Hurdles

Despite the advantages that composites offer automakers, there are still several hurdles to clear. The first is cost. Carbon fiber composites cost about 10 times more expensive to manufacture than aluminum and magnesium, and it’s even more costly than high-strength steels. The automotive industry has long demanded that carbon fiber cost must come down to $5/lb in order to make it viable for carmaking.

Indeed, Lux Research, at the CompositesWorld’s 2013 Carbon Fiber conference, estimated that advances in carbon fiber precursor and manufacturing technology likely will bring some grades of carbon fiber down to about $5/lb by 2017. But even this might not be enough.

At the same conference, Patrick Blanchard, technical leader, Composites Group at Ford Motor Co. Research & Advanced Engineering, noted that Ford research shows that consumers are not concerned about vehicle weight. They are most concerned with vehicle handling and braking and safety. Although vehicle weight affects these things, he said, weight by itself is unimportant. He claimed that powertrain advances that involve hybrid electric and plug-in electric technologies alone will enable Ford and other OEMs to meet CAFE targets. Reductions in vehicle weight, he argued, will extend the range of high-efficiency cars, but weight elimination is not necessary to increase efficiency. That said, he did note that weight is an issue, because new customer features in cars and trucks, since 1998, have added 17 lb/year to each new car model and 43 lb/year to each new truck model. Ford, Blanchard noted, is looking at aluminum and lightweight steel to help trim mass (Ford subsequently announced that its newest Ford F-150 pickup truck would use an aluminum frame). These "legacy" materials, he explained, fit best with Ford's manufacturing systems, which of course favor metals.

By comparison, carbon fiber composites, Blanchard noted, are lacking in several respects: Their production processes are not scalable to auto OEM volumes. Design and CAE tools need improvement. Robust repair technologies are not yet available. An adequate fiber supply is not yet in evidence. And carbon composite are not yet proven to be compatible with vehicle painting processes. Blanchard also noted that Ford has 39 assembly plants, globally, which produce 7 million vehicles per year. Reconfiguring those plants to accommodate carbon fiber manufacture, he claimed, would be prohibitively expensive. Nevertheless, he did say that he thinks composites usage in automotive has a future, particularly in multimaterial applications, but he made clear that carbon fiber use at Ford is not a foregone conclusion.

Finally, carbon fiber faces recycling challenges. Although there are firms that recycle carbon fiber composites, including Materials Innovations Technologies in the U.S., there is not a well-developed recycling market that can absorb the large amounts of composites that might come out of the automotive market. Regulations in Europe in particular put strict requirements on end-of-life recycling of cars and trucks and there is some doubt about composites being able to meet those standards.

Predictions/Possibilities

Hurdles aside, the level of activity in automotive composites guarantees that carbon fiber will see increased use in this market for many years. Carbon fiber makers Toray, Teijin, SGL, Zoltek, Toho Tenax and DowAksa are all working alone or with others to develop materials and processes for automotive composites. SABIC, Dow, Momentive, Huntsman, Cytec and others are pursuing materials options as well. The question is, where on the volume scale will composites use settle?

Chris Red, principle of Composites Forecasts and Consulting LLC, says, “Despite the recent advent of snap-curing thermoset resins, less costly out-of-autoclave processing and the alternative of thermoplastic matrices, which have driven down cycle times from eight hours or more to about 10 minutes, cycle times still limit CFRP’s uses to models produced in volumes of 40,000 or fewer vehicles per year . . . and sold at a price in excess of $60,000.” The exception to this statement, he notes, would be the BMW i3, which retails for about $41,000.

Even the application of composites in the 40,000 units per year range is a significant increase for a material that’s been most used in high-end, low-volume sports and luxury cars. This then begs the question about how the composites industry might supply high-quality parts at such a relatively high volume.

The BMW model relies on capturing the entire supply chain, from carbon fiber precursor production through carbon fiber manufacture to fiber weaving, cutting, kitting, preforming, molding and vehicle assembly. Other carmakers, however, particularly in the U.S., rely on a tiered network of parts suppliers, many of which don’t manufacture carbon fiber parts. Further, only a few of the Tier 1 suppliers have any history with composites — Continental Structural Plastics, Magna and Faurecia among them. If an automaker wants to increase use of composites and wants to continue to rely on its traditional tiered suppliers, then composites processing knowledge will have to be transferred to the automotive supply chain somehow, either by merger, acquisition, licensing or organically. In any case, the automotive supply chain has a learning curve to climb as it comes to know and love composite materials and processes. Similarly, composites fabricators have a learning curve to climb as they come to know and love the demands and rigors of high-volume automotive manufacturing.

CAMX offers a rare opportunity to explore many of the materials, process, technology and market issues surrounds automotive composites use. One of the highlighted sessions at the show will include CAMX Featured Session, organized by Chris Red about how and where the composites industry is evolving to meet the needs of carmakers. It will address:

- Where can composites best support the automotive market near term?

- What aerospace technologies promise solutions to automotive applications?

- What advances in “automation” are required to meet low cost, high production volume needs in this industry?

- Can carbon fiber provide design/process solutions to automotive needs?

- What are the fibers (types) and forms most likely to provide solutions?

- Can crashworthiness aspects be resolved with composites?

- Are “painting”, “Class A finish” and “composites repair” potential composites “show-stoppers” in automotive applications?

- What examples indicate that composites can make a real difference to solving processing, production time and CAFE requirements?

Look for more information on this and other CAMX information and technical sessions at

www.thecamx.org/education.php. This page will be updated as CAMX approaches and is your best source of education and presentation information for the conference and exhibition.

Related Content

Novel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreMaterials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreMaterials & Processes: Tooling for composites

Composite parts are formed in molds, also known as tools. Tools can be made from virtually any material. The material type, shape and complexity depend upon the part and length of production run. Here's a short summary of the issues involved in electing and making tools.

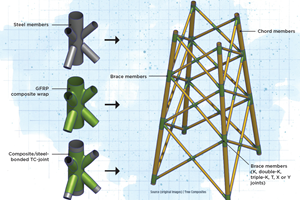

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)