Composites end markets: Infrastructure and construction (2024)

Composites are increasingly used in applications like building facades, bridges, utility poles, wastewater treatment pipes, repair solutions and more.

Composites are chosen for a variety of infrastructure and construction applications to solve challenges, ranging from a complex part geometry, to a need to withstand extreme weather events, a corrosive environment or high temperatures. In the case of the pictured filament-wound composite wastewater infrastructure shaft to be installed in Auckland, New Zealand, the pipes needed to be able to withstand corrosive chemicals and gases and last up to 100 years. Photo Credit: RPC Technologies

Construction and infrastructure cover numerous applications, from architecture, roads and bridges, to utility infrastructure like wastewater treatment and utility poles. Historically, in many of these applications, companies have been relatively slow to adopt composites over cheaper, more familiar legacy materials like wood, concrete or metal.

However, the light weight and corrosion resistance of composite materials, as well as other benefits like design flexibility and high mechanical performance, have made them a material of choice in a growing number of applications in recent year. Education and introducing building codes and standards specific to composite materials in new construction- and infrastructure-related applications will continue to enable their adoption as well.

Notably, in 2021, the U.S. implemented a bipartisan Infrastructure Law, announcing more than $185 billion in funding for projects spanning bridge and road repair, rail, public transit, upgrading power grids, installing electric vehicle (EV) chargers and more. At the bill’s 2-year anniversary in November 2023, the White House announced that more than 40,000 projects are underway around the country, including more than 7,800 bridge repair projects, more than 1,200 drinking water and wastewater projects and more.

While certainly not a comprehensive list, what follows are a number of new projects, announcements and innovations CW has covered over the past year in these sectors.

Building construction and architecture

Compared to traditional building materials like concrete, wood or metals, many composite materials and processes offer benefits like less waste or scrap, and faster construction. Leading the way are a number of high-profile projects featuring building interiors and exteriors, 3D printing, bio-based materials and more.

Creative building exteriors and interiors. Depending on the specific material and process, composites can generally be used to manufacture much more complex shapes than are possible with traditional materials.

An example of this in use is the exterior and interior of the Museum of the Future in Dubai, United Arab Emirates (UAE), one of the most complex structures ever built that opened in February 2022. The 78-meter-high building houses seven floors within a torus-shaped shell that sits atop a three-story podium. The exterior facade of the torus comprises 1,024 fire-retardant (FR) composite panels. Clad with stainless steel, each panel is a unique 3D shape and integrates molded-in Arabic calligraphy. (Read CW’s feature about the building of the building’s exterior). The building’s iconic interior lobby was also enabled by composites. Built by Dubai-based Advanced Fiberglass Industries (AFI), the interior included a calligraphy-embedded ceiling, walls and cladding for three spiral staircases — all consuming 7,700 square meters of composites. (Read CW’s feature on the museum interior.)

Even more recently, in August 2023 CW covered the announcement that the Pulse of Amsterdam building under construction in the Netherlands includes a 14,000-square-meter façade including 1,100 individual composite elements measuring 3.6 × 3.8 meters each. The engineering for this project was done by Solico (Oosterhout, Netherlands) for client Holland Composites (Lelystad, Netherlands), and was designed and constructed using Duplicor, a bio-based composite material.

On the research side, on display at JEC World 2023 (Paris, France) was a research demonstrator called “Adaptive FRP elements for façade shading” by the University of Stuttgart (Germany). The adaptive fiber-reinforced polymer (FRP) structures, built by robotic tape laying of carbon- and glass fiber-reinforced polyamide (PA) tapes, are designed for movement up to 90° based on the pressure from a person’s touch, based on compliant hinges and integrated pneumatic actuators. The research work serves as a proof-of-concept for how composites and biomimetic design can come together to build adaptive architectural structures (see video below for more).

Biomaterials and 3D printing. Including the Pulse façade example above, use of bio-based resins and/or fibers to make building materials more sustainable has also been increasing, especially in research and prototype projects.

One example is joint research by the German Institutes of Textile and Fiber Research (DITF, Denkendorf) and industry partners, who have been working to develop ultralight building components with hemp and flax fibers and resin made from linseed oil. Both pultrusion and hotpress processes were used to build prototype profiles and connecting nodes for use in low-load-bearing construction applications.

In recent years, efforts to alleviate housing shortages, especially in the U.S., have resulted in technologies and companies developing faster, more modular housing options. Composites — and specifically, 3D-printed composites — have played a role in several of these efforts.

Mighty Buildings Inc. (Oakland, Calif., U.S.) was founded in 2017 with the goal of building affordable housing using large-format 3D printing. Its first iterations were prefabricated accessory dwelling units (ADU) made from an unreinforced polymer the company developed; subsequent Mighty Kit building systems are made from 3D-printed fiberglass-reinforced polymer and used to assemble homes and other buildings. In March 2023, Mighty Buildings opened a second factory in Monterrey, Mexico, and in September, announced $52 million in funding.

The BioHome3D prototype proving its endurance during a winter in Maine. The goal is eventually scaling up to be able to produce commercially. Photo Credit: University of Maine

An example that combines both biomaterials and 3D printing is the BioHome3D project, a 600-square-foot home built from 100% bio-based, 3D-printed composites by the University of Maine (Orono) and partner Oak Ridge National Laboratory (ORNL, Oak Ridge, Tenn., U.S.). In December 2023, the University of Maine announced that the prototype home had made it through its first year of testing, and the plan is to scale up the production with the goal of producing a BioHome3D every 48 hours in an optimized 3D printing process at a Factory of the Future that is expected to be operational in 2026.

Civil infrastructure: FRP rebar, bridges and more

Benefits like light weight, corrosion resistance, high tensile strength and durability grant composites broad potential for civil infrastructure applications rebar for reinforcing concrete, bridges and more.

Reinforcing concrete: FRP rebar. GFRP rebar as an alternative to steel for reinforcing concrete in roads, bridges and other structures has been an available option for decades. Benefits include corrosion resistance, longer product lifespan and light weight, which can enable easier transport and installation.

One challenge to wider adoption of GFRP is that it is not a direct replacement for steel, necessitating design changes to accommodate differences in mechanical properties like higher tensile strength but lower tensile modulus, different coefficients of thermal expansion (CTE) and the fact that GFRP rebar is less amenable to welding and bending on the job site than steel is.

Recently, new standards have begun to be released to help facilitate the use of GFRP specifically in these applications. In December 2022, the American Concrete Institute (ACI, Farmington Hills, Mich., U.S.) released the first comprehensive building code covering the use of nonmetallic, GFP rebar in structural concrete applications. ACI CODE-440.11-22: Building Code Requirements for Structural Concrete Reinforced with Glass-Fiber Reinforced Polymer (GFRP) Bars addresses structural systems, members and connections, including cast-in-place, precast, non-prestressed and composite construction.

In 2023, the ASTM International (Conshohocken, Pa., U.S.) composite materials committee D30 released a new standard specification, D8505, for the latest generation of FRP rebar including both GFRP and basalt fiber-reinforced rebar.

Also announced in 2023, ExxonMobil subsidiary Materia (Pasadena, Calif., U.S.), NEG-US (Shelby, N.C., U.S.) and GatorBar (Ahmeek, Mich., U.S.) have formed a strategic alliance committed to increasing the market share of composite rebar within the concrete reinforcement sector. Made with Materia polyolefin thermoset resin and NEG-US fiberglass, GatorBar is said to be 2-4 times stronger and 4-7 times lighter than steel. It’s also said to be a cost-competitive alternative to steel rebar.

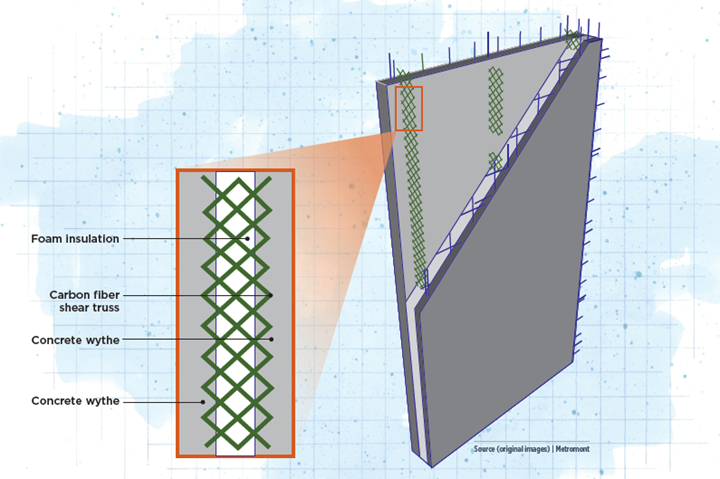

While not technically rebar, another composite product used to reinforce concrete is C-GRID, a carbon fiber-reinforced epoxy mesh used to reduce weight, cut construction costs and prolong the life of precast concrete panels for construction. Manufactured by Chomarat (Williamston, S.C., U.S.), C-GRID has been used to reinforce insulated, concrete wall panels for data centers.

C-GRID composite-reinforced insulated precast concrete panels were designed for high-efficiency data center applications. The product offers increased production rate and reduced preoperational and operational emissions, as well as optimized thermal and structural performance and chemical corrosion versus standard concrete panels. Illustrated by Susan Kraus

FRP bridges, walls, trench covers and more. Rebar-reinforced concrete is most often used for the largest construction applications, roads and large vehicle bridges, but composites can be used directly to manufacture a variety of other, and often smaller, civil infrastructure applications like bridge girders and decks; entire prefabricated pedestrian bridges; trench covers; sea retaining walls; rail platforms; and more.

In 2023, Creative Composites Group (CCG, Alum Bank, Pa., U.S.) introduced a new pultruded fiber-reinforced polymer (FRP) H-5 SuperDeck Lite deck profile. CCG said the new product aimed to meet need for more bridges, boards, sidewalks and trails that are able to support the weight of ambulance and maintenance vehicles within parks. Engineered to carry loads of up to 10,000 pounds, the SuperDeck Lite profiles are lighter than traditional pretreated wood and said to last longer.

Built from composites, CirculinQ panels are used for foot and bike paths to solve issues with subsequent flooding. Photo Credit: CirculinQ B.V.

CirculinQ is a modular road paving system is designed to collect and slowly release rainwater back into soils or sewers. Each CiculinQ panel is designed in three layers: the substructure holds and infiltrates water into soils while permitting cabling and other services to run through; the honeycomb PP/fiberglass deck snap-fits to tall bosses (that increase stiffness/strength) molded into the substructure and hatches on some models facilitate cleaning; the wear surface, a thin layer of aggregate on top of the deck, increases grip.

Launched commercially in 2022 for applications like bike paths and parking lots, the eventual goal is to roll out the product for urban highways.

Utility infrastructure: Utility poles, wastewater treatment and more

Utility infrastructure, including utility poles and cables, pipelines and cell phone towers, has, in the past, relied heavily on more traditional and less costly materials like wood or metals, but composites — demonstrating benefits like durability, longer lifespan and corrosion resistance — are increasingly adopted as an alternative in a variety of applications.

FRP utility poles and transmission cables. As aging wooden and metal utility poles are replaced, filament-wound or pultruded fiberglass composite poles offer a durable, corrosion-resistant alternative with a reported lifespan of up to 75 years.

An additional benefit for many poles available today is increased fire resistance through the use of fire-resistant resins, resin additives, veils or other solutions.

In 2022, CCG introduced its pultruded StormStrong utility poles (as well as StormStrong technology for bridges and other structures), which are engineered for added resiliency in the event of extreme weather events like hurricane-force winds, blizzards and deep freezes. In 2023, CCG announced that these poles had achieved a cradle-to-gate Environmental Product Declaration (EPD) from third-party lifecycle verification system BRE Global. Most recently, CCG now also offers FireStrong utility poles, which are classified as self-extinguishing per UL94 with a V0 rating. These poles include a self-monitoring system that lets an inspector know, after a fire event, whether the pole’s strength has been diminished by high temperatures and needs to be replaced.

Utility towers and protective structures. Beyond poles, composites can be used in utility infrastructure applications such as radomes, cell phone or other utility towers, and protective structures like trench and manhole covers or outbuildings.

Corrosion-resistant pipes and water purification. Composites can also play an important role in refurbishing aging underground potable water infrastructure by providing corrosion-resistant, durable and long-lasting underground pipe solutions.

One ongoing project in Auckland, New Zealand is the installation of the Central Interceptor (CI), a massive, 14.7-kilometer, 4.5-meter-diameter tunnel with a 226,000-cubic-meter capacity that, when completed, will run underneath the city collecting waste- and stormwater from smaller connecting pipes around the city and channeling them to a wastwater treatment plant.

Traditionally made from concrete, eight shafts — up to 7.5 meters in diameter — for the Central Interceptor project were designed from fiberglass and carbon fiber composites by RPC Technologies to meet challenging requirements. Photo Credit: RPC Technologies

The project began in 2019 and is slated for completion in 2026. While the main, horizontal CI pipe is made from segments of high-density polyethylene (HDPE)-lined concrete, a series of 18 vertical shafts, reaching depths of up to 70 meters, service the main shaft. Some of these shafts are made from traditional concrete but some, due to challenging requirements such as durability in the case of earthquakes and the corrosive sewer environment, were designed in a mix of carbon fiber and glass fiber, filament-wound composites by RPC Technologies Pty Ltd. (Seven Hills, New South Wales, Australia).

These eight composite cascade drop shafts, all of varying heights, depths, diameters and complexities, were challenging to design and manufacture. The largest, 7.5-diameter shaft required the design of a purpose-built, automated vertical filament winder. Read more about this project in CW’s feature article on the CI shafts.

Repair, strengthening, reconstruction

In addition to adoption of composite materials for new infrastructure builds, interest in and use of composites for repair or strengthening of existing structures is also growing.

Bridges in particular, which face stresses from heavy loads as well as extreme weather conditions or corrosive environments like saltwater, are increasingly reconstructed or reinforced with composites as they are repaired. In 2023, composite manufacturer Sireg Geotech (Arcore MB, Italy) announced that it is working alongside Manini Prefabbricati SpA (Umbria, Italy) on the reconstruction of a 23.30-meter long, 9.10-meter-wide bridge that had collapsed under the weight of a truck. Sireg designed pultruded Glaspree rebar to reinforce concrete slab and deck beams built by Manini.

In the U.S., CCG’s molded FRP panels have been used to replace aging sidewalks on bridges such as the Northampton Street Bridge, a historic cantilever bridge between Easton, Pennsylvania and Phillipsburg, New Jersey. The prefabricated panels are said to be 80% lighter than traditional reinforced concrete panels, and corrosion resistant.

On the research side, the University of Kansas School of Engineering (Lawrence, Kan., U.S.) and federal agency partners are looking into a combination of FRP, sensors, AI and drones to reinforce dams and levees across the U.S. The five-year, $7.7 million project has a dual focus on assessing and detecting damage, particularly in structure joints, and in which FRP materials are best for repair.

Furthermore, a number of companies are now offering a range of modular or custom FRP repair solutions for infrastructure applications. QuakeWrap (Tucson, Ariz., U.S.) is one company that has, for more than 30 years, offered a variety of GFRP and CFRP products for repair or strengthening of piles, pipes, walls or other structures.

For example, QuakeWrap’s 16-foot-diameter FRP pipes, known as StifPipe, were recently installed in the sewer system in Detroit, Mich., U.S. to reline and reinforce aging pipes. Produced from 12 layers of material, including carbon fiber, glass fiber and a proprietary core, StifPipe was chosen as a solution because it is prefabricated, lightweight despite its size and can be installed quickly, meaning the wastewater system did not need to be turned off for large amounts of time.

QuakeWrap team members demonstrate the size of the 16-foot diameter StifPipe. Photo Credit: QuakeWrap Inc.

Related Content

Why aren't composites synonymous with infrastructure?

The U.S. seems poised to invest heavily in infrastructure. Can the composites industry rise to the occasion?

Read MoreComposite rebar for future infrastructure

GFRP eliminates risk of corrosion and increases durability fourfold for reinforced concrete that meets future demands as traffic, urbanization and extreme weather increase.

Read MoreComposites-reinforced concrete for sustainable data center construction

Metromont’s C-GRID-reinforced insulated precast concrete’s high strength, durability, light weight and ease of installation improve data center performance, construction time and sustainability.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

Composites end markets: Sports and recreation (2024)

Light weight and high performance continue to make composites popular in the elite sporting good market. Sustainability in both materials and recycling solutions are a key innovation area.

Read MoreJEC World 2024 spotlights composites sustainability, innovation

This past year’s JEC Innovation Planets and awards are returning, with new opportunities like Country on Stage, a Building & Infrastructure Planet and more villages dedicated to specific aspects of the industry.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)