Composites end markets: Boatbuilding and marine (2024)

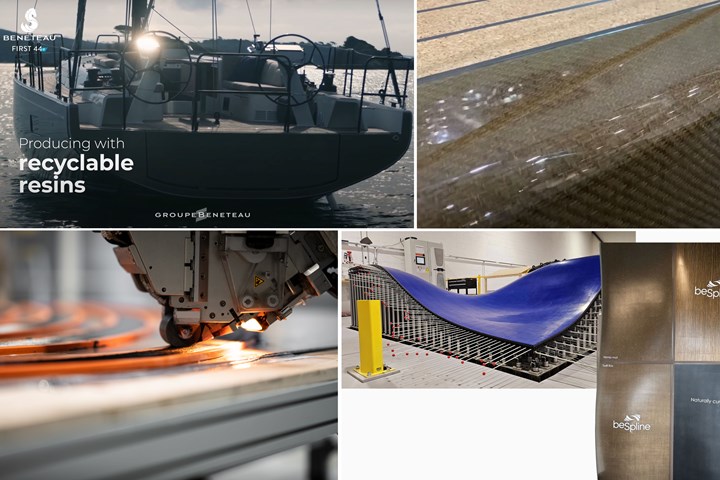

As the marine market corrects after the COVID-19 upswing, the emphasis is on decarbonization and sustainability, automation and new forms of mobility offering opportunity for composites.

Photo Credit: (top left, clockwise) Beneteau interview with JEC Group, Greenboats Flax27, beSpline and Avel Robotics.

Marine market data

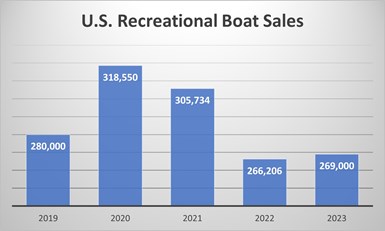

Data from National Marine Manufacturers Association. Note, 2019-2022 numbers reflect all recreational boats while 2023 is powerboats only. However, this does represent the majority of units — e.g., only 2,710 sailboats were sold in 2022. Photo Credit: CW from NMMA data

The recreational boat market in the U.S. is leveling out after a 40% surge during COVID-19 and subsequent slow-down through 2022. Although a January 2023 survey showed most U.S. marine retailers and dealers expected sales to drop by 10-20%, a November 2023 article by Michael Sasso at Bloomberg actually predicted a slight increase in 2023 sales to 269,000 new powerboats.

Although a small increase was also forecast by others in the industry, Frank Hugelmeyer, president and CEO of the National Marine Manufacturers Association (NMMA, Washington, D.C., U.S.), estimated in November 2023 that sales would be down versus 2022.

Either way, industry consensus is that the continued correction was inevitable and could have been worse, considering persistent recession warnings. And even though that recession never materialized, most dealers and retailers have yet to clear 2023 inventory, when normally they would be pushing next year’s models. This can also be seen in used boat sales, estimated by Hugelmeyer to be down by 10% in 2023, while Sasso at Bloomberg estimated 900,000 used boats were sold in 2023, the lowest level in NMMA data since 2011.

Market dynamics, single-digit growth in 2024

Sasso cites several factors at play. The industry struggled to keep pace with demand during COVID-19, and boat prices increased, initially driven by demand but also by huge increases in material and labor costs as well as supply chain issues. Now, interest rates have risen, making financing more expensive. Finally, consumers bought so many boats during the pandemic, that the market was essentially flooded for new and used boats.

Hugelmeyer notes some boat types fared better than others, with the slowest sales in freshwater fishing boats, pontoon boats and smaller fiberglass models (<25-30 feet), while larger boats and personal watercraft were more resilient. As 2023 came to a close, Soundings Trade Only projected 2024 sales would drop by 4-8% depending on the price of the boat, with one engine distributor noting, “the smaller the boat size and price tag, the more you’re seeing inventories build up.” Historically, the wealthy who purchase larger boats have not been impacted by inflation and interest rates as much as the average boat buyer, who earns less than $100,000 per year.

More technology

Photo Credit: BoatUS, Passagemaker, Simrad, Stok Electric

Across all sizes and price points, boats are becoming increasingly complex thanks to new technology and customization including automation, electrification and hybrid propulsion, sensors, GPS/navigation, cameras, sound systems and more. For example, in the above-cited Soundings Trade Only article, engine supplier Patrick McGovern noted showing a boat last year with joystick-operated steering that had perception added to it (see last section of 2021 article on Com&Sens and similar system on an 80-meter Van Huisman sailing yacht). Such added equipment is driving an increase in the number and size of onboard battery packs and eating into storage space, creating a demand for smaller, lighter components.

Foiling boats

The trend toward foiling watercraft continues to advance — even pontoon boats are now being retrofit with foil kits (made with aluminum, not composites) to improve speed and reduce drag. In 2023, CW featured news about Artemis Technologies’ (Belfast, Ireland) first commercial electric foiling workboat, the EF-12 crew transfer vessel (CTV). Manufactured with glass and carbon fiber composites, the foiler enables a smoother ride, higher speeds and longer range in up to 1.5-meter waves. In testing, the 11.5-meter prototype demonstrated 90% improved energy efficiency when compared to fossil fuel counterparts and has zero greenhouse gas (GHG) emissions. Artemis Technologies will test and deploy a 12-meter CTV at Ørsted’s Barrow wind farm on the U.K.’s west coast over the next 2 years. In 2023, CW also covered the company’s Artemis EF-12 Escape zero-emission water taxi for up to 12 passengers.

Foiling boats will continue to drive the use of lighter composites, including carbon fiber, as evidenced by 9.5-meter foilers supplied by Linx Tenders (Palma de Mallorca, Spain) for larger yachts, built by brand owner BMComposites. “The first Linx 30 was constructed entirely from infused carbon fiber to adhere to weight limitations on the mother vessel’s crane,” explains CEO Mark Branagh. The boat’s light weight also aided the hydrofoil system in cutting fuel consumption by 40%. The Linx 30 also used Gurit (Wattwil, Switzerland) Prime 37 low-toxicity epoxy resin, which incorporates bio-based content. More on this trend below.

AFP for foils

As the use of foils expands, the need for higher performance and automation to achieve complex layups has driven one company to pioneer the use of automated fiber placement (AFP). The December 2022 plant tour on Avel Composites (Lorient, France) showcases this company’s innovative approach to produce 300-kilogram carbon fiber-reinforced polymer (CFRP) foils for 60-foot IMOCA (International Monohull Open Class Association) racing sailboats.

Avel Robotics uses AFP to build 300-kilogram, 6- to 8-meter-long foils for IMOCA racers, including half the fleet for the 2024 Vendée Globe round-the-world race. Its innovation includes building actual sub-elements (bottom) for materials test data to improve FEA accuracy and long-term prediction. Photo Credit: Avel Robotics

Founded in 2017, Avel’s goal was to build structures that would lift 8-10 metric tonne racers moving at up to 56 kilometers per hour without failures seen in previous hand layup composite foils. It uses two Coriolis Composites (Quéven, France) C1 AFP machines, each applying up to eight carbon fiber/epoxy tapes. One set of 6- to 8-meter-long foils takes 1 month to design and 5 months to build. AFP is mainly used for the stock, or primary structure of the foils. These can be laid up directly onto a curved mold and autoclave cured or built as a series of precured curved plates bonded together with epoxy adhesive and autoclaved again into an integral structure. Corecell foam core is then bonded to either side of the stock, followed by leading and trailing edge inserts, which are also made from multiple AFP plates called battens.

The company is also unique in its manufacture of actual sub-elements for its test coupons, used to generate the materials data input for FE modeling during design. Such data, thus comes not from a material supplier but from its own manufacturing process, accurately reflecting the effects of AFP, curvature, thermal profiles during cure, etc. With 28 employees and a turnover of €2.7 million in 2022, Avel Robotics has delivered CFRP parts for 57 projects in offshore racing, naval and defense applications, and is now pursuing opportunities in the aircraft industry.

Decarbonization

Foiling is indeed seen as an enabler for decarbonizing marine vessels, used with more sustainable, fully electric and hybrid combustion engine/electric propulsion. This trend toward zero-emission boats continues to advance, with even combustion engines now being developed to use more sustainable fuels, including biofuels such as renewable diesel. “Everybody is working to expand the range of fuel options … so you can get a lot closer to carbon-free usage,” says McGovern in the Soundings Trade Only cited above.

In the December 2023 article, “Pathways to decarbonization,” Hugelmeyer at NMMA points out that recreational boats account for less than 0.1% of all global greenhouse gas (GHG) emissions and that marine engine emissions have decreased by more than 90% over the past two decades while fuel efficiency has increased more than 40%. Still, with 30 million recreational boats in use worldwide, the industry sees plenty of potential for further CO2 reduction.

The International Council of Marine Industry Associations (ICOMIA) has recently completed initial research on this for boats less than 78 meters long. Propulsion options include battery electric, hybrid-electric, hydrogen (combustion and fuel cell electric) and combustion engines using sustainably produced liquid substitutes for fossil fuels. Because of the diversity of boat types and uses — e.g., fishing, water sports, overnight cruising, etc. — ICOMIA says there is no universal approach to decarbonization but recommends a range of emerging technologies will be needed. Reduced weight will continue to be a key enabler, and more sustainable, recycled and/or recyclable materials are also advancing. Boat shows last year were already highlighting renewable materials for upholstery and decking, while CW saw an increase in bio-resins and biofibers in marine applications (see below).

Another zero-emissions option being developed is solar-powered yachts. The Zen50 is a solar- and wind-powered blue water catamaran designed and produced by Zen Yachts (Barcelona, Spain). It received a Gussies 2023 award in the Electric Production Boat category and was built with MEL Composites (Barcelona) as resin infusion technical advisor and supplier of the vinyl ester resin, carbon fiber and Corecell foam for the 15.7-meter catamaran. The Zen50’s advanced composites enable it to sail continuously at cruising speeds of 6 to 10 knots, without requiring any fuel onboard.

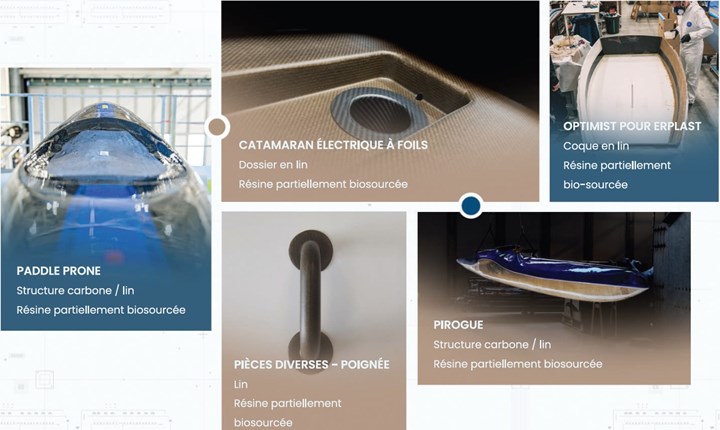

Biocomposites, recycled materials

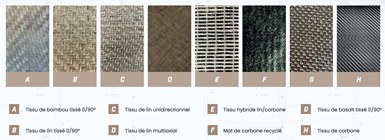

CW definitely sees growing use of bio-resins and natural fibers in boatbuilding. The Alliance for European Flax-Linen & Hemp (Paris, France) agrees, reporting that marine industry adoption of flax fibers is expanding into major OEMs as well as smaller shipyards. “Over the last 10 or 15 years, several innovative flax fiber boats have been built and the fiber has started to gain significant traction,” says Julie Pariset, innovation and CSR director for the alliance.

The 60-foot racer We Explore by Outremer, MB9 by Greenboats (top right) and Virgin Mojito 650 by idb Marine use flax fiber composites. Photo Credit: we-explore.org, Greenboats, idb Marine

She notes that in addition to reducing the carbon impact of composites, flax fiber offers low density and high specific properties. “It can be used to manufacture composite laminates with mechanical properties not dissimilar to typical E-glass composites,” says Pariset, “and the coefficient of thermal expansion of a flax fiber [reinforced] epoxy part is also quite close to that of a carbon fiber part.” Flax also provides acoustic and vibration damping as well as warm aesthetics below decks. “Flax yacht interiors can create a more pleasant environment for passengers with less noise and harshness than standard composites,” she adds. Read more including case histories for the ecoRacer 30, Greenboats (Bremen, Germany) Flax 27 Daysailer and developments by the Beneteau Group.

In 2022, noncrimp fabric (NCF) supplier Saertex (Saerbeck, Germany) launched a collaboration with flax fiber supplier Terre de Lin (Saint-Pierre-le-viger, France) and displayed, at JEC World 2022, a flax composite rudder blade, part of a sailboat built predominantly from multiaxial flax fabrics by idb Marine (Concarneau, France). The boatbuilder now produces the 6.5- and 8.88-meter sailboats Virgin Mojito 650 and 888 with hulls and decks made from flax composites. Production of the 9-meter Virgin Mojito 30 will begin in 2024. Terre de Lin also partnered with catamaran builder Outremer (La Grande-Motte, France) to produce We Explore, a 60-foot Outremer 5X with 50% flax fiber construction that skipper Roland Jourdain sailed in 2022 to place second in the multi-category of the famous Route du Rhum race.

MerConcept offers assistance with the design, fabrication and LCA of biocomposite parts. Photo Credit: MerConcept Lab, biocomposites offering pdf

In 2023, Jourdain and his company Kaïros (Concarneau, France) formed an economic interest group (GIE) with François Gabart and his company MerConcept (Concarneau), aiming to develop sustainable solutions for offshore racing and boating. Services offered by GIE MerConcept X Kaïros include:

- Study of marine eco-design projects

- Implementation support including prototyping

- Lifecycle analysis (LCA) of possible solutions using the S3 tool.

“The initial focus was on biomaterials and recycling, but the issues of impact measurement and LCA soon became apparent,” says Gabart in a December 2023 boatindustry.com article. “Even before the GIE, we developed a common LCA tool for our own projects and those of our customers.” The GIE is also working on the BioBat project with sailboat charter company Grand Large Yachting in partnership with Outremer to develop alternative materials for the yachting industry using LCA studies based on processes as well as materials. Boatindustry.com has a number of other interesting articles on biocomposites and recycling.

Meanwhile, Greenboats announced in November 2023 its launch of the MB9 sailboat for the 2024 sailing season. The company has also formed Circular Structures, an online shop to help others access and use natural fiber composites (NFC).

In May 2023, Thomas Tison Yacht Design & Engineering (Lorient, France) and Northern Light Composites (NLComp, Monfalcone, Italy) announced the ecoFoiler. The 3.80-meter foiling dinghy will reportedly be made with NLComp’s patented recyclable rComposite materials as well as biocomposites. A prototype hull displayed at JEC World 2023 used Bcomp (Fribourg, Switzerland) ampliTex reinforcements, recyclable Arkema (Colombes, France) Elium resin and was produced with a Breton SpA (Castello di Godego, Italy) 3D-printed mold using recyclable thermoplastic polymer. “Eco-composite and foiling projects are now reaching a wider audience,” says Tison.

NLComp has also formed Eco Yachts to produce climate-neutral boats including its 30-foot sustainable composites-intensive EcoRacer 30. The first such boat was produced by Magnani Yachts, having licensed NL Comp’s rComposite building technology. With similarly materials and processes as the prototype hull described above, Eco Yachts also plans to announce a new range of eco motor yachts in 2024.

Recyclable molds have been demonstrated by Arkema in collaboration with milling and tooling company Merritt Precision (Merritt Island, Fla., U.S.). An entirely recyclable glass fiber composite mold was produced using Elium liquid thermoplastic resin. The recyclable resin has been tailored for infusion processes of large components with low viscosity, long reactivity and a low exothermic reaction.

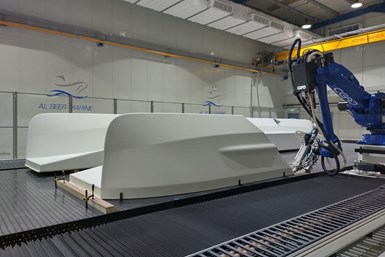

3D-printed boats

3D printing continues to gain traction in boatbuilding. 2023 saw a new world record for the largest 3D-printed boat. Reported as the world’s first 3D-printed water taxi, the 11.98-meter-long, 3.5-meter-wide vessel was manufactured by Al Seer Marine (Abu Dhabi, United Arab Emirates) and Abu Dhabi Maritime, surpassing the 7.72-meter-long 3Dirigo printed at the University of Maine in the U.S. The catamaran hulls were printed in 5.5 days each using 67% recycled materials including 30% glass fiber and UV stabilizer. The prints were made using Al Seer Marine’s 4 × 36-meter CEAD (Delft, Netherlands) Flexbot system, which it claims is also the world’s largest.

In June 2023, Tuco Marine Group (Faaborg, Denmark), manufacturer of ProZero workboats, announced the Danish Innovation Fund-supported RoboPrint project to revolutionize production of composite vessels using continuous fiber 3D printing. Partners include technology leads Technical University of Denmark (DTU, Kongens Lyngby) and research consultancy FORCE Technology (Brøndby,), while Robot At Work (Odense) will provide the RAW 3D printer and Cosine Additive (Houston, Texas, U.S.) will develop the printer head to be used. Tuco Marine CEO, Jonas Pedersen, says the project will enable his company to “delve deep into the possibilities that automation can offer our production of fast workboats here in Faaborg.” The company’s press release cites the RobotPrint project as enabling Tuco Marine to enter a new era of production technology that will strengthen their position in the market. Its goals include reduced manual work in composites production, decreased costs and enhanced production quality to achieve higher levels of efficiency and flexibility in production as well as enabling innovative, new 3D designs.

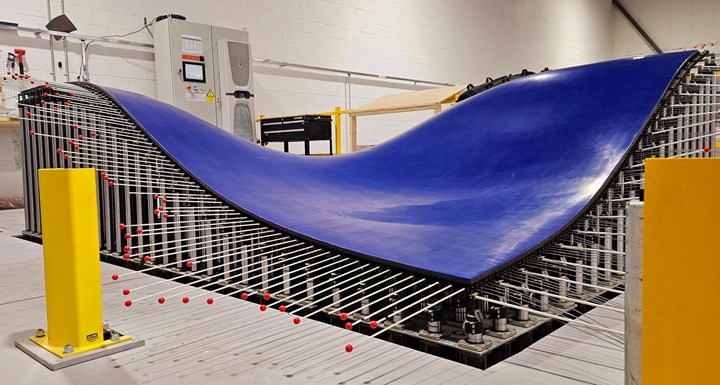

Adaptable molds, preshaped foam core kits

Another innovative technology seeing expanded use in marine is adaptable molds. CW’s tour of beSpline (Sherbrooke, QC, Canada) showcases its use of Adapa’s (Aalborg, Denmark) digitally controlled, reconfigurable molding system to provide 3D-shaped laminates and Shaped Foam Kits. “Having foam core precut into kits has been done for many years,” says BeSpline CEO Yoann Bonnefon. “What we are doing goes further, thermoforming the foam into preshaped pieces to fit each boat hull. It’s almost five times faster to install a kit … and customers see a roughly 20-25% weight reduction because the preshaped foam doesn’t need to have all the cuts to enable bending, but which also absorb resin.”

Using an Adapa adaptable mold, beSpline produces its Shaped Foam Kits for innovative boat builders such as (top down) Lyman Morse, Boston Boatworks and Moore Brothers for the Regent Seaglider eVTOL prototypes. Photo Credit: beSpline, Boston Boatworks and Regent

Shaped foam core has been used by builders of high-performance yachts and racing boats for decades. One example is beSpline customer Boston Boatworks (Charlestown, Mass., U.S.), who thermoformed core by hand in the 1970s to achieve slam load dissipation and weight savings in custom race boats. “We would heat the foam in an oven and vacuum bag it onto the hull plug,” says CEO and co-founder Scott Smith. “It was labor- and time-intensive, but we took weight out and improved the mechanical properties of the hull.” Now, however, the company is seeking efficiency in its series production of BB44 and BB52 bluewater cruising boats. “The same 3D CAD file that controls precision throughout the build of our boats is what beSpline uses to create the 3D thermoformed core kit,” says Smith. “This matches what we were doing by hand, but without the elapsed time and labor-intensive approach.”

Smith notes a BB series boat will start every 6 weeks, “And we couldn’t do that if we couldn’t cycle the hull molds. With beSpline, we can do that and improve the properties.” He also notes that beSpline Shaped Foam Kits are also being used by Regent (North Kingstown, R.I., U.S.) in its Seaglider electric propulsion, low-altitude flying ground-effect vehicles being commercialized to carry passengers along coastal routes. Regent has announced $8 billion in Seaglider orders from airlines and ferry operators on six continents.

Amphibious eVTOL use composites and boatbuilder expertise

Photo Credit: (top left clockwise) Vickers Aircraft, Dornier Seawings, Elfy, Novotech, Icon and Jekta.

Regent announced in 2023 that its expansion plans up to 600,000 square feet of new manufacturing and test facilities, in order to begin fulfilling its commercial order backlog by mid-decade. Regent isn’t alone in this market segment that relies heavily on composites from both boatbuilders — Regent’s first prototypes have been built by Moore Brothers (Bristol, R.I., U.S.) — and from the light sport aircraft industry. Other manufacturers and models include:

- Vickers Aircraft Co Ltd. (Hamilton Airport, New Zealand) Wave

- Dornier Seawings (Wessling, Germany) Seastar, Orca and DS-2C

- Jekta (Payerne, Switzerland) PHA-ZE 100

- Elfly (Bergen, Norway) Noemi

- Icon (Vacaville, Calif., U.S.) A5

- Novotech (Casoria, Italy) Seagull

Composites continue to advance in shipping

1:1 catamaran demonstrator produced using FIBR4YARDS’ Industry 4.0 solution. Photo Credit: IRT Jules Verne

FIBRE4YARDS is a project funded under the European Union’s Research and Innovation Programme Horizon 2020 and dedicated to developing use of fiber-reinforced polymers (FRP) in shipbuilding using Industry 4.0 concepts. CW recently reported on results announced by project partner IRT Jules Verne (Bouguenais, France) after 3 years of collaborative development with 12 other organizations from six European countries.

FIBRE4YARDS focused on developing new technologies for automated construction, a digitalized shipyard and new engineering tools for ship design that enable new production technologies. The automated technologies developed can be used by shipyards or suppliers:

- Out-of-die UV-cured pultrusion enabling shipyards to directly bond stiffeners to desired areas (e.g., hull, deck, superstructure), eliminating manual lamination and polyurethane molds.

- Robotic-based systems for additive manufacturing (3D printing and AFP).

- Hot stamping of thermoplastic composites for tailored, lightweight small to medium structural parts.

- Adaptable molds to create curved structures (see beSpline above) enabling prefabricated panels in the correct geometry, shape and joint design that can then be assembled into a complete structure using simple jigs instead of expensive, one-off molds.

“In FIBRE4YARDS, we have proven that it’s possible to rethink the shipyard,” says Xavier Martinez, a researcher at CIMNE, one of the project coordinators. “If we digitize it, if we move from manual construction to automated processes, if we incorporate modular construction and, last but not least, if we incorporate and use numerical tools that can take all these processes into account, then we’ll be able to build ships that are cheaper, that have higher quality and with an environmental impact that is reduced through its lifecycle.”

Related Content

Sulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreThermoplastic composites welding advances for more sustainable airframes

Multiple demonstrators help various welding technologies approach TRL 6 in the quest for lighter weight, lower cost.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreRead Next

Composites end markets: Sports and recreation (2024)

Light weight and high performance continue to make composites popular in the elite sporting good market. Sustainability in both materials and recycling solutions are a key innovation area.

Read MoreTop 10 CompositesWorld articles of 2023

Through a variety of editorial content, CW explored the trends and topics that are rapidly flourishing in the industry. Based on Google Analytics, these top 10 articles were considered the most popular.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)