Structural polyurethanes: Bearing bigger loads

The versatile polymer shows new strength (and other advantages) in pultrusion and core materials applications.

Ever since water was accidentally introduced into a reactor that contained toluene diisocyanate and polyester polyol, creating the first flexible polyurethane foam, materials scientists and designers have long appreciated the versatility of polyurethanes. As a flexible foam, it became a common component of automotive seating. As a polymer resin, it has been used widely as an adhesive, a coating (e.g., for popular hardwood flooring) and an elastomer. It has formed fibers for textiles and, as a hard plastic, has been molded into electrical components. More recently, however, polyurethanes have been tailored in rigid foams and resin systems, with performance properties — stiffness, hardness and density — adequate to the task of structural applications. As a result, composites manufacturers are able to take advantage of their fast-cure characteristics and high strength-to-weight ratios. Given this, polyurethane resins are having an impact now in processes and applications previously dominated by polyesters, vinyl esters and epoxies, while polyurethane foams are seeing use in new fiber-reinforced core materials.

The promise of pultrusion

Pultrusion has been used for decades to manufacture a variety of structural composite parts. The components of early pultruded composite structures typically comprised unidirectional glass fiber in combination with polyester or vinyl ester resins. More recently, pultrusion technology has been adapted to include woven fabric and mat, and epoxies have joined the matrix ranks, thanks to machinery and resin-formulation breakthroughs that have enabled pultruders to manage the historically more viscous epoxies. Recently, however, significant progress has been made in commercializing a pultrusion process based on polyurethane resin.

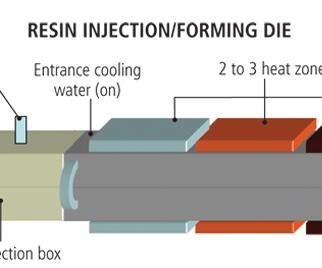

Bayer MaterialScience LLC (BMS, Pittsburgh, Pa.) has played key roles in the development of polyurethane pultrusion technology and the growth of commercial applications. Craig Snyder, BMS market channel representative, says polyurethane can be pultruded on standard pultrusion equipment, with two modifications. First, a meter/mix unit is needed to control the proportion of the isocyanate to polyol, the two-part resin’s constituents. BMS has worked with equipment manufacturers to develop a commercially available metering unit. Second, the conventional open, wet-resin bath system found on most pultrusion machines must be replaced with a resin injection box mounted flush to the entrance of the die. The injection system is necessary to accommodate polyurethane’s faster gel time.

Polyurethane pultrusion offers significant improvements in strength and considerable potential cost savings, in comparison to parts pultruded from polyester or vinyl ester resins, Snyder says. Glass fabric and/or mat, he explains, is usually added to the axial fiber with polyester and vinyl ester pultrusion systems to enhance the transverse properties of the composite parts. The complex shape of some pultruded profiles, such as window frames, can require four or five different mats that must be cut and then continuously shaped by a series of dies as they are fed into the die during the pultrusion process. But Snyder maintains that polyurethane is two to five times stronger and stiffer than polyester and vinyl ester resin systems. As a result, processors often can eliminate the fabrics and mats and return to axial rovings. This significantly reduces the cost of materials and setup labor, and enables manufacturers to increase line speeds. Further, the fiber volume in the finished part can go as high as 80 percent, compared to a practical maximum of 60 percent in polyester- or vinyl ester-based pultrusions. “Pultruded polyurethane can compete on the performance side with epoxy resins, but it has a processing advantage in that you can go to much higher line speeds,” Snyder reports. He adds that the higher glass content and greater strength of pultruded polyurethane also permit manufacturers to make thinner profiles and, therefore, lighter parts and assemblies. “This technology will be able to go into structural applications that other resin systems have not gone.”

Inline Fibreglass Ltd. (Toronto, Ontario, Canada) uses Baydur PUL polyurethane, a two-component polyurethane system supplied by BaySystems, the umbrella brand for the global polyurethane operations of BMS, to pultrude window frame components. The company makes a line of pultruded glass-fiber-reinforced polyester windows, but also pultrudes various polyurethane structural components that go into the construction of the windows, such as reinforcement guides and pressure plates. These pultruded parts are made out of Baydur PUL polyurethane and 80 percent glass fiber. Bernard Rokicki, Inline’s dealer sales manager, says polyurethane was chosen for these nonappearance parts because of its strength and good thermal properties. Ultimately, Rokicki says, the company would like to make a complete window system from polyurethane. To achieve that goal, however, Inline must overcome cost and processing inefficiencies related to painting the material. “Right now there’s not a good method of painting it,” says Rokicki. “It’s very difficult to make paint stick to something that’s 80 percent glass.”

Rokicki reports that Inline is working with several coatings suppliers to develop new primers and paints, and is close to achieving this objective. The work is well worth the effort, he says, because the higher glass content will enable the windows to meet commercial fire ratings, which require that 75 percent of the substrate remain after burning. This will make the polyurethane windows competitive with aluminum counterparts, opening up potential new markets in high-rise apartments and office buildings. “We’re dedicated to getting there because the first one out [with pultruded polyurethane windows] is going to strike gold,” Rokicki contends. “A new product always requires a certain amount of time for consumers and contractors to accept it. However, because of the potential of this product to go into commercial buildings, you only have to convince one person, an architect, to be successful right out of the gate and get a large job.”

Testing the limits of polyurethane’s load-bearing capability, Conforce International Inc. (Concord, Ontario, Canada) is using Baydur PUL 2500 to pultrude ribbed panels 1.25 inches/31.75 mm thick, 24 inches/610 mm wide for ocean-going shipping containers purchased by the U.S. military. Sold under the tradename EKO-FLOR ms1, the lightweight interlocking panels are cut to length and used as container flooring, which must bear the weight of trucks during container loading and unloading. Although the government specification calls for the panels to withstand 8,000 lb/3,629 kg of load per truck wheel, the finished product’s actual load-bearing capability exceeds 17,000 lb/7,711 kg.

Marino Kulas, president and CEO of Conforce, says the company chose to pultrude the panels from the Baydur polyurethane material “because of the overall mechanical properties and perceived performance improvements, including a highly desirable strength-to-weight ratio, overall weight reduction and the ability to work in tandem with our specific reinforcements.” Kulas says Bayer provided crucial support in the EKO-FLOR ms1 product development, including structural design analysis, material assessment and optimization, and tooling design. He expects EKO-FLOR ms1 will enable the company to carve out a new market niche for its composite products line.

The advent of structural core

Beyond its use as a matrix in structural composites, rigid polyurethane foam (see the "Rigid polyurethane foam primer" sidebar at the end of this article) is providing the basic carrier substrate for glass fiber-reinforced structural core materials in a growing variety of parts and components molded for marine, construction and wind-energy applications.

Core specialist Nida-Core Corp. (Port St. Lucie, Fla.) now offers two types of rigid, glass-reinforced, closed-cell polyurethane foam core products, designated STO and SXO. (The company also makes glass-reinforced flexible foam products from thermoplastic, primarily polyethylene.)

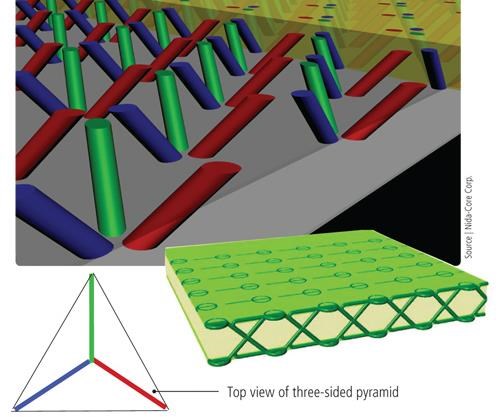

The products are manufactured by inserting, or “tufting,” glass fiber into polyurethane foam sheets, using proprietary fiber-insertion equipment patented by Nida-Core. The glass fiber, typically E-glass, is in the form of continuous fiber rovings fed from spools. Successive fiber insertions are made without cutting the fiber. In the STO version, the glass fibers most often are aligned in parallel rows along the length of the sheet, enhancing longitudinal properties. The SXO brand, which was introduced at the 2009 JEC Show in Paris, is made by inserting the glass fiber along three different axes to create a three-dimensional (3-D) “pyramid” or triangulated pattern of glass throughout the sheet (see illustrations on this page). This imparts a quasi-isotropic effect, with material and mechanical properties relatively identical in the longitudinal and transverse directions.

Nida-Core’s business development manager Tim Johnson says the foam’s primary purpose is to act as a vehicle for the reinforcing truss system created by the rows or triangulated patterns of glass fiber. Polyurethane is preferred over other foam types because of the processing requirements of the products. STO and SXO core materials are designed for vacuum-assisted resin transfer molding (VARTM) processes. The lowest-cost foam that will resist one atmosphere of pressure during molding is rigid polyurethane foam.

Nida-Core has multiple suppliers of polyurethane located in Europe and the U.S. The base product is low-index foam with a density of 2 lb/ft3. The term index refers to the ratio between the polyol and isocyanate — a low-index foam is one with lower friability or tendency to crumble. Low friability is a requirement for cores used in applications such as truck panels on refrigeration trucks, which are subject to road vibration and other dynamic loads. The company also uses foam with a higher index for certain applications, such as roofing, in which a higher fire-resistance rating is specified.

STO and SXO cores are typically sandwiched between skins made of woven glass fabrics and infused with unsaturated polyester or vinyl ester resin. Resin flows through the core, entering at the fiber insertion points and flowing along and wetting out the fibers. In the case of the SXO material, an additional layer of woven glass mat is placed between the core and laminate schedule prior to molding. Upon infusion, the glass mat creates a mechanical linkage with the triangulated glass fibers, which have termination points on the surface of the core. The linkage eliminates the need for glue or fasteners to tie together skin and core, resulting in cost savings compared to cores made of balsa or PVC, the most traditional competitive core materials.

Johnson says the idea of making a glass-reinforced rigid polyurethane core evolved from a need to improve construction of sandwich panels in refrigerated delivery trucks. The low-density polyurethane foam typically employed as insulation in these trucks has poor shear properties, requiring the insertion of studs to hold the skins together. The studs add material and fabrications costs and also act as thermal shunts. “Our cores simplify construction and improve insulation at the same time,” says Johnson.

Kayco Composites LLC (Grand Prairie, Texas) also manufactures glass-reinforced, high-density polyurethane sheet material, branded Kay-Cel. Standard sheet dimensions are 4 ft by 8 ft (1.2m by 2.4m). Larger sheets can be made upon request. Sheet thicknesses can range from 0.5 inch to 2 inches (12.7 mm to 50.8 mm). Each Kay-Cel sheet comprises two layers of 18-oz. or 24-oz. woven roving glass mat infused with polyurethane foam with a minimum density of 20 lb/ft3. Higher-density polyurethane (up to 30 lb/ft3) also can be supplied. Kayco operates a CNC router at its facility and can size the raw sheet to the specific core-size dimensions required for the customer’s mold.

Used primarily as core for sandwich composites in the marine market and, increasingly, in the wind-energy industry, Kay-Cel rigid polyurethane core materials have been used, Kayco claims, in more than 50,000 boats, primarily in areas that must bear high loads, such as transoms, with no reported failures attributed to the material. Matt Talton, Kayco account manager, says the two critical performance properties for core materials used in boat transoms, which might have to support engines weighing up to 800 lb/363 kg, are good flexural and compressive strength. Kay-Cel cores mimic the flexural and compressive strength of wood, while providing the additional benefit of water- and rot-resistance.

Kay-Cel cores can be used in either resin transfer molding (RTM) or VARTM molding processes. A typical sandwich construction consists of a gel coat, a glass-fiber schedule infused with vinyl ester or epoxy resins, a Kay-Cel core and another layer of resin-infused glass. Ordinarily, resin does not infuse the polyurethane, which is a closed-cell foam, but Talton says manufacturers often drill “weep holes” in the core, which allow the resin to penetrate to the backside of the part, creating a locking mechanism between the skins on either side of the core.

More expensive than balsa but cheaper than PVC foam, polyurethane foam has been used historically in the construction of the more expensive boats. Talton, however, sees a trend toward the use of polyurethane cores in high-volume recreational boats. “Warranties have to be longer these days,” Talton explains. “When a boat manufacturer hears a competitor is offering a 10-year warranty, it will have to match it, and by going to polyurethane, there is less chance of warranty work due to rotting wood.”

Irving, Texas-based CoreKits has been using Kay-Cel polyurethane core materials in the fabrication of pre-shaped core kits, which custom manufacturers then use to mold parts for complete sections of boats as well as wind turbine blades and other products. CoreKits buys sheets of polyurethane and other core materials and cuts them to specific dimensions with a CNC machining center. The company also attaches other components (e.g., aluminum cladding), but does no molding. Company president Ruben Garcia likens the process to making a large-scale jigsaw puzzle. Garcia says he uses Kay-Cel primarily in areas that require strength, such as boat engine mounts and “hard points.” These include bracket, drilling and tapping locations. He says the company, during recessionary 2009, added a fourth production line at its Texas plant and opened a new facility near Charleston, S.C. He also sees growing uses for reinforced polyurethane cores in the wind-energy industry.

“Wind-turbine blades are getting so large that engineers are looking for ways to lighten them,” Garcia says. To achieve the goal, engineers are turning to new hybrid constructions. “Hybrid core kits used to be only balsa and PVC, but now there are more materials in play, such as polyurethane.” Polyurethane allows engineers to make longer turbine blades, while maintaining structural integrity and strength without adding significant weight.

As structural applications of polyurethane expand, the trend is adding a unique twist not only to the history of polyurethane, but to the history of composites. Over the next few years, expect suppliers and processors alike to continue this exploration and expansion of polyurethane’s structural advantages.

Related Content

Composite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreScott Bader ATC begins Crestabond MMA structural adhesive production

Scott Bader’s Drummondville, Canada, facility has begun manufacturing and supplying composites-applicable adhesives to its North American customers.

Read MoreMaterials & Processes: Tooling for composites

Composite parts are formed in molds, also known as tools. Tools can be made from virtually any material. The material type, shape and complexity depend upon the part and length of production run. Here's a short summary of the issues involved in electing and making tools.

Read MoreScott Bader partners with Elixir for Crestabond distribution in India

Crestabond MMA structural adhesives range will continue to drive advanced composites growth in India, in addition to Scott Bader’s global expertise and local technical support.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More