Pressure vessels for alternative fuels, 2014-2023

Lower fuel costs and escalating emissions standards are driving a 10 percent annual growth in alternative fuel pressure vessel sales.

Share

High-pressure gas storage vessels represent one of the biggest and fastest-growing markets for advanced composites. In 2013, construction of pressure vessels of all types — metal, composite and metal/composite hybrids — represented more than $2 billion in global sales. That same year, pressure vessel manufacturers accounted for 6 to 7 percent of the estimated 65,000 metric tonnes (143.3 million lb) of global demand for carbon fibers. Although they are used in self-contained breathing apparatuses and provide oxygen and gas storage on aerospace vehicles, the primary end-markets for composite-reinforced pressure vessels are bulk transportation of compressed natural gas (CNG) products, and fuel storage in passenger cars, buses and trucks with powertrains dependent on CNG and hydrogen alternatives to gasoline and diesel.

Growth equation

Demand for alternative fuels is growing, in large part, because the extraction of natural gas from shale reserves has contributed to lower prices in North America and parts of Europe. In the North American market, for example, the cost of natural gas fuels currently runs about 40 percent less than diesel per diesel gallon equivalent. In addition, increasingly stringent emissions regulations, including the European Union’s (E.U.) Euro 6 Standard, which became effective earlier this year, are making diesel-powered buses and commercial vehicles more expensive for operators. Impending regulations are improving the marketability not only of CNG but also of hydrogen (H2) gas — after a period of relative dormancy — for fuel-cell powered vehicles.

In addition, the current availability of postrecession, low-interest loans has helped create a surge in demand for these alternative fuels, accompanied by strengthening and expansion of the pressure-vessel manufacturing base.

CNG vehicles growing

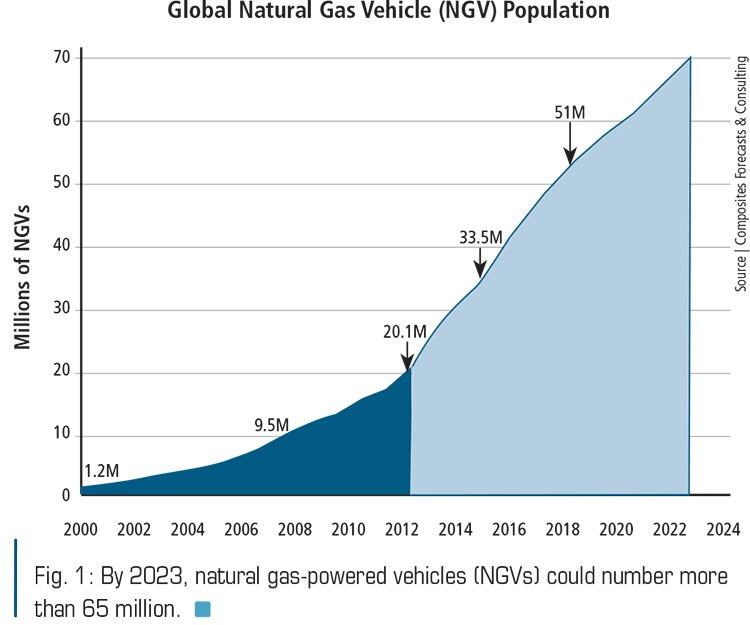

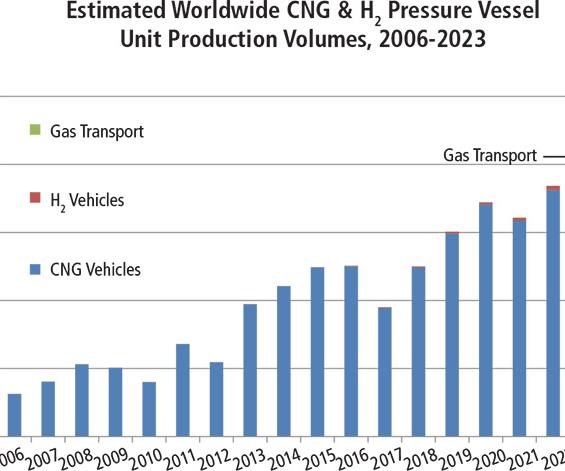

Five years ago, the number of natural gas-powered vehicles (NGVs) in operation around the world — cars, trucks, buses, and other industrial vehicles — totaled about 10 million. Aggregate data offered by nearly 90 countries indicates that during 2013, the global NGV population exceeded 20 million vehicles. In the next three years, it is anticipated that this number will approach 35 million vehicles. By 2023, NGVs could number more than 65 million (see Fig. 1, at left).

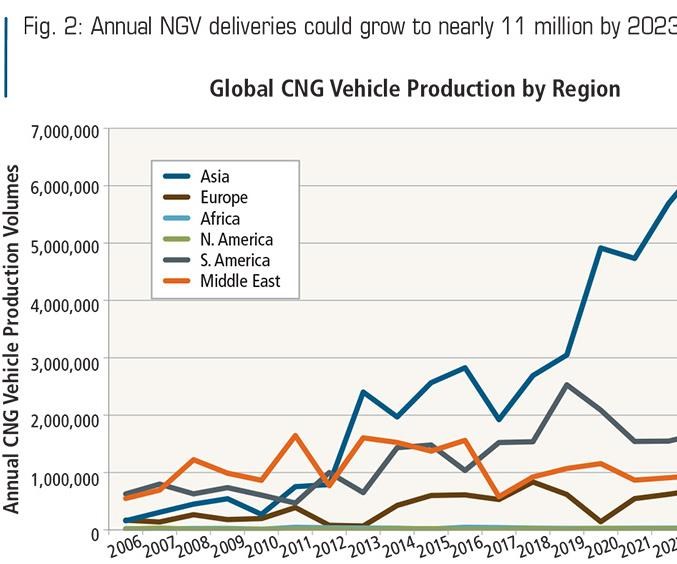

In 2013 alone, it is estimated that nearly 5.1 million NGVs were delivered to customers. By way of comparison, the general automotive industry manufactured about 87 million vehicles (of all types). Based on strong demand in Argentina, Brazil, China, India, Iran, Italy and Pakistan, NGV deliveries are expected to reach nearly 5.8 million vehicles in 2014 and could realistically grow to nearly 11 million per year by 2023. Vehicle types vary from country to country (see Fig. 2), but on the whole, about 94 percent of the total represents passenger vehicles; almost 4 percent are mass-transit buses and the remainder are medium- to heavy-duty trucks, forklifts and other industrial and commercial vehicles. Aggregately, over the 10-year forecast, there will be a market for 75 million NGVs. The vast majority of these, approximately 94 percent, are expected to be equipped with high-pressure (≥200 bar/≥2,900 psi) fuel storage systems. The balance will be equipped with liquefied natural gas systems, wherein the natural gas is cooled to cryogenic temperatures (-162°C/-260°F) for storage at relatively low pressure (4 to 5 psi/0.28 bar) in a liquid state.

Hydrogen fuels on the rise

Although CNG is commanding greater market share among global automotive OEMs, there has been a renewed push toward hydrogen fuel cell-powered electric vehicles (FCVs). Granted, past promises about the marketability of such systems were received with what was then well-deserved skepticism: If the predictions of policy makers and marketers had been accurate a decade ago, there would be more than 5 million FCVs on the road today (click on “The Markets: Fuel cells and batteries,” under "Editor's Picks," top right). In 2013, the actual number of transportation fuel cells delivered to customers declined to about 2,200 units, compared to approximately 2,700 units in 2012. Currently, the fielded fleet of FCVs around the globe stands at about 15,000, with a few hundred buses, trucks, and forklifts in commercial service. This situation, however, is beginning to change. Since 2007, 13 automotive OEMs have released FCV demonstrators and test fleets. These FCVs include the Chevrolet Equinox Fuel Cell, the Honda FCX Clarity, the Hyundai ix35 Fuel Cell, and the Mercedes-Benz B-Class F-Cell. Notably, in 2015, Toyota Motor Corp. (Aichi, Japan) expects to be the first company to offer a commercial FCV. Sales in Japan are expected to begin in April 2015 and open in Europe and the U.S. later in the year. Most importantly, Toyota won’t be alone. Hyundai is expected to follow suit, and Honda, Nissan, Ford, BMW and others plan to join them no later than 2017. These passenger-vehicle brands, combined with mass-transit buses and limited volumes of commercial trucks, are poised to make hydrogen-powered vehicles — finally — a reality.

Encouragingly, the number of refueling stations needed to support these vehicles is beginning to grow rapidly throughout Japan, Germany, the U.K. and other early adopters (the U.S. among them but, so far, only in California). Globally there are approximately 325 hydrogen refueling stations. Only 25 were added in 2013. During the next two years, however, Japan and California are planning to bring online a combined 100 new hydrogen refueling stations. Germany expects to add about 400 refueling stations by 2023. This analysis forecasts that at least 2,500 refueling stations will be operational globally by 2023. Using the CNG industry as a model, these hydrogen refueling stations have the potential to support between 10 million and 20 million vehicles.

Based on a fairly conservative view of how fuel cell manufacturing capacity will scale up, the number of new-build FCVs was expected to double this year compared to 2013, totaling about 4,000 vehicles. Despite this relatively small number as a starting point, it is plausible that annual production could climb to approximately 200,000 vehicles per year by 2023. This would create sizeable demand for high-pressure hydrogen storage tanks (CNG Type III, IV, and V pressure vessels, described in the sidebar, below, or click on "CNG tanks: Pressure vessel epicenter," under Editor's Picks").

In addition to the above, there is a compelling outlier: A number of small companies are developing products and technologies that could help existing operators of medium- and heavy-duty trucks convert their diesel engines to use either natural gas or hydrogen fuels. Truck operators would be offered systems that include new fuel injector systems, fuel storage and conditioning systems and new electronic control units. Adoption of such “retrofit kits” could enable owners of 310 million in-service medium- and heavy-duty trucks to meet increasingly stringent emissions requirements.

Value in gas transport

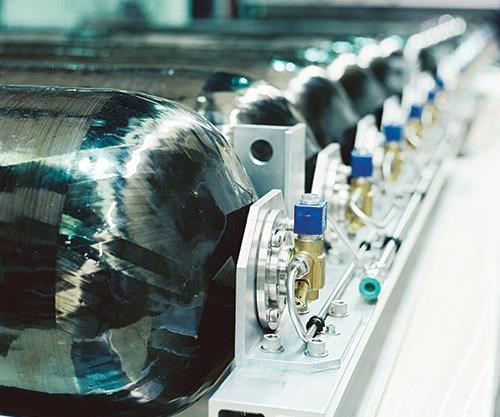

Gas transport systems also have been an area of recent new growth. These systems are designed either to transport gaseous fuels from stranded production fields or to deliver these fuels to markets in which building a pipeline transport system is not feasible. Compared to the tanks used in NGVs and FCVs (typically 30 to 200 liters/8 to 53 gal in capacity), this new generation of pressure vessels is much larger. The first to market, manufactured by Hexagon Lincoln (Lincoln, Neb.) under the trademark Titan, have an internal volume of more than 6,000 liters/1,585 gal (see the photo at left).

Development of gaseous fuel transport systems has been underway since 2006. Lincoln Composites opened its first dedicated facility for manufacturing these vessels in 2009. Initial certifications for the Lincoln products were awarded in 2010 and first customer deliveries followed soon thereafter. Other companies, Luxfer Gas Cylinders (Salford, U.K.), through its acquisition of Dynetek Industries in 2012, and Quantum Technologies Worldwide Inc. (Lake Forest, Calif.) among them, have developed similarly sized pressure vessel products.

Potentially bigger than the market for mammoth ground-transport cylinders is the prospect of shipping large volumes of CNG over the world’s waterways. Although gas transport ships equipped with carbon fiber composite containment vessels have not yet made it into service, there are several development teams engaged in active pursuit of this opportunity.

So what is bigger than mammoth? Imagine 100, 200 or more CFRP pressure vessels on a single ship — each vessel at least as large and, in some cases, several times larger than the Titan.

These types of vessels and transport ships are under consideration for a number of markets. Candidates include island nations in Asia, such as Indonesia, and coastal population centers around the world. Although such projects are still in early-stage design and development, this forecast includes the possibility that at least a few pressure-vessel-equipped transport ships will be commissioned to serve South American and island-bound markets.

Pressure vessel demand

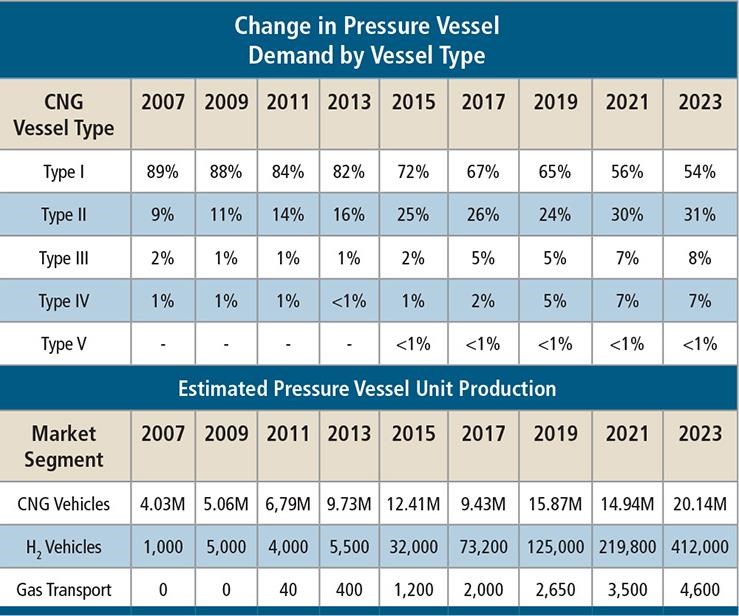

Over the past two years, this collective demand has prompted a dramatic increase in pressure vessel production numbers. Overall annual production (all vessel types) stood at approximately 5.5 million units in 2012, valued at $1.1 billion. With increasing demand in 2013, the global market rose to 9.7 million units, worth $2.3 billion. The rush in demand motivated a number of vessel fabricators to significantly expand their capacity — much of which became operational this year. By 2016, this analysis forecasts that production will approach 12.5 million pressure vessels and could grow to more than 20 million units by the end of the forecast (see Fig. 3). Over the entire 2014-2023 period, predicted production of pressure vessels represents about $45 billion in potential sales, broken down regionally as follows:

- Europe 14%

- North America <1%

- Asia-Pacific 61%

- Latin & South America 12%

- Africa <1%

- Middle East 12%

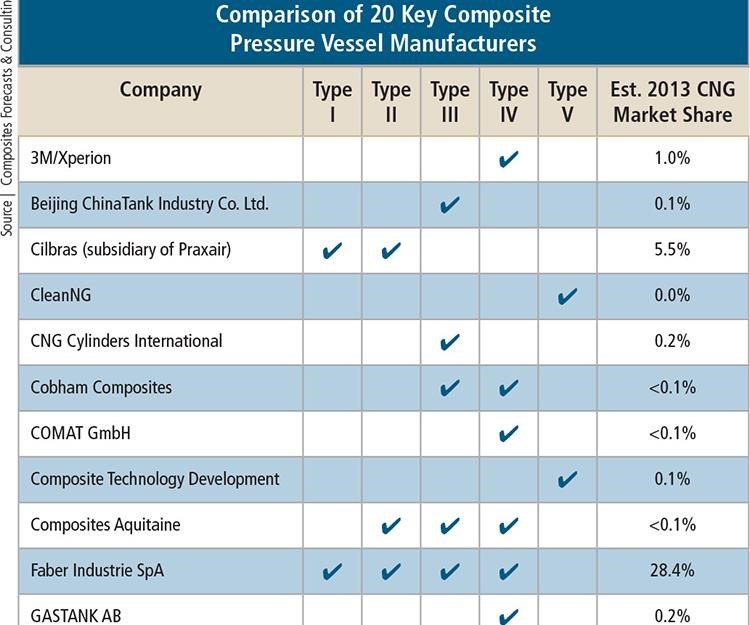

Our research into the activities of the world’s growing number of pressure vessel manufacturers uncovered some intriguing trends. A decade ago, only a dozen or so companies offered CNG Type III and Type IV pressure vessels. As the market has grown, so has the supply base. At least 30 companies now compete in this space. Further, many of them offer a wide range of products, suitable for virtually every conceivable vehicle application (see a sampling of this diversity in Fig. 4). Many new entrants are still, comparatively, quite small, but their formation nevertheless lends credence to the observed trend: clearly greater market acceptance of carbon fiber composite cylinder systems.

Doing the market math

The developing markets, which place heavy emphasis on passenger vehicles, continue to demand large volumes of CNG Type I and II (metal-centric) pressure vessels. But the number of all-metal Type I pressure vessels is only expected to grow at an average annual rate of about 3 percent over the forecast. Unit production volumes on the whole, however, are rising about 10 percent each year. That means the proportional market shares of vessels that incorporate composites — CNG Types II, III, IV and V — are growing at a much faster rate (see Fig. 5).

CNG Type III and IV vessels, which consume the greatest volumes of carbon fiber composites, are growing largely as a result of demand from OEMs of mass-transit busses and commercial trucks (Class 6 to Class 8). For these medium- and heavy-duty vehicles, the higher fuel density and low mass of these vessels can enable greater range and fuel economy, increase the operational interval between refueling stops, and help to reduce maintenance costs.

Historically, these high-performance pressure vessel types have been sold primarily into European, North American, and well-developed Asian economies. When the E.U.’s Euro 6 Standard went into effect earlier this year, the economics that support CNG- and hydrogen-powered buses and trucks became even more compelling and, therefore, should significantly expand the demand. In North America, the availability of shale gas now gives the operators of high-use, and formerly diesel-powered, vehicles a return on their $20,000 to $30,000 cost premium for their investment in CNG-powered vehicles in about one year. After that, the less expensive CNG enhances bottomline profit. South Korea, China, India, Turkey, Argentina, Russia and Brazil also are seeing a notable increase in demand for the Type III and Type IV vessels. This increase has been a boon to established pressure-vessel manufacturers and has provided the impetus for expanded domestic production.

Growing market for composites

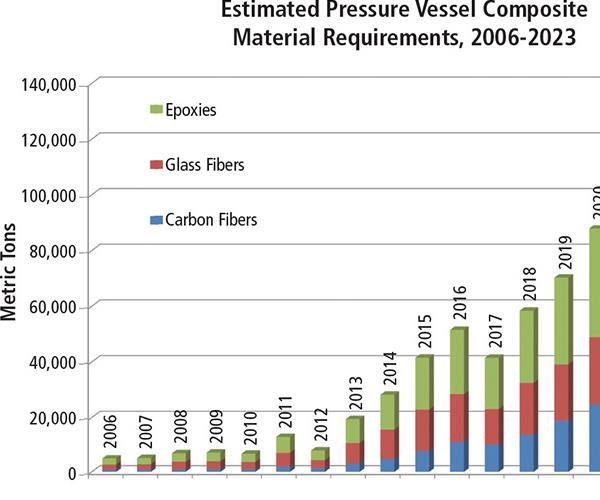

In step with the market for pressure vessels, demand for the raw materials necessary to produce those vessels is growing. Delivery of more than 150 million pressure vessels is forecast between 2014 and 2023. During this forecast period, vessel fabricators will need to procure approximately 15 billion lb (6.84 million metric tonnes) of raw materials to support the predicted production volumes. Of this total, about 11 percent will be composed of composite materials (epoxy resins and glass, basalt and carbon fibers, etc.).

During 2013, the estimated total volume of composite raw materials delivered to vessel manufacturers was 42.7 million lb (8,768 metric tonnes). Epoxy resin systems make up the largest component of this volume, at 45 percent. High-tensile-strength carbon fiber currently accounts for 15 percent, but as the pressure vessel market continues to move toward greater adoption of Type II, III and IV cylinders, carbon fiber’s relative share of the materials market is expected to grow dramatically. By the end of the forecast, carbon fiber is expected to account for as much as 26 percent of the materials total.

In applications where weight is less critical (for example, already small, lightweight passenger vehicles), for which the upfront purchase price is a significant issue, high-performance glass fiber and basalt fibers could see significant adoption. Despite their lower cost, however, glass and basalt fibers will co-own slightly less than a 30 percent share (see Fig. 6).

As a result, annual demand for raw carbon fiber will grow from 4,684 metric tonnes (more than 10.3 million lb) of fiber in 2014 to as much as 38,638 metric tonnes (nearly 85.2 million lb) by 2023 — an average annual growth rate of nearly 30 percent. Over the 10-year outlook, these figures equate to more than $12 billion in total composite raw material sales, including about $5.8 billion in carbon fibers (primarily 12K, 24K, and large-tow formats).

To keep up with demand, carbon fiber suppliers will likely need to add 30,000 metric tonnes (more than 66.1 million lb) of low-cost, standard-modulus, high-strength product. This is considered a key reason why Toray Industries Inc. (Tokyo, Japan) acquired Zoltek Corporation (St. Louis, Mo.) in 2013 and Mitsubishi Chemical Carbon Fiber & Composites Inc. recently announced plans to double carbon fiber production capacity at its existing site in Sacramento, Calif. Because much of the market demand for and many emerging suppliers of pressure vessels will come from South Korea and China, domestic fiber suppliers there will likely see considerable growth as well. If this analysis and its predictions are accurate, use of carbon fiber in pressure vessel manufacturing could rival carbon fiber use by fabricators in today’s leading segments for carbon composite applications: wind turbine blades, automobiles and aircraft.

Related Content

The state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreOpportunities and challenges for composites in electric vehicles

Polymer and material specialists at chemical consulting firm ChemBizR reflect on the role of composites in current and future efforts to make electric vehicles more efficient — and more attractive for consumers.

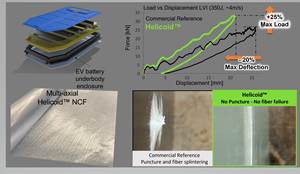

Read MoreHelicoid Industries releases three use cases of Helicoid technology

Use case applications with Helicoid technology implementation demonstrated mechanical performance improvements, such as impact resistance and strength.

Read MoreAptera reveals first composite production parts for BinC vehicle

Pre-production efforts are underway to begin building production-intent vehicles.

Read MoreRead Next

Fuel cells (finally) set to power composites growth

Fuel cells and related technologies will form a sizable new market as they move past the phase of demonstration projects, overcome longstanding technology hurdles and gain momentum in their progress toward affordability.

Read More

.jpg;maxWidth=300;quality=90)