Prepreg forecast: Strong growth through 2013

Prepreg applications are on the rise in the composites industry as manufacturers in a variety of industries increasingly adopt this versatile material. Today, prepregs find use in commercial aerospace, military/defense, general aviation, space/satellite, marine, sporting goods, automotive, civil engineering, wind

Prepreg applications are on the rise in the composites industry as manufacturers in a variety of industries increasingly adopt this versatile material. Today, prepregs find use in commercial aerospace, military/defense, general aviation, space/satellite, marine, sporting goods, automotive, civil engineering, wind energy and transportation markets, and more. Prepreg materials offer a number of advantages, compared to the metals that they are typically targeted to replace: higher specific stiffness and specific strength, greater corrosion resistance and faster manufacturing. Composite products made with prepreg materials can provide a higher fiber volume fraction than products made by other processes, such as filament winding or pultrusion. In addition, prepregs offer an extensive range of resin and fiber combinations, enabling the user to maximize performance. Further, prepregged fiber forms, ranging from advanced precision slit tape to woven and multiaxial broadgoods built with specific tack and drape, are being designed for tomorrow's low-cost manufacturing technologies — such as automated fiber placement (AFP) and out-of-autoclave (OOA) processing. OOA prepregs can enable a manufacturer to avoid capital investment in autoclave equipment and ongoing autoclave processing costs. Hexcel's (Dublin Calif.) trademarked HexPly M56, for example, is intended for aircraft secondary structures. Unlike traditional aerospace prepregs that must be autoclave-cured to achieve the required properties, this material is designed to provide similar quality and performance from a simple oven cure under vacuum. Available with woven carbon, unidirectional carbon tape, woven glass or metallic mesh reinforcements, the product is suitable for hand layup, automated tape laying (ATL) and AFP. A range of OOA prepregs also are available from Advanced Composites Group (Heanor, Derbyshire, U.K. and Tulsa, Okla.) — see "Learn More."

In 2007, total worldwide prepreg shipments exceeded 125 million lb (56,700 metric tonnes), up from about 60 million lb (27,215 metric tonnes) in 2002 and representing $2.2 billion (USD) in revenues. On a volume basis, the global market has doubled in five years, growing at a rate of more than 10 percent per year since 2002, mainly due to the booming wind energy market, the rapid growth of composites manufacturing in Asia and a strong aerospace industry in North America and Europe.

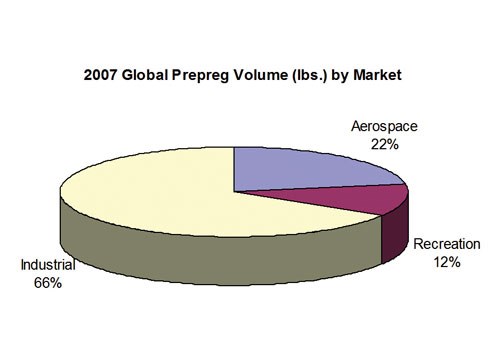

The industrial market, led by the wind energy segment, is the largest user of prepregs on a volume basis, accounting for roughly two-thirds of total shipments in 2007 and posting a 25 to 30 percent growth in that year alone. The aerospace industry is the second largest, followed by the recreational/sporting goods industry.

On a shipment-value basis, aerospace represents the largest market for prepreg, with an approximate 60 percent share of industry revenue, followed by the industrial and recreational/sporting goods markets.

From 2002 to 2007, the prepreg market's annual growth in terms of shipment volume averaged nearly 12 percent, led by the wind energy, commercial aerospace and general aviation markets. In terms of revenue, the wind energy, commercial aerospace and general aviation segments again led the growth of prepreg, both in the 2002-2007 period and in 2007 alone.

The prepreg market is growing rapidly in all regions. North America is the largest prepreg market, with more than 45 percent of the global market share, mainly because of huge demand in the aerospace market from both the commercial and military/defense sectors. North American demand for prepreg increased by 12 percent and 19 percent in terms of shipment value and volume, respectively, in 2007. The European prepreg market is ranked second, accounting for 35 to 40 percent of the global market share, and is similar to the North American market. Growth in Europe, Asia and Rest of World (ROW) during the last five years has consistently been in double digits. Although Asia and ROW together represented only about 12 percent of the global market in 2002, in 2007 they represented more than 15 percent with the highest regional growth rate, led by China and India, which have increasingly adopted prepregs for applications in wind energy, aerospace, civil structures, sporting goods and consumer goods.

On a global basis, prepreg market revenue is forecast to grow 13 to 14 percent in 2008 and average almost 12 percent per year during 2008-2013. Global prepreg shipment values are projected to grow to $4.4 billion in 2013 from $2.6 billion in 2008. This growth depends significantly on the performance of the commercial aerospace, military/defense, general aviation, wind energy and sporting goods industries, which represent 75 to 80 percent of the global market in terms of shipment volume and revenue.

In 2008, significant growth is expected in several markets: aerospace (especially commercial aerospace), military/defense and general aviation; wind energy in North America, China and India; marine in Europe; and civil engineering, particularly in China and India.

During 2008-2013, wind energy and commercial aerospace are expected to continue as growth leaders, with annual volume increases of more than 15 percent, followed by the general aviation and civil engineering segments, at 10 to 11 percent per year. Regionally, during that period, the North American prepreg market will see revenues grow at an average annual rate of 10 to 11 percent, while European revenues grow at a slightly faster rate — 11 to 12 percent. But the Asian region will post the highest annual rate — 16 to 17 percent.

Assuming these forecasts hold, Asia/ROW will have a market share of almost 20 percent in 2013, while North America remains the largest market, with a 40 to 45 percent share.

As this forecast indicates, many potentially valuable opportunities exist in the global prepreg industry. A number of manufacturers are opening new plants or expanding current facilities due to high demand, particularly in the wind energy and commercial aerospace markets. In response, prepreg suppliers are building new capacity to meet the increased demand. This trend is likely to continue as prepregs gain even more acceptance for use in various new aircraft models and emerging applications.

Related Content

Thermoplastic composites welding advances for more sustainable airframes

Multiple demonstrators help various welding technologies approach TRL 6 in the quest for lighter weight, lower cost.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreSulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

Read MoreComposite rebar for future infrastructure

GFRP eliminates risk of corrosion and increases durability fourfold for reinforced concrete that meets future demands as traffic, urbanization and extreme weather increase.

Read MoreRead Next

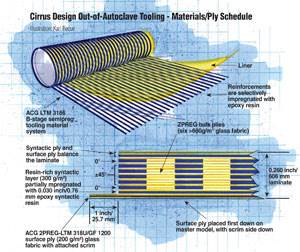

Out-of-autoclave tooling gets out of the blocks

General aviation aircraft manufacturer adopts new oven-cure tooling.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)