Interior innovation: The value proposition

OEMs and Tier suppliers ask materials and molding processes to go “green” and do more for less.

Body styling draws customers to auto showrooms, but what keeps them in cars, say industry insiders, is how comfortable and safe they feel within the cockpit. That’s why, after focusing on passenger car exteriors and convenience features during the 1990s, designers during the ’00 decade refocused on interiors, improving haptics (tactile sensation), damping road and engine noise, creating greater visual harmony inside the cabin, adding side airbags and collision-avoidance features, and providing more ways to sync with communication devices and data-delivery services (satellite navigation, satellite radio, cell phones, MP3 players, Internet access, etc.). As more features were dropped into the same package space, designs had to become more efficient, often by means of higher levels of parts integration and thinner wall sections. Additionally, automakers sought greater functional integration. For example, pillar trim, previously little more than dust covers, now plays an occupant-safety role.

Materials, therefore, had to work harder and provide the same level of long-term durability (10 years) as exterior components. Further, all cabin surfaces not only needed to match in terms of color, grain and gloss under a number of different lighting conditions when new, but they also had to fade at the same rate so they still would match a decade later — no mean feat, given the number of different materials used inside passenger compartments. Engineering tools also had to become more sophisticated to permit design closer to each material’s engineering limits. And finally, production processes had to show greater efficiency. All this to optimize cost and performance.

Recently, strong consumer and OEM interest in “green” technologies, such as bio-based monomers and natural-fiber reinforcements that reduce the vehicle’s weight, cost and carbon footprint, have converged with tough new European regulations on odor, fogging and volatile organic compound (VOC) emissions to increase pressure on interior designers. Expectations are that California will implement interior emissions standards for state-purchased vehicles, using what is known as Section 01350 standard testing, which imposes strict limits on material emissions. If implemented, California’s purchasing program could impact all passenger vehicles sold in North America (see “That 'new car' smell,” under Editor's Picks," at right).

These factors, coupled with immense pressure on all automakers to trim curb weight (to boost fuel economy) and maintain or reduce costs, yet respond to consumer demand for greater comfort, convenience and luxury, have opened tremendous opportunities for creative solutions based on reinforced plastics. The following are just a few of the innovative technologies that are already helping molders and their customers find solutions to the evolving needs in the vehicle-interiors market.

Versatile, no-VOC acrylic polymer

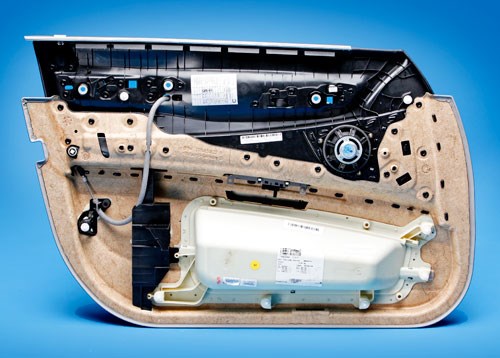

One of the most interesting new automotive-composite materials is a unique polymer that displays both thermoplastic and thermosetting properties. This behavior holds tremendous potential for improving performance, reducing weight and greening the interior. Called Acrodur by its inventor and producer, BASF SE (Ludwigshafen, Germany), this crosslinkable acrylic-latex copolymer has been used for a decade in Europe as, among other things, a high-performance, eco-friendly binder resin for nonwovens. Its newest use is as a matrix for highly reinforced, semistructural composites with excellent thermomechanical and physical properties (see "BASF launches ...." under "Editor's Picks"). In fact, its first commercial automotive use was on the ’08MY 7 Series luxury sedan from BMW (Munich, Germany) in natural fiber-reinforced door-panel inners molded by Dräxlmaier Group (Vilsbiburg, Germany). Acrodur was deemed distinctive enough to win top honors in the “Materials” category during the 2009 SPE Automotive Innovation Awards Competition last November. (Read more about that awards program online at http://speautomotive.com/inno.htm and http://speautomotive.com/awa.htm.)

Acrodur starts out as a solution polymer (dispersed in water) that is said to have an extreme affinity for binding with fibrous or particulate reinforcements because of its very low viscosity and its chemistry, which forms both mechanical and chemical bonds to reinforcements. It’s especially synergistic when paired with natural fibers because the resin not only coats but also penetrates the fiber shaft. Impregnated fiber mats are air- or oven-dried to a thermoplastic “B-stage” that allows thermoplastic prepregs and semifinished goods to be formed — this alone makes it an unusual material. When heat greater than 150°C/302°F is applied to the prepregs during molding (typically, in a compression-molding press), Acrodur’s acrylic and latex phases crosslink cleanly to form stiff yet ductile interpenetrating networks, producing parts with a very durable thermoset matrix, the only reaction by-product of which is water. (Several grades allow a range of ductility and stiffness to be achieved in molded parts.)

In composite parts, Acrodur is said to deliver a remarkable list of benefits. The combination of thorough wetout, with mechanical and chemical bonding, permits composites with very high loading levels. At 70 percent natural-fiber loading, the specific gravity of the composite is less than 1.0, so processors can produce very light, thin parts with excellent properties that will be maintained in the long term. In the case of natural fibers, fiber penetration reportedly enables fiber volume fractions as high as 90 percent. This means automakers can use natural fiber/Acrodur to replace short-glass-reinforced engineering thermoplastics and long-glass-reinforced polypropylene (PP), as well as composites made with other thermoset matrices (e.g., phenolic, epoxy, urethane and unsaturated polyester). At comparable wall thicknesses, Acrodur composites perform better. With thinner walls than the parts they replace, Acrodur parts can achieve comparable performance at lower weight and cost, especially at high fiber loadings.

The benefits extend to the environment. When it replaces thermosets, Acrodur eliminates the hydrocarbon solvents and VOC emissions that commonly devolve during crosslinking and subsequent part service life — a potential boon as cabin emissions standards get tougher. No emissions means no special air-handling equipment is required during processing to protect workers and the environment — a source of cost savings. Because Acrodur bonds so well with reinforcements, coupling agents (another source of composite VOC emissions) may not be needed — at least on natural fibers. And the ultrahigh fiber loadings that are possible with rapidly renewable natural fibers can reduce the vehicle’s carbon footprint without sacrificing performance.

The polymer also delivers practical manufacturing benefits, particularly in automotive interior parts. Processors have the option of achieving different part finishes in the same tool, ranging from those that have a continuous hard-plastic surface (with fibers buried like a conventional molded-plastic part — achieved at lower fiber loading) to parts that have a somewhat porous structure throughout the part thickness (typical at higher reinforcement levels where it’s truer to say you’re producing resin-impregnated fiber mats rather than fiber-reinforced polymer).

For unskinned parts, color options with this water-based system are said to be virtually limitless. For parts that subsequently will be skinned, such as the BMW door panel, the fact that the molded part can be formulated to be somewhat porous means that Dräxlmaier no longer needs to laser-drill holes in the laminate to pull a vacuum during postmold lamination of the panel’s skin/foam overlay. This, of course, saves process steps and cost.

This material already meets a lot of OEM requirements for interiors, so greater use of it inside the car and in geographies outside of Europe can be expected. However, in the longer term, it could prove even more interesting for vehicle exteriors, although further evaluation and testing will be required to verify this, says Gero Nordmann, BASF Acrodur market-development manager.

High-load wood fiber composite

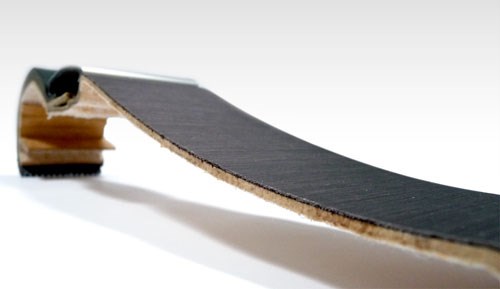

Tier 1 automotive supplier Faurecia (Nanterre, France) has developed several high-content, reclaimed-wood fiber composites for interior-trim components. Long used in Europe for interior-trim substrates, the company’s Lignotock family features 85 percent wood fiber with 15 percent phenol-formaldehyde (PF) binder resin, reducing weight and cost vs. conventional glass-reinforced thermoplastics while boosting sound-deadening performance. According to Jay Hutchins, director of Faurecia Interiors’ Marketing and Planning group, a newer, more ductile grade called Lignoflex uses only 70 percent wood fiber, plus an unusual pairing of 20 percent polyethylene terephthalate (PET) fibers and 10 percent PF binder. The PET fibers hold the wood fibers and PF binder together during initial production of a lofted mat (prepreg) and enables Faurecia to skip a subsequent preforming step that was necessary with earlier Lignotock products. Additionally, the PET fibers help prevent tearing of the fiber mat during molding, allowing designs with undercuts and deeper ribs/sharper radii than could be produced with earlier products. The PF binder crosslinks at molding temperatures of 200°C/398°F, leaving the PET fibers (which melt at 220°C/428°F) intact to contribute to better elongation in molded substrates. Typically used for door-panel inners, Lignoflex substrates are 40 percent less dense than conventional glass-reinforced thermoplastics and 20 percent lighter than standard Lignotock substrates, without sacrificing mechanicals. Because PF outgasses, Faurecia has developed two additional formulations in each family (called Lignotock Plus and Lignoprop, respectively) that feature BASF’s Acrodur for OEMs that want a lower-VOC option.

Lignoflex substrates can be bonded to hardwood veneers during compression molding (in a patented product/process called Ligneos) to form trim panels for the luxury segment that are lighter than conventional thermoplastic composites and offer the beauty of a real-wood surface. Another Lignoflex variant, called Ligneco, is a compression-moldable, A-surface wood fiber composite substrate designed with enough porosity to take a stain like wood and be used unskinned as the visible surface on door-panel inners. And just coming on the market now is a lower-density offshoot of Lignoflex, called Lignolight. Although the latter uses the same basic matrix/reinforcements as the former, this sheet-form composite is produced at a density of 1,400 g/m² instead of the 1,800 to 2,000 g/m² of Lignoflex, enabling compression molding of even lighter, thinner substrates. Of course, because all of these products make significant use of carbon-sequestering, reclaimed wood fibers, they also reduce the carbon footprint of vehicles that use their technology.

Reducing VOC emissions at the source

Given the tough new VOC, fogging and odor requirements for interior components in Europe — ISO/TS 16949:2002 (automotive) certification — and the possibility of tougher interior emissions standards in California, there’s a lot of activity among resin suppliers to find ways to reduce base-resin contributions as evidenced by new low-VOC grades now being offered by a number of suppliers. Unfortunately, says Louis Martin, director, Addcomp BV (Rochester Hills, Mich.), there are many pathways for the release of VOC emissions in molded parts, including residues left from base-resin polymerization, components of the additives package, plus postmold treatments like paint and adhesive bonding. His company, headquartered in Nijverdal, The Netherlands, is a supplier of stabilization and additives packages for PP-based long-fiber thermoplastic (LFT) and direct-LFT (D-LFT) composites widely used on vehicle interiors, as well as wood fiber, wood flour and natural fiber composites.

One avenue is to reduce impurities (trace contaminants) in the chemical building blocks that can become VOCs during processing. Addcomp has spent years working to reduce emissions in its additives packages by addressing coupling-agent purity, going so far as to purchase a maleic-anhydride-grafted polyolefin (MAGPO) technology developed by Solvay Specialty Polymers (Brussels, Belgium) and then manipulating both the chemistry and the manufacturing process to produce cleaner products designed to set new standards for purity, performance and low dosing levels. The company claims its Priex coupling agent is the only one now on the market that meets the ISO/TS 16949:2002 requirements.

Despite success in this area, Martin explains that the possibility of even tougher standards prompted the company to take the “next logical step” to reduce emissions in other components of the additives masterbatch, resulting in a similar and successful approach to stabilizers. However, all VOCs can’t be eliminated at the source, Martin explains, either because of technical challenges or because no supplier is willing or able to provide purer inputs. In such situations, a new strategy was needed, such as finding ways to reduce emissions elsewhere — in this case, the masterbatch. This led to work on the use of stripping agents and absorbents. These additives, respectively, capture and flash off (vaporize under heat), and permanently bind up, chemicals that otherwise would be emitted during compounding of the stabilization masterbatch and the base resin.

Research was conducted at Fraunhofer Institute for Chemical Technology (ICT) (Karlsruhe, Germany) using polypropylene supplied by Dow Chemical Co. (Midland, Mich.). The results showed that a new stripping agent that removes non-maleic-anhydride-based VOCs from the masterbatch via vacuum degassing during preliminary compounding was slightly better at defogging molded test specimens, while the absorbent was slightly better at reducing VOC emissions. Although the stripping agent only works during initial masterbatch compounding, that short time period is the critical juncture where VOCs can be controlled most easily. However, use of the agent would require compounders and D-LFT molders who compound at the press to equip their extruders with degassing units. In contrast, the absorbent should, theoretically, continue to be effective during subsequent molding and part service life, but that has yet to be verified by tests. Addcomp has not said whether it will make this technology commercially available, but it is said to be in discussions with customers about the degree to which VOC emissions in masterbatches need to be reduced. At the least, solutions exist and could be commercialized quickly if California raises the bar on interior emissions standards.

Eliminating paint in long-glass compounds

Paint is not only a source of VOC emissions — during initial part production and subsequent service life — but it also adds time and cost to part production, complicates recycling and is vulnerable to scratching. Much work by major thermoplastic resin suppliers, therefore, has focused on ways to eliminate the need to paint hard interior-trim surfaces. New grain patterns and pigment packages have been developed for polymers. These conceal scratches and even out blotchy surfaces common with glass-reinforced parts. Work also has focused on temperature control in the tool to produce resin-rich surfaces that help bury fibers. Although these efforts have brought success with short-glass thermoplastics, it’s been tougher to achieve with LFT and D-LFT parts, particularly in light colors, because the fibers are longer and loading levels are higher. As a result, parts made with these materials have tended, historically, to be restricted to nonvisible locations and traditional black color.

That seems to be changing, based on a growing number of commercial applications. For example, engineers from Ford Motor Co. (Dearborn, Mich.) point to the doorsill scuff plates on the ’08MY Ford Focus as their earliest unpainted first-surface, molded-in-color (MIC) LFT parts, injection molded by now-defunct Blue Water Plastics (Marysville, Mich.) using Celstran 20-percent LFT-PP from Ticona Engineering Polymers (Florence, Ky.). Jeffrey Helms, Ticona’s global automotive manager and former chief engineer of materials engineering at Ford, says this success encouraged Ford to use the same material and process for more challenging and more visible first-surface, single-bin overhead consoles for the ’08MY Ford Expedition and Lincoln Navigator SUVs. Here, it replaced talc-filled thermoplastic polyolefin (TPO), which had insufficient thermal stability for this above-the-belt-line application. Special UV stabilizers were added to help prevent color shift, and the part’s B-side was kept hotter in the tool than the A-side to ensure a resin-rich skin that concealed the fibers. The change brought improved appearance, reduced squeak and rattle, increased stiffness and dimensional stability under thermal loading and improved scratch resistance. So successful was the program that it was translated to overhead consoles on the ’08MY Ford F150 pickup and ’09MY Ford Flex CUV, and it now is proliferating across many additional platforms and finding use in double-bin overhead consoles.

An even more ambitious unpainted first-surface application was launched last year on the ’10MY Lincoln MKT CUV. Substantial left and right console side panels were converted from painted, glass-reinforced polycarbonate/acrylonitrile-butadiene-styrene (PC/ABS) to MIC LFT-PP. Injection molded by Automotive Components Holdings (ACH, Dearborn, Mich.), the textured panels show no fiber read-through, are 100 percent color-matched to the rest of the interior hard trim and offer higher stiffness than talc-filled PP. They did so at a lower cost than the engineering plastics they replaced. Additionally, Ford saved $6 per vehicle by eliminating paint and the need for squeak-and-rattle countermeasures.

Pelletized LFT compounds also are playing a more structural role in vehicle interiors, as seen in the center-console support on the ’10MY Buick LaCrosse luxury sports sedan from General Motors Co. (Detroit, Mich.). Molded by Grammer AG (Amberg, Germany), the part features a compound from SABIC Innovative Plastics (Pittsfield, Mass.) and is said to have been the first use of wire-coated LFT-PP to produce the structural element of a center-console module, which previously was produced in stamped steel. The switch from steel to a composite reduced weight, increased parts integration, saved assembly costs and eliminated the need to prime and paint this non-first-surface part to avoid corrosion.

Adding luxury without increasing costs

Cost is still king among automakers, but consumers have clearly said they won’t tolerate “cheap” at any price point. In response, OEMs are looking for cost-effective ways to add a luxurious look and feel via design details and soft-touch surfaces. “In most segments, you’ll no longer find the hard [unskinned] plastics that were common at the start of the decade,” says Faurecia Interiors’ Hutchins. “With OEMs continuing to make the interior a key selling point for their vehicles, higher quality features and premium materials are being used even on the B-car segment [subcompacts].”

An intriguing technology from Germany seems poised to increase productivity, improve haptics and reduce VOC emissions and costs even at low-to-moderate production volumes. Jointly developed by BMW, Fischer Automotive Systems GmbH (Horb, Germany) and Bayer MaterialScience (Leverkusen, Germany), the DirectSkinning process combines conventional thermoplastic injection molding of a hard substrate (e.g., Bayer’s Bayblend PC/ABS) with reaction-injection molding (RIM) of an integral, soft polyurethane skin (Bayer’s Bayflex LS). The process involves two steps but only one tool, making it a very effective method for producing an instrument-panel (IP) carrier or topper pad, center console, door trim or storage-compartment lid, the faces of which are completely or selectively covered with a soft-touch, UV-stabilized urethane skin. Much like two-shot injection molding with thermoplastic elastomers (TPEs) but with better haptics, DirectSkinning is more efficient than traditional multistep mold-then-skin processes. The method produces parts at lower cost, with less handling, helping reduce contamination and damage. Additionally, the high-quality, abrasion-resistant surface is free of plasticizers and halogens (common with vinyl skins), and it’s less costly than leather wrapping or slush molded/foam-in-place skins. The urethane’s low viscosity makes it easy to cover large parts with complex geometries (e.g., variable-foam-thickness transitions and corners with sharper radii) that would challenge other skinning technologies. Bayer’s David Loren, OEM key account manager for the company’s Automotive NAFTA business, says that a wide range of colors, textures and thicknesses are possible in a process that is highly reliable in a production but has a relatively small footprint. Grain, color and optics can be precisely matched to neighboring surfaces and the material meets European VOC emissions requirements.

Lighter, greener, greater value

There’s no sign that vehicle interiors will become less important anytime soon, and there is every indication that they will remain an important selling point in all vehicle classes. Accordingly, materials suppliers and processors of reinforced plastics will continue to be asked to provide more for less, building greater value and providing more product differentiation options. Fortunately, today’s production runs are smaller and automakers need to shed mass (particularly in forthcoming alternative powertrain vehicles, see “Quiet revolution,” under "Editor's Picks") and go green quickly, and consumers continue to crave onboard communications capabilities and greater luxury and increased comfort — all factors likely to fuel innovation. For automotive composites suppliers who weathered the recent recession, it holds the promise of economic revival.

Related Content

Carbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreThe making of carbon fiber

A look at the process by which precursor becomes carbon fiber through a careful (and mostly proprietary) manipulation of temperature and tension.

Read MoreComposite rebar for future infrastructure

GFRP eliminates risk of corrosion and increases durability fourfold for reinforced concrete that meets future demands as traffic, urbanization and extreme weather increase.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreRead Next

Quiet revolution: Composites in EVs

Startup automakers make use of composite body/chassis components to extend the range of hybrid-electric and battery-electric vehicles.

Read MoreThat "new car" smell: Sniffing out the regulatory trends

Environmental consultant Pat Hooper contends that growing concern about auto interior air quality is the elephant in the room that the composites industry can't afford to ignore.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)