Graphene: Ready for prime time?

Advanced materials analyst Ross Kozarsky (Lux Research, Boston, Mass.) evaluates the commercial readiness of graphene-based nanomaterial reinforcements for the composites industry.

Driven by remarkable science, such as the 2003 work by University of Manchester professors (and Nobel laureates) Andrew Geim and Kostya Novoselov, who used pencil-quality graphite and regular adhesive tape, graphene has been touted as the next material wunderkind for the better part of the past decade due to its exceptional mechanical, electronic and thermal properties. Many companies are looking to capitalize on its commercial potential, including leading startups XG Sciences (Lansing, Mich.), Vorbeck Materials (Jessup, Md.) and Angstron Materials (Dayton, Ohio), and corporate behemoths such as Posco, Cabot, Samsung Electronics, Sony and IBM. However, one look at the rocky history of carbon nanotubes (CNTs) shows that the current research and patent boom is — despite impressive technical achievements — far from a guarantee of commercial success. Major challenges loom large.

It is important, first, to distinguish between two very different forms of the material: graphene nanoplatelets (GNPs) and graphene films. GNPs are discs of graphene, one to hundreds of atomic layers thick, and graphene films are uniform, usually monolayer sheets of graphene. GNPs made by XG and Angstron use liquid-phase exfoliation and thermal treatment, but newer startups are touting less expensive, yet unproven, ways of treating mined graphite or coal. Most monolayer films are made via chemical vapor deposition (CVD). GNPs are best suited to carbon filler applications, e.g., as an additive to enhance conductive properties for EMI shielding or electrostatic dissipation (ESD). The conductivity, transparency, elasticity and mobility properties of graphene films offer significant innovation opportunities in applications such as transparent conductive films, filtration, and high-performance electronic devices — but most also pose significant cost and processing hurdles.

As graphene’s leading players continue scale-up efforts and aim to benefit from economies of scale and corporate partnerships, they must learn from the trials encountered by CNT pioneers. Specifically, as graphene developers seek to gain traction outside the lab, they will be faced with major commercialization challenges, including high cost. Despite the efforts of a slew of developers, GNPs average about $150/kg today, and monolayer graphene films cost $100,000/m2 (supplied on copper foil). These costs might not be an issue for very high-end uses, such as high-frequency transistors, but significantly lower-priced but “good enough” materials, such as carbon black and indium tin oxide, will impede the penetration of graphene into conductive fillers and transparent conductive films.

Despite forecasts of big cost reductions from economies of scale and automation, reliable low-cost processes still are not in place. Another hurdle is to prevent GNP agglomeration when dispersed in resin. What’s more, graphene must not only displace incumbent options but also compete with other emerging advanced materials in target markets, including multi-walled CNTs (MWNTs), metallic nanowires and nanoclays

At Lux Research, we built a detailed model to assess graphene’s market penetration, taking into consideration historical adoption rates, costs, market requirements and input from interviews with key technology developers along the entire value chain. Based on the modeling results, we forecast that the aggregate graphene market, for all applications, will post a compound annual growth rate (CAGR) of 40 percent, from $9 million in 2012 to $126 million in 2020. GNPs will contribute the bulk of demand. However, a host of recent capacity expansion announcements — e.g., Ningbo Morsh Technology Co. Ltd.’s (Cixi City, Zhejiang, China) ambitious plan to scale up to 300 metric tonnes (661,349 lb) per year — threaten to throw the space into oversupply. That’s anathema if developers are to become profitable.

Composites and energy storage will duke it out for GNP market supremacy through the end of the decade, reaching $32 million and $30 million, respectively, in 2020. In particular, we anticipate conductive EMI and ESD applications, as well as consumer electronics Li-ion cathode additives, to be particularly solid fits for the material. In composites, specifically, MWNTs are appealing from the standpoint of higher specific strength and modulus, but GNPs are more easily dispersed than MWNTs in a resin and have a much smaller effect on resin viscosity at any given conductivity level.

If the market is to move forward and leverage graphene’s exceptional properties, the key drivers will be novel forms and processes — making the material more three-dimensional, with a greater surface area, for example, or combining graphene with other novel materials. GNPs combined with diamond or CNTs can produce hybrids with an ever-broader spectrum of potentially achievable properties and applications. In the long run, if the multifunctional capabilities of the material (modulus, electrical and thermal conductivity, transparency, impermeability and elasticity) can be combined in an economical and scalable manner, graphene may yet serve as an enabling platform to further adoption of novel composites.

Related Content

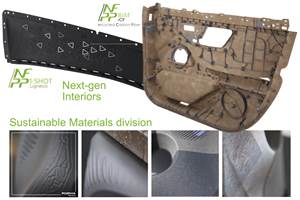

Faurecia advances biocomposites, recyclability, reduced CO2 and sustainability in automotive

Efforts include advancing NAFILean materials family in weight reduction and sustainability, as well as new Sustainable Materials division and R&D Center.

Read MoreLufthansa Technik, Diab develop greener composites for interior cabin components

Aeroflax flax fiber-based prepreg and one-step thermoplastic manufacturing process for 100% recyclable panels production pioneer lighter weight, reduce CO2 emissions.

Read MoreBMW unveils new M4 GT4 race car, features most natural fiber parts for GT series to date

Bcomp ampliTex and powerRibs technologies make up bodywork components such as the hood, front splitter, doors, trunk and rear wing and several interior components, taking next steps for future production models.

Read MoreThermoset-thermoplastic joining, natural fibers enable sustainability-focused brake cover

Award-winning motorcycle brake disc cover showcases potential for KTM Technologies’ Conexus joining technology and flax fiber composites.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)