Follow the leader — or maybe not

The easy explanation for lack of proliferation of carbon composites is the “not invented here” syndrome.

In June 2013, I posed the question whether any other automotive OEM would follow BMW’s (Munich, Germany) lead in capturing the entire carbon fiber composites supply chain, as the company has done for its i-Series and, more recently, its flagship 7-Series, with the Carbon Core concept. Three years later, the answer seems to be a resounding “no.” Based on my observations, replication by additional OEMs doesn’t appear to be on the horizon, either. Does this suggest that BMW may have erred in this endeavor?

I don’t think so. The drivers for making vehicles lighter have not changed. Because others don’t quickly follow, many innovations take a lot of time to proliferate, or to be adopted by competitors. I’ve spent a lot of time with the folks at BMW the past two years, visited their composites manufacturing lines, and it’s clear they have learned much that is difficult to replicate without actually living through the experience.

The “intelligent lightweighting,” as I have termed the Carbon Core concept indigenous to the 7-Series platform, certainly arose out of BMW’s experience on the i3 and i8 platforms. The rumored i5 vehicle is likely to have more metal and fewer composites than the other i-Series vehicles, yet will be both weight and cost-effective, if produced. BMW is still fine-tuning the balance between composites and metals.

The BMW example is far from unique. Glass-reinforced phenolic disc brake pistons were first introduced in the US market between 1968 and 1970 as a replacement for steel pistons. They managed to gain significant traction in the US during the following two decades, but European OEMs would not embrace the idea. In the mid-1990s, I was calling on European brake systems companies, many with US affiliates that used phenolic, trying to convince them that there was a quarter century of empirical evidence in support of composite pistons, but I kept hearing excuses: “Our speeds are much higher” or “Our mountains are too steep.”

Granted, Germany did have, on average, roads with higher speed limits, but the highest paved mountain road in Europe is in Spain at 3,384m/11,102 ft, and phenolic pistons had demonstrated superior performance to steel in the US on descent from Pikes Peak in Colorado, with a top paved elevation of 4,300m/14,110 ft. It wasn’t until the late 1990s that General Motors’ (Detroit, MI, US) European subsidiary, Opel AG (Rüsselsheim am Main, Germany), began using phenolic pistons, and they continue to gain market share in Europe. It only took about 30 years for this to happen. Conversely, there are numerous composite components on European vehicles that have never made the transition to US or Japanese platforms.

Aerospace has similar stories. The Airbus (Toulouse, France) A320-200 made its first commercial flight in 1988 with a fully composite empennage. Seven years later, The Boeing Co.’s (Chicago, IL, US) 777 flew with a similar construction. This was relatively quick by comparison to the auto brake piston example. The time span between the first flight of the carbon fiber fuselage on the Boeing 787 and the similar Airbus A350 was only three years and three months. By any account, this is exceptionally fast. However, the first FAA-certified, carbon fiber pressurized fuselage appeared on the Wichita, KS, US-based Beech Aircraft Starship in 1989, delivered fully 22 years before the first commercial flight of the 787. While the Starship was not a long-term commercial success, the technology has been well proven — and there are a handful of registered aircraft still operated by private owners. For those well-versed in aerospace history, this technology was first demonstrated on LearAvia’s (Reno, NV, US) all-composite LearFan 2100 in 1981, although that aircraft was never certified, due to problems unrelated to the composite components.

The easy explanation for this lack of proliferation is the “not invented here” syndrome, and, to be sure, that plays a big role. Leadership at various companies define materials strategy in different ways, and every engineer needs to be certain that a design will meet required performance parameters. Perhaps an alternate approach to that pursued by BMW can achieve the same result — a number of automotive OEMs have established close relationships with carbon fiber suppliers and Tier 1 molders, each of which will have to make large investments to fulfill volume requirements. Whether this strategy enables each OEM to meet the required emissions or fuel-economy requirements in a timely fashion remains to be seen. In aerospace, Bombardier has already taken the leap, using carbon fiber wing structures on its CSeries single-aisle aircraft. Will Airbus and Boeing follow? So far, the response by both has been to aggressively price the A320 and 737 to keep Bombardier at bay. But long term? I’m guessing they will follow. Eventually .…

Institute for Advanced Composites Manufacturing Innovation (IACMI)

Related Content

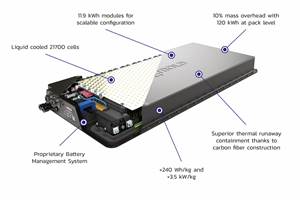

Troubleshooting thermal design of composite battery enclosures

Materials, electrical insulation and certification are all important factors to consider when optimizing electric battery performance against potential thermal runaway.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreProtecting EV motors more efficiently

Motors for electric vehicles are expected to benefit from Trelleborg’s thermoplastic composite rotor sleeve design, which advances materials and processes to produce a lightweight, energy-efficient component.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More