CW Business Index at 50.4 – First growth in two months

Steve Kline, Jr., the director of market intelligence for Gardner Business Media Inc. (Cincinnati, OH, US), the publisher of CompositesWorld magazine, outlines the results of the CompositesWorld Business Index survey for June 2015.

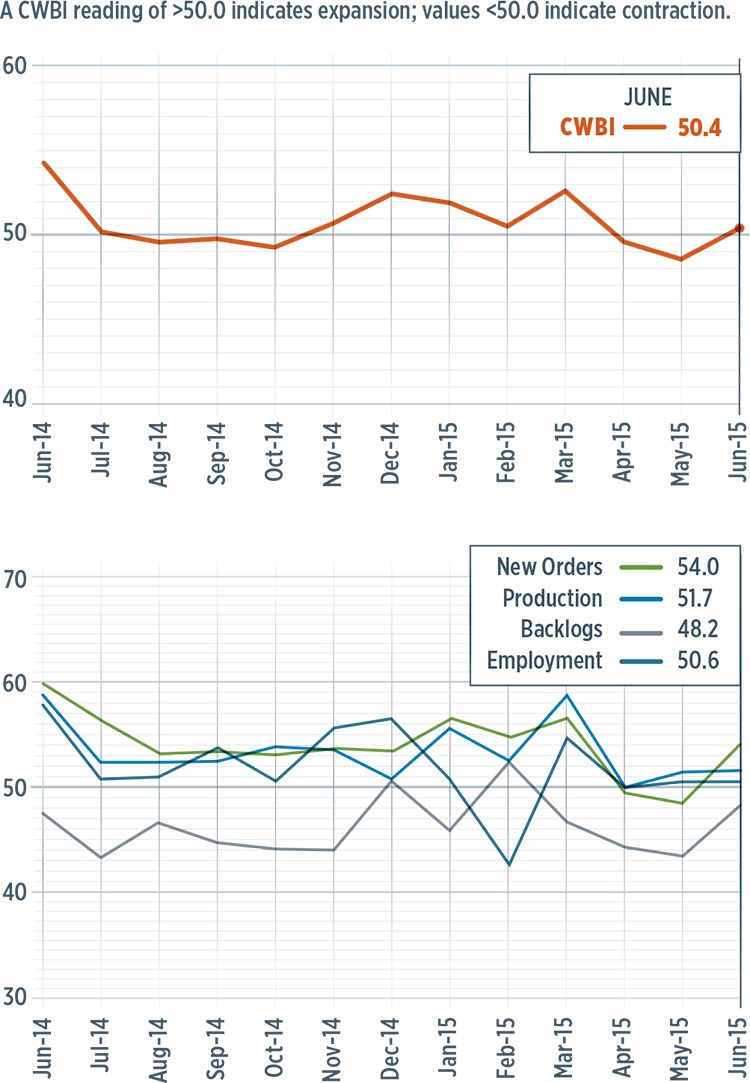

With a reading of 50.4, the CompositesWorld Business Index for the US composites industry in June indicated expansion for the first time since March 2015. The rate of growth was slower than the growth recorded from November 2014 to March 2015, but at least the industry was growing again. The Index had been at its lowest level in May since August 2013. And compared with one year earlier, the Index for June, despite the uptick, continued to contract. On an annual basis, the US industry contracted in June at an accelerating rate for a second month.

A dramatic improvement in new orders was the key reason for the shift to growth from contraction in the overall Index. New orders had contracted at a moderate rate the previous two months. But in June new orders grew faster than its average in the previous year. Production moderately expanded in June. The rate of increase was unchanged from May. As a result, the backlog subindex contracted at a significantly slower rate in June. In fact, a slight uptrend in the backlog index has been tracked since February 2015. This was a sign that capacity utilization at US composites fabrication facilities should improve soon. Employment in June was essentially unchanged for the third month in a row. Exports contracted for the 12th straight month. The rate of contraction had generally accelerated since December 2014, which correlates with very strong growth in the value of the US dollar. Supplier deliveries lengthened at one of their slowest rates of 2015.

Since March, material prices had increased at a generally accelerating rate. However, the rate of increase in material prices in June was still less than at any time since November 2012. Prices received were unchanged in June after decreasing in May. Prices received had increased from December 2014 through April 2015. Future business expectations improved somewhat in June from May — they were about 5% above their historic average but also near their low to that point in 2015.

In May, all but the largest US composites fabricator categories contracted. In June, however, all but the smallest facilities group showed increases. Plants with more than 250 employees expanded for the second month in a row. Companies with 100-249 employees expanded for the third time in four months. Plants with 50-99 employees expanded for the second time in four months as did fabricators with 20-49 employees. All of these plants grew at a similar rate in June. Fabricators with 1-19 employees contracted for the fourth month in a row. The rate of contraction had been fairly consistent in all four months.

Regionally, the US Southeast was, by far, the fastest growing in June. In fact, its subindex was the second highest ever recorded for any region since the CWBI survey began in December 2011. The region expanded for the third time in four months. The North Central-East expanded for the sixth time in seven months, and the West also grew, but did so at a very modest rate. The South Central was flat in June after contracting sharply in May. The Northeast contracted in June for the sixth time in seven months. The North Central-West contracted at a very significant rate and for the second time in three months.

In June, future capital spending plans expected in the coming 12 months were less than 50% of their historic average. Compared with one year earlier, future spending plans had fallen off by 66%. June was the fourth month in a row those plans had contracted by at least 27%.

Related Content

Novel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreJEC World 2022, Part 3: Emphasizing emerging markets, thermoplastics and carbon fiber

CW editor-in-chief Jeff Sloan identifies companies exhibiting at JEC World 2022 that are advancing both materials and technologies for the growing AAM, hydrogen, automotive and sustainability markets.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.JPG;width=70;height=70;mode=crop)