Composites in sporting goods: Been there, done that?

Dale Brosius, a regular CW columnist and head of his own consulting company, which serves clients in the composites industry worldwide, wonders if market saturation been reached for advanced composites in the once dynamic sporting goods sector.

I started playing tennis in 1972. I paid around US$10 for my first wood-framed racquet. I managed to get good enough to make my high school tennis team in Houston, TX. I played recreationally in college and for several years after that, and then dropped the sport when I moved to Detroit, MI, in 1984. Along the way I upgraded racquets, each time opting for the latest wooden versions — the aluminum racquets didn’t feel right, and the early carbon fiber models that hit the market near the end of this period seemed too expensive and unproven.

Fast forward to 2008, when I decided to pick up the game again. Every racquet available was fashioned from carbon fiber, and there were multitudes of choices. I settled on a model from Wilson, which I have upgraded twice, since then, with the latest versions. I still own the last wooden racquet I purchased and have played with it for comparison. There is no comparison — my carbon fiber versions are so much better, offering a great balance of power and control. During the intervening 24 years, I also picked up golf and am now on my second set of clubs with carbon fiber shafts. (Like most carbon fiber sporting goods, the material was billed as “graphite”). I also became a snow skier and am on my fifth pair of composite skis. All of this makes me a repeat customer in multiple sectors of the composite sporting goods market. I made each iterative purchase because I believed the new models would improve my skill level and, for the most part, that has been true.

But I’m beginning to think that, as a consumer, I am the exception rather than the rule when it comes to sporting goods rate of acquisition. After earning a reputation for several decades as the most dynamic market for composite materials, the sporting goods sector’s growth rates of late have become rather anemic by comparison. Ten years ago, the quantity of carbon fiber used in sporting goods was equal to that used by all industrial applications combined and more than twice that used in the aerospace industry. In 2014, however, industrial applications are expected to consume four times the fiber used in the sporting goods industry, and the aerospace sector exceeded sporting goods consumption several years ago. Chris Red, principal of Composites Forecasts and Consulting LLC (Mesa, AZ, US), forecasts growth rates of 11% and 12%, respectively, for industrial and aerospace applications out to 2020, with growth rates of only 4% for all consumer applications, which includes sporting goods and the faster-growing electronics segment. And I have seen one other forecast for sporting goods that predicted a decline in carbon fiber consumption between 2010 and 2020!

What can one read into this data? Has market saturation been reached in the sporting goods sector? Is the noted durability of composite materials partly responsible for the slower growth rate because fewer consumers have a need to replace broken equipment? Is what people already own “good enough” for the frequency and competition level at which they participate? One possible explanation is that improvements in performance today are, at best, incremental. I can recall in the 1990s, the introduction of a number of new high-modulus, high-strength carbon fibers that were immediately rolled out to market into high-priced and higher performance fly-fishing rods — to great fanfare. Golf shaft designers quickly took advantage of these new fibers to adjust nuances like torque and flex points. Driven by growing popularity of cycling races like the Tour de France, carbon fiber bicycles saw numerous innovations in the 1990s and 2000s, in materials and fabrication methods. These were times of rapid innovation. Today, however it seems like minor changes are promoted as major ones. In tennis, Wilson introduced a small amount of basalt fiber into some racquets a few years ago, and this year Head has introduced a racquet with a layer of graphene in the handle. Good for advertising? No doubt. Improved performance for the average player? That might be a bit more subjective.

Increasing regulations in sport also might be stifling innovation. In motorsports, Formula 1 teams were early and eager to adopt carbon fiber, then higher-modulus versions, at any cost. Other racing formats began to incorporate composites, but today, each motorsport class has restrictions in place to prevent “richer” teams from dominating. Competitive cycling and sailing also have various restrictions relative to equipment design. These limits also might be damping growth.

Who knows? Here’s what I know: Wilson has just introduced a new line of tennis racquets, a couple of which incorporate braided layers of carbon and aramid in addition to unidirectional carbon. This very afternoon I will be trying them out, looking for the next edge on the courts. It’s been 2 years since I last purchased a racquet — time for an upgrade.

Related Content

Novel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

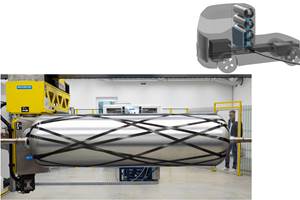

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More