Composites in Class A body panels: Evolution continues

Low-density SMCs lead the way as fiber-reinforced polymers make headway in auto components that must please the eye.

Class A is a qualifier for the surface finish of automotive body parts. For composites, it means that flatness, smoothness and light reflection is equivalent to that attainable with steel, and indicates the part’s ability to compete with metal in paintability or as-molded cosmetics. How a part achieves Class A finish impacts body-in-white (BIW) assembly and coating processes — for example, can the parts be painted in-line or must they be painted offine and attached beyond the body shop? These differences, quantified in seconds, scrap rates and dollars, ultimately define a model’s bottom line.

Composites have been used in Class A automotive parts since the 1940s, but their use has seen significant swells and setbacks (see "Innovation Driving Automotive SMC"). Current market projections agree that car models in the foreseeable future will use multiple materials — including high-strength steel, aluminum and fiber-reinforced composites — to comply with regulations for reduced fuel consumption and emissions.

Class A remains a requirement for car closures (e.g., fenders, hood, trunklid/decklid, roof, doors, quarter panels), and also a challenge, as OEMs seek to use composites to navigate not only lightweighting, but also global supply, modularization and demand for an increasingly multifunctional vehicle envelope. A big question is, which composite materials and process options will meet these requirements?

Aluminum as target

According to a June 2016 presentation by IHS Markit (London, UK) automotive forecaster Michael Robinet, closure manufacture will shift to aluminum from steel by 2022-2023, and then to CFRP and other composites before 2030. This change in materials bodes well for suppliers and fabricators of fiber-reinforced sheet molding compound (SMC). “Our competition in SMC used to be other molders,” says Mike Siwajek, director of R&D at Continental Structural Plastics (Auburn Hills, MI, US), a manufacturer of parts using SMC and other composite materials. “Now we compete head-to-head with aluminum on weight, cost and surface finish.”

Notably, CSP has received many awards for its low-density TCA Ultra Lite SMC with a specific gravity (SG) of 1.2, in production on the General Motors (Detroit, MI, US) C7 Corvette. The tooling cost for SMC is much lower than for steel or aluminum stamping, offering as much as a 50% reduction. “This gives CSP’s molded SMC parts a cost advantage on Class A parts up to 150,000 units per year,” he explains. “Above that volume, the cost advantage goes away, but we are still on par with metal.”

Cost parity at high volume is a powerful asset, says Siwajek. “OEMs are trying to take platforms global vs. having a different model for each continent.” Economies of scale are achieved by making the same parts worldwide, and SMC augments this advantage. “For example, three to five dies are required for a stamped steel part,” he explains, “but with SMC, only one tool is required, greatly reducing the investment needed for global supply.”

Another aspect of this trend is to build fewer, globalized platforms, but increase the number of model variants, each specialized to meet different customer demands per region and age group. “For example, in the late ‘90s/early 2000s, Mustang had five to six different hoods for models, offering styling and performance tweaks, like the Mach 1, the Shelby, etc.,” Siwajek explains. “SMC helps to do this very cost-efficiently.”

“We’re also starting to get into different geometries where metals struggle,” Siwajek adds, “for example, in liftgates and doors, where we can produce fully assembled components to reduce complexity and weight.” One of CSP’s initiatives is benchmarking current designs and products, answering key questions: “Where can we save weight and provide value? How can we provide relief where OEMs are having issues?” He offers, for example, a part comprising a magnesium inner and an aluminum outer. “There are distinct disadvantages to these materials,” Siwajek argues. “They aren’t as dimensionally stable, which causes issues during painting and assembly. They also pose a significant risk for galvanic corrosion.” He says CSP is working with multiple OEMs to move away from metal. “Many are afraid of putting SMC through the E-coat process at temperatures above 210°C, thinking that ‘plastics’ won’t handle it. But our TCA parts do that, no problem.”

Competing composites

SMC, however, is not the only composite under consideration, as carmakers pursue multi-material designs for lightweighting. Reinforced thermoplastics and carbon fiber composites also have evolved, although not everyone is convinced of their performance in Class A applications. Michael Polotzki, managing director for SMC compounder Menzolit GmbH (Turate, Italy), sees two reasons why thermoplastics are not as competitive for Class A body surfaces. “First, the thermal elongation is two to three times higher than SMC,” he explains, “which makes it very difficult to meet tolerance requirements, especially on larger parts. Second, the stiffness of the part is not high enough so that you have to add reinforcing structure. This adds cost, weight and production complexity.” Polotzki also asserts it is difficult to incorporate ribs and struts into thermoplastic parts without seeing these print through to the visible surface.

But thermoplastics might be developing new support with carbon fiber. Gary Lownsdale, president of Trans Tech International (Loudon, TN, US) and a 50-year veteran of the automotive and composites industries, sees the trajectory of carbon composites in automotive moving toward thermoplastic resins for two main reasons: fast processing for <2-minute cycle times, and the ease of injection molding compared to resin transfer molding (RTM). “Injection molding is now a very well-understood and well-controlled process,” he explains. “It is easy to model the parts and simulate the process with readily available software. It is also a high-pressure process, which helps with complex shapes and consistent quality.” What about high-pressure RTM (HP-RTM) using thermoset resins? “HP-RTM is reaching toward injection molding,” says Lownsdale, “but there are still many unknowns.”

Lownsdale rebuffs the issue of print-through in thermoplastics, noting that it remains a concern for SMC as well. “There are techniques to overcome this, like using a thin veil against the tool,” he acknowledges. “Another solution is gap molding, where they bring the press down and then back it off just enough to allow a resin-rich surface before closing the press to finish molding.” Lownsdale also sees some molding limitations. For example, he believes fenders are not as well-suited to SMC, “because they are much more complex in shape.” He also points out that some SMC molders still struggle with paint defects.

CSP and Menzolit say they have overcome these problems, adopting Industry 4.0 data analysis to drive part defect and scrap rates close to zero (see the Side Story to this article titled, "SMC 4.0"). Polotzki says the “paint pop” issue is well known with SMC (see "SMC resin and primer advances prevent paint pops"). “We advise the molder to use in-mold coating (IMC) technology and avoid these problems.” He says IMC closes the material surface, eliminating pinholes. “It costs a little bit more, but the result is much better. It enables electrical conductivity in the surface so that these parts can go through inline painting.”

Siwajek says European OEMs have continued to have some issues with painted SMC, but notes they also have taken different approaches. Some OEMs have brought parts molding in-house, while others have used hybrid systems that feature a thermoplastic outer with an SMC inner. “The problem is such parts have to be painted outside of the factory, handled carefully as they are shipped into the assembly line and then attached after the E-coat process, which adds complexity, cost and risk.” Siwajek notes that one of his company’s highest volume jobs currently is the Jeep Wrangler roof (see the opening photo, above) for Fiat Chrysler America (FCA, London, UK). “It is a unique application because it has a Class A surface on both the inside and outside of the part. We make up to 900 of these per day.”

Carbon fiber SMC

Looking ahead, the demand for lightweighting will prompt serious efforts to incorporate carbon fiber reinforcement into SMC. “We are working on several projects looking at carbon fiber in SMC for serial applications,” says Polotzki. “However, at the current price of carbon fiber, this will only be used in niche products, such as high-end and premium cars.” What price would enable use of carbon fiber SMC in mass production vehicles? “Below €11/ kg [US$5.3/lb],” Polotzki replies. “Then it makes more sense as a means to reduce density, wall thickness and, thus, weight.”

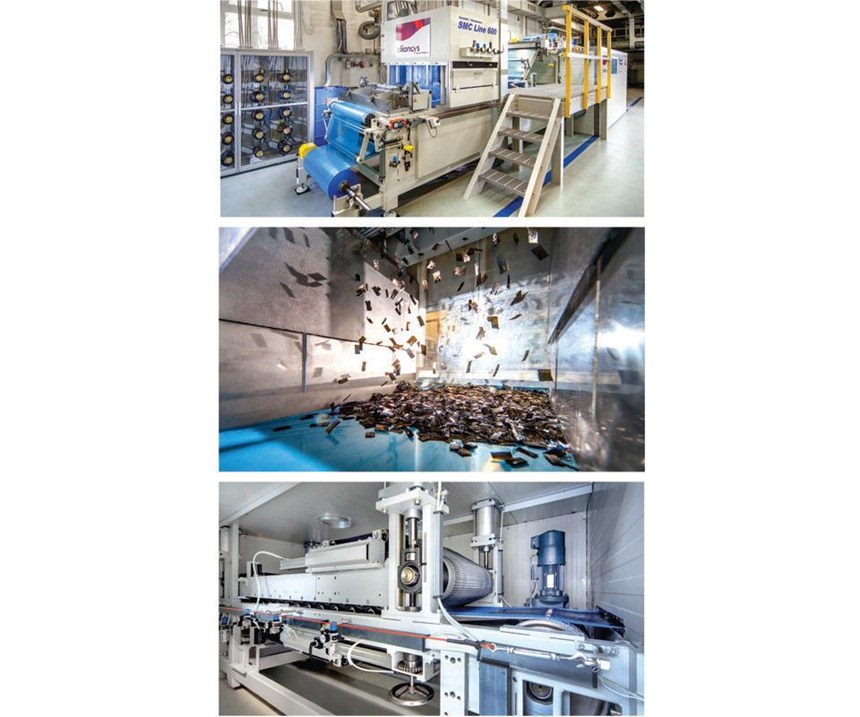

Menzolit’s partner in applications for automaker Daimler AG (Stuttgart, Germany), Aliancys AG (Schaffhausen, Switzerland), also has moved forward with carbon fiber, installing a new SMC line at its R&D facilities in Zwolle, The Netherlands, for trialing a full range of SMC products with customers. “We have made the development of carbon fiber-based solutions a key priority in our long-term strategy,” says Aliancys CTO Paul Vercoulen.

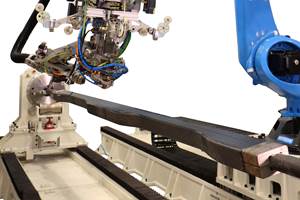

Magna Exteriors (Concord, ON, Canada) was recognized by the Society of Plastics Engineers (SPE, Bethel, CT, US) this past October for the first compression-molded carbon composite hood on a production vehicle. The bonded, two-piece hood for the 2016 Cadillac ATS-V and CTS-V sedans uses fast-curing carbon fiber/epoxy prepreg. Six plies of 50K uni carbon fiber are used for the outer panel, and a fabric weave is used for the inner panel, both from Barrday Inc. (Millbury, MA, US). The hood weighs 27% less than an aluminum version. Robotic preform and material loading processes reportedly help drop cycle time below 10 minutes, enabling volumes up to 30,000/year. The hoods are painted, with an option for exposed weave on the inner panel.

Magna’s above announcement followed its launch of EpicBlendSMC EB CFS-Z, an SMC developed using Zoltek Corporation’s (St. Louis, MO, US) Panex35 commercial carbon fiber, compounded at its Grabill, IN, US, plant and available for sale to other molders. Initial applications were structural. All Magna Exteriors composites operations were acquired by CSP in July 2014, making CSP the world’s largest SMC fabricator.

“Our approach is to put carbon fiber where it makes sense,” says CSP’s Siwajek, “for example, using hybrids with glass fiber where the carbon is for reinforcing structures. rough design, you can get the best bang for your buck, and achieve unique, cost-effective solutions.”

Polynt Composites Germany (Miehlen) has offered CF-SMC since spring 2016, targeted initially to structural applications but with Class A products in development. “Our Polynt RECarbon products are reinforced with recycled carbon fiber mats,” says product development manager Nicole Stoess. “We also offer Polynt SMCarbon (3K-50K) SMC in both epoxy for autoclave processing, and epoxy and vinyl ester SMC for compression molding.” She notes further that “several, well-known European automotive companies have expanded their use of CF-SMC significantly enough that Polynt has recently added a new 1.5m-wide SMC machine, fully dedicated to customized carbon fiber materials.”

Covering all the composite bases

“What I see for 2020-2025 models is hybrid materials,” says Lownsdale, who clarifies, “not just combining steel with aluminum and CFRP, but a combination of thermoplastics, thermosets and carbon fiber.” He notes, as an example, a decklid using injection molded thermoplastic for the outer panel and RTM’d CFRP for the inner panel, adding, “This approach works in hoods and roofs also. Processes that never appeared to be similar, we can now combine.”

CSP also has produced a Class A panel with RTM CFRP inner, but this one with a TCA Ultra Lite SMC outer, developed by its European R&D group. “They won a 2016 CAMX award for this multi-material decklid which uses recycled carbon fiber material,” Siwajek relates. “They reworked a traditional SMC part to cut weight by 13% vs. aluminum.” The parts were molded in less than 3 minutes using a fast-cure epoxy resin from Hexion Inc. (Columbus, OH, US). “These low-cycle-time resins put RTM on par with SMC,” claims Siwajek, noting that TEIJIN ARAMID BV (Tokyo, Japan) recent purchase of CSP is increasing his company’s access to a range of new fiers and thermoplastics.

Indeed, fast-cure resins and the HP-RTM process were developed specifically to deliver low-cycle-time composite auto parts, making them more competitive with metals. Although originally developed with polyurethane and epoxy, HP-RTM using thermoplastic resins is now an option, as are hybrid processes that combine thermoforming and overmolding — injection molding thermoplastic on top of the molded composite substrate (see "HP-RTM on the rise").

Another trend is a move by traditional neat plastics molders into structural composites. A case in point is Plastic Omnium (Île-de-France, France), the world leader in plastic auto exteriors. It turned out 27 million bumpers, 5 million front-end modules, 1.2 million tailgates, 1.5 million fenders and 1 million spoilers in 2015 — and made 3 million composite structural parts, touting abilities in thermoplastics and thermosets as well as development of carbon fiber and smart materials. Introduced in 2013, its hybrid thermoplastic/composite Higate tailgate integrates a Class A long glass fiber-reinforced polypropylene (LGF PP) outer with SMC inner. Used on Peugot, Range Rover, Jaguar and Citroën models, Higate also is the company’s first composite tailgate in China for the Roewe E50 electric vehicle.

This ability to mold parts across a spectrum of materials and processes is also being embraced by new entrants into automotive composites. In 2015, Tier 1 auto exhaust/emissions control specialist Katcon (Santa Catarina, Nuevo León, Mexico) launched Katcon Advanced Materials (KAM) at its headquarters near Monterrey. Offering composites design and manufacturing for lightweighting vehicles in a new 9300m2 facility, KAM’s full range of processes includes thermoforming, injection molding and light RTM. It was reportedly the first North American company to install an HP-RTM machine (supplied by ENGEL, Schwertberg, Austria) fitted with polyurethane (PUR) injection technology (from PUR processing machinery specialist Hennecke, Sankt Augustin, Germany). In 2016, KAM licensed “crush core wet-pressing technology for Class A surface” from Magna Exteriors (Graz, Austria). A modification of composite spray molding (CSM), the method combines sprayup and compression molding with robotics and fast-cure PUR resins. Magna demonstrated the process in a pre-production hood with a Class A surface, using a paper honeycomb core and carbon fiber fabric or glass mat faceskins sprayed with resin and cured in a heated tool and compression press. The cured part was demolded, trimmed and placed again in a compression mold, where vacuum resin injection molding (RIM) added an outer PUR skin for Class A finish (see "Processing within the PUR cure window"). The two-step process was completed in 8 minutes, and the part was painted offline.

Modularization and multifunctionality

Already a trend in the 1990s, Tier 1 suppliers continue to advance their ability to integrate parts and deliver complete front end, roof, door and tail/liftgate modules. One example is Magna’s all-thermoplastic (and recyclable) tailgate for the 2014 Rogue crossover utility vehicle (CUV), which combines a painted thermoplastic polyolefin (TPO) outer with a molded-in color, 30% reinforced LGF PP inner. The module includes tail light system, rear window, electronics and spoiler into a single unit, delivered to the Nissan assembly line, reducing space, workers and time for the OEM. The part also cut weight 30% vs. stamped steel and claimed a 35% lower cost outer vs. SMC due to reduction in and reuse of scrap.

Plastic Omnium’s Higate composite tailgate integrates lights, antennae, motorization and crash protection at low cost and 25% less weight than steel, as fitted to the Peugeot 308. A variant prototype switched the SMC from glass to carbon and, despite adding aerodynamic spoilers and side deflectors, still cut weight 10% vs. an aluminum design (Fig. 2, above). Polotzki agrees with the benefit of SMC in this type of integration, adding, “We are working with several OEMs and Tier 1 suppliers as they develop new products using SMC for decklids and roof modules because it enables radiolucent parts with antennas embedded,” says Polotzki.

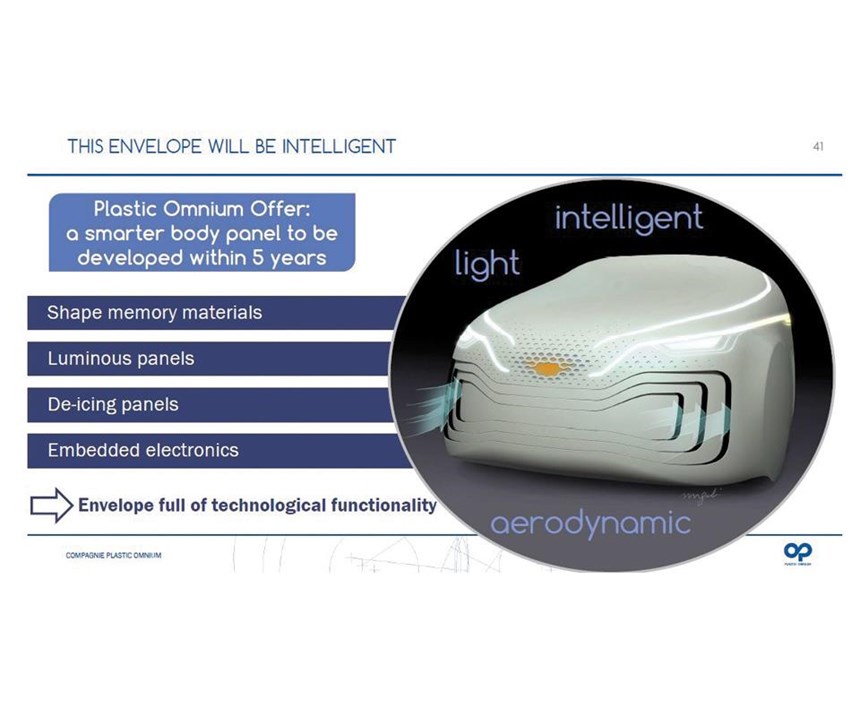

In its December 2016 Investor Day presentation, Plastic Omnium asserted that the future vehicle envelope will be intelligent. The company said it will offer a lightweight, smart material body panel system within five years (Fig. 3), aimed at integrating more functions.The Tier 1 supplier also will partner with OEMs to develop integration of and efficient architectures for complex interactive modules. One function already desired by car owners and demonstrated in a three-year research program is electrical energy storage.

Next steps for SMC

Siwajek acknowledges the trend toward body panel multifunctionality, including energy generation and storage, but envisions a longer development timeline. “Embedded circuitry is pretty far down CSP’s development pipeline,” he cautions, “but we’re looking at graphene and other nanomaterials. If we can boost conductivity and get additional functions like energy storage and protection against electromagnetic and radio frequency interference (RFI, EMI), that’s great, but we still have to meet Class A and cost requirements.” He adds that CSP will pursue these types of developments with an OEM as a partner, noting that such partnering is happening much more often. “We have several projects right now, where OEMs have brought problems to us and we are working together to develop solutions, sharing labs, data and resources.”

For the present, the big issue continues to be weight reduction. “The next opportunity for SMC is to further reduce density while maintaining part stiffness,” says Polotzki. Ashland Performance Materials (Columbus, OH, US) has released results from new 1.1 and 1.0 SG density SMC product development which show no compromise in surface quality, while Core Molding Technologies (CMT, Columbus, OH, US) is promoting its 0.98 SG Hydrilite SMC. This offers a 17% reduction from its 1.18 SG Airilite and Econolite products. A full Class A version of Hydrilite is still in development. “With an ongoing need for lightweighting solutions, no doubt our customers will continue to request further reductions in density, which we will strive to achieve,” said CMT VP marketing and sales Terry O’Donovan. And no doubt the quest to make these work in the Class A vehicle envelope of the future will continue as well.

Related Content

MFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More