Composites 2014: A multitude of markets

The effects of the Great Recession linger, but aren't holding back growth — the composites industry is definitely on the mend and riding an upward trend.

Although the effects of the 2008 global financial downturn are still felt, the composites industry, in general, is on the mend. Market research firm Lucintel (Dallas, Texas) estimated that the total value of the world’s composite materials sector in 2012 was $7.3 billion, a 9.5 percent jump over 2011, and predicted that number will grow to $10.9 billion by 2018, which represents a 7 percent compound annual growth rate (CAGR). Lucintel also said in early 2013 the composites market will recover to prerecession levels in 2014 and identified several markets that are “underserved.” These markets include medical technologies, pressure tanks, offshore oil and gas structures/piping and, in the construction industry, rebar for concrete and commercial and residential window frames.

Published, in October 2013, The Freedonia Group’s (Cleveland, Ohio), newest Fiber-Reinforced Plastic Composites report, says demand in the U.S. for composites will escalate 4.7 percent per year and reach 4.3 billion lb (1.95 million metric tonnes) in 2017, valued at almost $23 billion. Market advisory firm Infiniti Research Ltd. – TechNavio (Rockville, Md.) on the other hand, reported in November 2013 in its Global Composite Market 2013-2016 study that the market for composites worldwide could be valued at $28.34 billion as early as 2016.

Although the numbers differ, there is agreement on one thing: The industry is growing.

Growth standouts

According to The Freedonia Group, glass fiber composites will again dominate the field, by some distance, and polyester resins will provide most of the matrices. Motor vehicles and construction will lead the markets surge, at 6.1 and 6.8 percent growth per annum. Automotive composites, alone, will consume 1.38 billion lb (625,960 metric tonnes) and construction applications will demand almost 1.24 billion lb (562,450 metric tonnes).

Globally, the BRIC countries (Brazil, Russia, India and China) will continue to get cmposites industry press. China will continue to be a leading force, racking up significant growth over the next five years to reach an estimated $11.5 billion in 2018. That according to Lucintel’s Growth Opportunities in the Chinese Composites Market 2013-2018 study, which indicates that major composites consumers, such as the construction, transportation, and electrical and electronics markets experienced good growth in 2012. The report says, surprisingly, that the largest consumer of composites materials in China was the electrical/electronics sector, followed by the pipe and tank market. Aerospace and defense, marine, and the electric/electronics segments are expected to maintain healthy growth in the 2013-2018 timeframe.

The “B” in BRIC, Brazil stalled a bit in 2013 overall, but its composites industry reported revenue of $365 million for the third quarter, 3 percent higher than its second quarter figure and 8.1 percent higher than in the same period during 2012, reports the Latin American Composite Materials Assn. (ALMACO, São Paulo, Brazil). In total, 118.16 million lb (53,600 metric tonnes) of raw materials were processed from July to September, 2.3 percent higher than that reported previously and 4.4 percent higher than in third-quarter 2012. The data are from market researcher MaxiQuim (Porto Alegre, Brazil), a consulting firm hired by ALMACO.

Agribusiness, construction and wind power were the segments responsible for the positive result, says Gilmar Lima, president of ALMACO. “These markets tend to keep the same trend in the following quarter,” he notes, predicting that their increases “should even offset the decline in demand from the automakers of buses and trucks caused by uncertainties in the economic scenario in 2014.”

According to MaxiQuim, the consumption of raw material reported in the fourth quarter of 2013 could be as high as 199.27 million lb (54,100 metric tonnes), valued at $371 million (USD). For the year, the indicators pointed to the conclusion that the Brazilian composites industry should report total revenue of $1,425 billion (+8.9 percent) and total composite raw materials production of 462.97 million lb (210,000 metric tonnes), representing a (+1.6 percent).

“We remain with the perspective of a year with growth, marked only by the loss of competitiveness and profitability of the entire production chain caused by the devaluation of the Brazilian currency and the cost increase in Brazil,” reported Lima.

Notably, there is enormous potential for growth in the global market. According to Lucintel, composites still own only very small percentages of four of the six largest markets served, compared to competing steel and aluminum. Composites have historically done best in the marine market despite its ups and downs, with 68 percent of the total. In wind energy, where composites got in on the ground floor when the market was a newcomer, composites own 38 percent of the wind turbine market. But in transportation, pipe and tank, construction and consumer (including sporting) goods, composite materials have netted, respectively, only 3.6, 7, 4, and 14 percent. All observers agree on one thing: That will change.

Horizons in sight

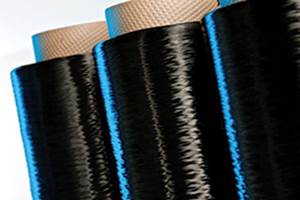

Despite the tendency for promising market applications in the composites industry to remain on the horizon — never quite within reach — the future, overall, bodes well. Aerospace, wind energy and now automotive gains in this decade have proven that persistence pays. Continued trends toward automation, streamlining of composite manufacturing methods and continued development of new material forms should make composites more user-friendly — not to mention more cost-effective — encouraging their use in greater quantities in existing markets and making them even more attractive to new industrial and consumer-driven markets. Greater availability of key materials, such as carbon fiber, and the resulting stability in their pricing will encourage OEMs to take prototypes into production. Proponents of composites, technologies that show their truest value in lifecycle cost analysis, have always taken the long view. As they already know, and a growing number of their satisfied customers are finding out, those sometimes-distant horizons are always within reach.

Some market data for this report was sourced from:

Growth Opportunities in Global Composites Industry 2013-2018, Lucintel (Las Colinas, Texas), March 2013. Contact Lucintel, Tel.: (972) 636-5056; E-mail: helpdesk@lucintel.com.

Growth Opportunities in the Chinese Composites Market 2013-2018, Lucintel (Las Colinas, Texas), March 2013. Contact Lucintel, Tel.: (972) 636-5056; E-mail: helpdesk@lucintel.com.

MaxiQuim (Porto Alegre, Brazil); Tel.: +55 51 3328.1078; Web site: www.maxiquim.com.

Global Composite Market 2013-2016, (Novmber 2013), Infiniti Research Ltd. – TechNavio (Rockville, Md.), Tel.: (630) 333-9501; Web site: www.technavio.com.

Fiber-Reinforced Plastic Composites, (October 2013), The Freedonia Group (Cleveland, Ohio); E-mail: info@freedoniagroup.com.

Related Content

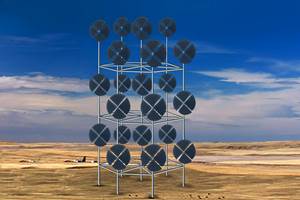

Drag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreMaterials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)