Carbon Fiber: UP!

Despite 2008-2009 recession lows, prognosticators at CompositesWorld's recent Carbon Fiber Conference predict a decade of highs.

The carbon fiber market has not been immune to the global recession. Demand for this most expensive and, therefore, most watched high-performance fiber appeared unstoppable through 2007 and into early 2008: The first Boeing 787 Dreamliner was nearing completion. Airbus, after two misfires, had successfully pulled the trigger on preproduction sales for its A350 XWB. Wind energy and other end-markets were gearing up to consume more of this highest of high-performance fiber. And carbon fiber manufacturers, to worldwide industry applause, responded with a series of capacity expansion announcements. But since then, demand has declined. In 2008, the first of a series of technical and supply-chain management problems beset the 787 program, contributing, ultimately, to almost two years of production delays. In parallel, the gathering storms of recession damped demand in markets everywhere. As the economic slump bottomed out in 2009, carbon fiber manufacturers put off or slowed expansion plans.

Those who follow the carbon fiber market, therefore, converged with some uncertainty in December, at CompositesWorld's recent Carbon Fiber 2009 conference, wondering how carbon fiber supply and demand might fare once the recession runs its course. But the consensus at the annual gathering (Dec. 9-11, San Diego, Calif.) was that both supply and demand will resume their upward trajectories.

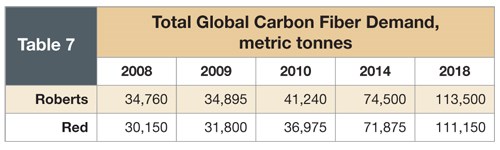

The message was delivered forcefully by co-presenters Chris Red, VP and editor at Composite Market Reports (Gilbert, Ariz.), and Tony Roberts, principal of AJR Consultant (Lake Elsinore, Calif.). Red and Roberts each outlined forecasts they had developed independently in a “tag-team” format. Although they differed in their predictions for some end-markets and the assumptions on which their figures were based, their data were, in general, more notable for congruence than divergence. (See their market figures and projections at right.)

Carbon fiber supply

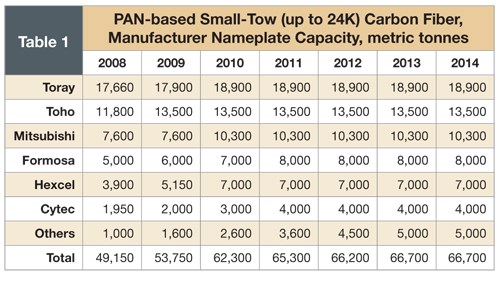

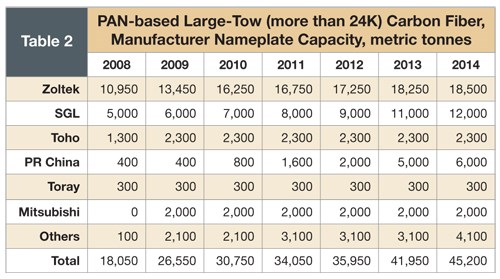

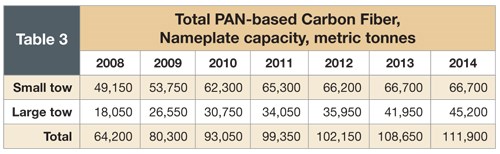

Estimating carbon fiber supply is an inexact science, primarily because not all carbon fiber suppliers share data about current and planned capacity. Because of this, conference attendees were told that although there was some uncertainty in the figures, the overall trends and totals are accurate enough to provide a good general sense for how the market could be expected to evolve. The forecasts were based on PAN-based fiber, by far the largest category of carbon fiber product, and therefore of greatest interest to most attendees. The data were categorized by fiber tow size. Small tow encompassed products up to 24K fiber, and large-tow data covered those products larger than 24K.

Figures for small-tow carbon fiber were broken out individually for major suppliers — Toray Industries Inc. and Mitsubishi Rayon Co. Ltd. (both based in Tokyo, Japan), Toho Tenax Europe GmbH (Wuppertal, Germany), Hexcel (Dublin, Calif.), Cytec Engineered Materials (Tempe, Ariz.) and Formosa Plastics (Taipei, Taiwan). Total nameplate capacity for small-tow PAN carbon fiber in 2009 was about 53,750 metric tonnes (almost 118.5 million lb).

Major suppliers of large-tow fiber include Toray, Toho, Mitsubishi, Zoltek Corporation (St. Louis, Mo.) and SGL Carbon SE (Wiesbaden, Germany). Nameplate capacity for large-tow in 2009 totaled ~26,550 metric tonnes (> 58.5 million lb).

Post-recession growth will be driven by the same forces that have propelled the carbon fiber market thus far: lightweighting, particularly for increased fuel efficiency in public and private modes of transport; the potential to reduce product lifecycle costs; and what is expected to be a gradual, global conversion to alternative energy sources. By 2014, Red and Roberts estimate that small-tow nameplate capacity will grow to 66,750 metric tonnes (nearly 147.2 million lb). Large-tow nameplate capacity will be about 45,200 metric tonnes (close to 100 million lb) by 2014. (For annual breakouts by manufacturer, see Tables 1 and 2.) Actual yield of usable fiber will be less because of the knockdown effect - wasted out-of-spec material as compared to nameplate capacity. Red and Roberts said that the knockdown varies quite a bit by tow size but averages about 30 to 35 percent, meaning 65 to 70 percent of the nameplate capacity is marketable.

Carbon fiber demand

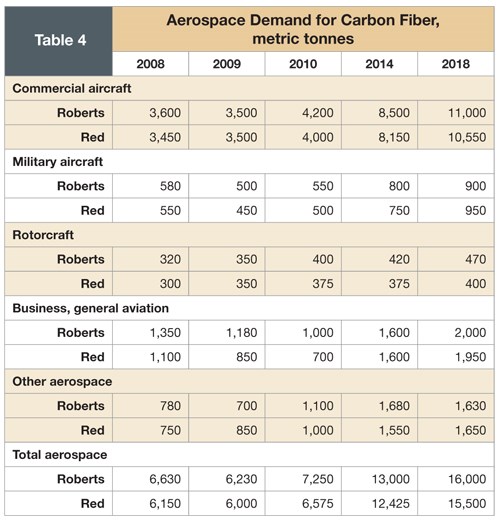

Demand for carbon fiber will be led, as it has been for the past few years, by aerospace applications (see Table 4). Beyond the midsized, twin-aisle 787 and A350 XWB, there are single-aisle aircraft in development or early production that promise to make significant use of the material as well. This list includes regional jets, such as the Bombardier Dash-8, the Canadair Regional Jet 100, the Embraer 190/195, and Mitsubishi's MRJ. Bombardier also is working on the CSeries aircraft, based on a 110-seat design concept that will compete, in part, with Boeing's 737 and the Airbus A320. In his keynote address, Jens Hinrichsen, president of Aerospace Advisory Group LLC (New Alexandria, Pa.) weighed factors that will influence the extent to which carbon fiber is practical for construction of smaller commercial transports. His conference comments are condensed in the sidebar below.

Suppressed during the downturn (not least by the storm of negative press unleashed when GM auto execs deplaned in Washington, D.C., to plead poverty and beg bailout funds), the business jet market is nevertheless poised to prosper in a global recovery. More than 80 unique models that make use of carbon fiber composites in primary and secondary structures are in production or scheduled for certification during the 2009-2018 time period.

With the exception of the canceled F-22, military aircraft programs will continue to consume much carbon fiber, led by the F-35 Lightning II, which is still in its System Development and Demonstration phase and is yet to ramp up to full production. Red told conference attendees that he thinks “the days of manned fighter aircraft are over, following development of the F-35.” He believes that emergent unmanned aerial vehicles (UAVs) are the future of military combat airships. If Red is right, then aircraft developers unhindered by pilot-safety issues will be more free to adopt new materials and manufacturing techniques, a scenario that favors selection of carbon fiber-reinforced polymers.

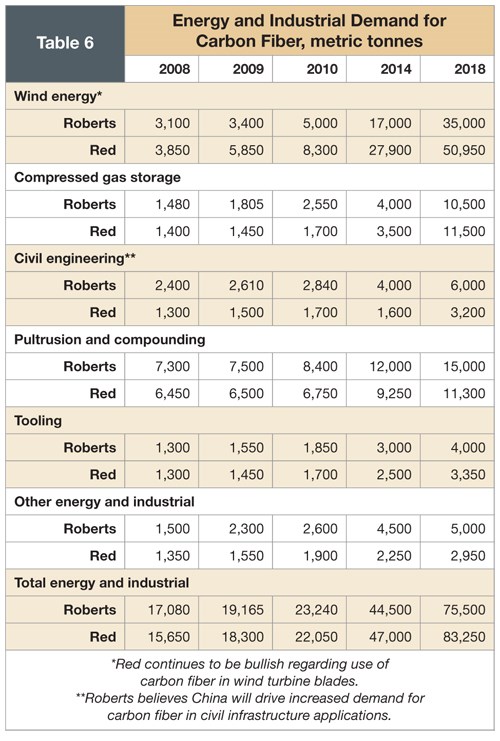

Although Roberts and Red disagreed about how much carbon fiber will be consumed in wind turbine blades (see Table 6), they agreed that the wind energy market shows particular promise. By 2014, Red expects more than 50,000 metric tonnes (110 million lb) of the fiber will go into blades each year. A more conservative Roberts posits 35,000 metric tonnes (77 million lb) for wind blades annually, by 2014. Conference speaker Steven Kopits (Douglas-Westwood, New York, N.Y.) contributed additional insight into the future of offshore wind farm development (see sidebar).

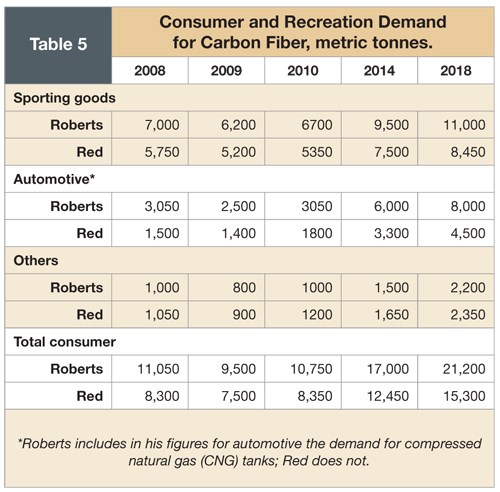

Both look for carbon fiber to make inroads in composite pressure vessels for storage of compressed natural gas (CNG) for CNG-powered vehicles. Aiken, S.C.-based composites industry consultant Malcolm Rosenow highlighted demand for carbon fiber in the natural gas vehicle (NGV) market (see sidebar). Carbon reportedly also has a future in ultrahigh-pressure hydrogen storage tanks, which eventually will feed fuel cell-based electric power systems in vehicles and stationary structures. In 2006, less than 200,000 composite pressure vessels were manufactured. But by 2018, that number is expected to increase to 1.3 million units per annum.

Conspicuously absent from the glare of the Carbon Fiber 2009 spotlight were three large markets that, thus far, have eluded what composites proponents have long hoped would be star status. In the automotive industry, carbon has earned a niche in the supercar segment where its high cost isn't a deterrent to sales. But current economic woes, which have hit automakers especially hard, and a long history with part-per-minute metal-stamping technology, have limited the bulk of auto composites to glass-reinforced plastics for select underhood, support-structure and interior apps and, in limited quantity, glass-reinforced sheet molding compounds (SMCs) in body panels. Likewise, civil engineering (e.g., bridges and other infrastructure) and the oil and gas industry have been resistant to carbon, in part, because they, too, tend to be change-averse and find greater comfort, in their highly regulated environments, with legacy steel and concrete technologies. These realities are reflected in their comparatively low 2008-2009 annual totals (Tables 5 & 6). Nevertheless, presenter Brian Spencer, president of Spencer Composites Corp. (Sacramento, Calif.) talked about some promising signs in both markets (see sidebar). And Red and Roberts foresaw a decade of solid growth for carbon fiber in all three markets, with each seeing better than two-fold increases by 2018.

Editor's Note: For more insight into Cytec's and Hexcel's short- and long-term carbon fiber prospects, see HPC's news item on p. 26, entitled “Carbon fiber market: Key suppliers offer post-recession predictions.

Related Content

Materials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreCleveland pedestrian drawbridge features FRP decking from Creative Composites Group

Lightweight molded panels with hybrid non-skid technology system make up the new double dutch-style bascule bridge completing Cleveland’s harbor loop.

Read MoreComposites end markets: Infrastructure and construction (2024)

Composites are increasingly used in applications like building facades, bridges, utility poles, wastewater treatment pipes, repair solutions and more.

Read MoreCirculinQ: Glass fiber, recycled plastic turn paving into climate solutions

Durable, modular paving system from recycled composite filters, collects, infiltrates stormwater to reduce flooding and recharge local aquifers.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)